Chapter 1

MACRO ECONOMIC PROFILE

Introduction

As part of the Indian Union, Kerala’s economy is deeply affected by the downturn in the national economy. While Kerala has a lot to offer to the rest of the country in terms of excellent human capital formation, high environmental standards, remarkable tourist sites, inflow of remittances from abroad, good decentralized governance and so on, it is highly dependent on the rest of India (and abroad) for food, fuel, basic industrial goods, a variety of consumer goods and even on migrant labour from other states. This chapter gives an account of important economic features of Kerala as a whole – trends in population and urbanisation are analysed as they have a major impact on other critical economic parameters such as poverty, productivity and growth. Availability of capital resources (public finance and institutional finance) has also been discussed at length, because affordable finance acts as a spur to the development of an economy. Inflationary pressures, especially in food, fuel and housing can be highly detrimental to welfare of the people. The importance of systematic planning and careful monitoring of its implementation is also critical for the development of the country. Some of these issues are dealt with in this chapter.

Demography

Population is one of the important drivers of economic growth. It helps to determine the size of work force as well. As per the final data published by the Directorate of Census, Kerala’s population as on March 2011 was 3,34,06,061. Out of this 1,60,27,412 (48 per cent) are males and 1,73,78,649 (52 per cent) are females. When the last census was taken, these figures were 3,18,41,374 total, 1,54,68,614 (48.6 per cent) males and 1,63,72,760 (51.4 per cent) females.

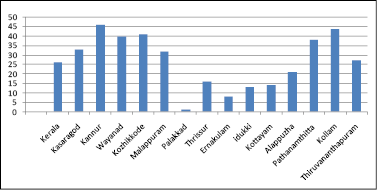

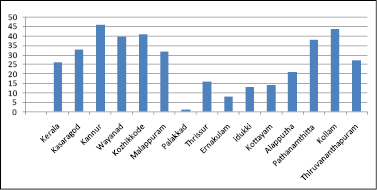

1.2 The growth rate of Kerala’s population during the last ten years is 4.9 per cent, the lowest rate among Indian states. Fig. 1.1 shows that the national rate of growth of population during the last ten years was 17.6 per cent. The population growth trend shows that Kerala is moving towards zero population growth or towards negative growth. Among the districts Malappuram has the highest growth of 13.4 per cent, while Pathanamthitta has the lowest growth rate (- 3.0 per cent). Idukki also has a negative growth rate (-1.8 per cent).It reveals that the growth rate of six southern districts (Idukki, Kottayam, Alappuzha, Kollam, Pathanamthitta and Thiruvananthapuram) together is comparatively very low.

Fig. 1.1

Decadal Population Growth of India and Kerala 1901-2011

Source: Census of India 2011

1.3 The child population (0-6 years) in Kerala shows a declining trend. Census data reveals a negative growth rate of the child population in the state (-8.44 per cent). The census figures show that the child population is declining in all districts except Malappuram. The total number of children in Kerala is 34,72,955, with the highest number (5,74,041) in Malappuram and the lowest (92,324) in Wayanad.

1.4 The share of urban population in Kerala is 47.7 per cent of the total, representing a decadal increase of 21.74 per cent since 2001. As many as 1,59,34,926 persons in the state are living in urban areas while the rural population is 1,74,71,135 representing 52.3 per cent of the total. The highest per cent of urban population (68.07per cent) is in Ernakulam district and the lowest (3.86 per cent) is in Wayanad.

Fig 1.2

Sex Ratio Decadal Change

Source: source: Census 2001,2011

1.3 The child population (0-6 years) in Kerala shows a declining trend. Census data reveals a negative growth rate of the child population in the state (-8.44 per cent). The census figures show that the child population is declining in all districts except Malappuram. The total number of children in Kerala is 34,72,955, with the highest number (5,74,041) in Malappuram and the lowest (92,324) in Wayanad.

1.4 The share of urban population in Kerala is 47.7 per cent of the total, representing a decadal increase of 21.74 per cent since 2001. As many as 1,59,34,926 persons in the state are living in urban areas while the rural population is 1,74,71,135 representing 52.3 per cent of the total. The highest per cent of urban population (68.07per cent) is in Ernakulam district and the lowest (3.86 per cent) is in Wayanad.

Literacy

1.5 Kerala has the highest effective literacy rate of 94 per cent among Indian states. It was 90 per cent during 2001 census. Kottayam tops with 97.2 per cent and Pathanamthitta is just behind with 96.5 per cent. Wayanad has the least literacy rate of 89 per cent and Palakkad is just above with 89.3 per cent. Even the lowest literacy rate of Wayanad (89) is higher than national rate of literacy (72 per cent). All districts have a score above 90 except Palakkad (89.3) and Wayanad (89). The difference between the lowest and the highest value is just 8.2. When compared with the literacy rate of 2001, all the districts are showing better performance.Details are in Appendix 1.1

Sex Ratio

1.6 The sex ratio ( number of females per thousand males ) of Kerala according to census 2011, has improved by 26 points to reach 1084.The sex ratio of Kerala was 1022 in 1961. After 1971 it started moving to more favorable levels.

1.7 Among the districts, Kannur has the highest sex ratio (1136) followed by Pathanamthitta (1132). While Idukki has the lowest score (1006) , Ernakaulam is just above with 1027. All the districts have the index above 1000. In 2001, only Wayanad had the index score below 1000 (994). The difference between the lowest (Idukki-1006) and highest (Kannur-1136) is 130 points.

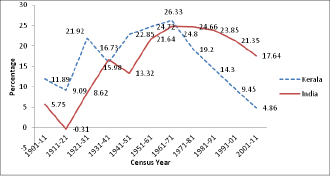

Fig 1.2

Sex Ratio Decadal Change

source: Census 2001,2011

1.8 While analyzing the decadal change (Fig.1.2), it is evident that in northern districts (Kasaragod, Kannur, Wayanad, Kozhikkode and Mallappuram) has an increase of above 32 points (average 38.4), while southern most districts (Alappuzha, Pathanamthitta, Kollam and Thiruvananthapuram) have an increase above 21 points (average of 32.5). While the central districts (Palakkad, Thrissur, Ernakulam, Idukki and Kottayam) have lower rate of increase below 16 (average 10.4). Even though the gain pattern differs, all districts attained a favorable position. Details are in Appendix 1.2

Decadal Change

1.9 Child sex ratio in Kerala is 964 as per the 2011 census data. It was 960 in 2001. Pathanamthitta has the highest score (976) followed by Kollam (973) and Kannur (971). While, Thrissur has the lowest score of 950 , Alappuzha is just above with the score of 951. The distance from lowest to highest is just 26 points. All the districts have the score below 1000. This is alarming as it indicates that there is a change in the trend of there being more females than males in the overall population. When analysing the decadal change, the highest gain is for Kollam (13) and Kozhikkode followed with a score of 10. All other districts have the score below 10 points. Thrissur (-8), Idukki (-5) and Alappuzha (-5) have negative decadal change in sex ratio. Details are in Appendix 1.2

1.8 While analyzing the decadal change (Fig.1.2), it is evident that in northern districts (Kasaragod, Kannur, Wayanad, Kozhikkode and Mallappuram) has an increase of above 32 points (average 38.4), while southern most districts (Alappuzha, Pathanamthitta, Kollam and Thiruvananthapuram) have an increase above 21 points (average of 32.5). While the central districts (Palakkad, Thrissur, Ernakulam, Idukki and Kottayam) have lower rate of increase below 16 (average 10.4). Even though the gain pattern differs, all districts attained a favorable position. Details are in Appendix 1.2

Child Sex Ratio ( 0-6 Years)

1.9 Child sex ratio in Kerala is 964 as per the 2011 census data. It was 960 in 2001. Pathanamthitta has the highest score (976) followed by Kollam (973) and Kannur (971). While, Thrissur has the lowest score of 950 , Alappuzha is just above with the score of 951. The distance from lowest to highest is just 26 points. All the districts have the score below 1000. This is alarming as it indicates that there is a change in the trend of there being more females than males in the overall population. When analysing the decadal change, the highest gain is for Kollam (13) and Kozhikkode followed with a score of 10. All other districts have the score below 10 points. Thrissur (-8), Idukki (-5) and Alappuzha (-5) have negative decadal change in sex ratio. Details are in Appendix 1.2

Density of Population

1.10 Kerala’s density of population as per 2011 census is 860 persons / sq. km. It is much higher than that of India (382). Thiruvananthapuram is the most densely populated district (1508) while, Idukki is the least densely populated district (255).Density of population has increased in all districts compared to 2001 census but for Pathanamthitta (-16) and Idukki (-4), it has declined.

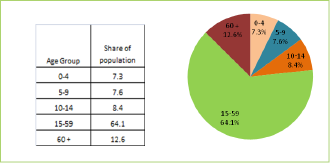

Age Group Distribution

1.11 Around 64.1 per cent of population is in the working age group of 15-59. The remaining 36 per cent of the total population is the dependant group. Among this 12.6 per cent are old dependants and 23.3 per cent are young dependants (Fig 1.3)

Fig 1.3

Percentage Share of Population in different Age Groups- Kerala 2011

Source: Census 2011

SECTION 2

Income

National Income

1.12 The Gross National Income (GNI) at factor cost at 2004-05 prices is estimated at ` 54,49,104 crore during 2012-13, as against the previous year’s estimate of ` 51,96,848 crore (Table 1.1). In terms of growth rates, the gross national income is estimated to rise by 4.9 per cent during 2012-13, in comparison to the growth rate of 6.4 per cent in 2011-12. The GNI at factor cost at current prices is estimated at ` 93,61,113 crore during 2012-13, as compared to ` 82,76,665 crore during 2011-12, showing a rise of over 13 per cent. The Net National Income (NNI) at factor cost at current prices is estimated at ` 83,67,706 crore during 2012-13, as compared to ` 73,99,934 crore during 2011-12, showing a rise of over 13 per cent.

1.13 GDP at factor cost at constant (2004-05) prices in the year 2012-13 is estimated at ` 55,05,437 crore showing a growth rate of 5 per cent over the Estimates of GDP for the year 2011-12 of

` 52,43,582 crore. The GDP at factor cost at current prices in the year 2012-13 is estimated at

` 94,61,013 crore showing a growth rate of 13.3 per cent over the estimates of GDP for the year 2011-12 of ` 83,53,495 crore. The per capita income (per capita GDP at factor cost) in real terms, i.e. at 2004-05 prices, is estimated at `45,238 for 2012-13 as against ` 43,624 in 2011-12, registering an increase of over 3.7 per cent during the year. The per capita income at current prices is estimated at ` 77,740 in 2012-13 as against `69,497 for the previous year depicting a growth of 11.8 per cent.

Table 1.1

National Income, Domestic Product & Per Capita Income at Factor Cost(All India)

( र crore)

Sl. No |

Item at factor cost |

At 2004-05 Prices |

At Current Prices |

||||

|

2010-11 |

2011-12 (P) |

2012-13 (Q) |

2010-11 |

2011-12 (P) |

2012-13 (Q) |

|

1 |

Gross National Income (GNI) |

48,82,249 |

51,96,848 (6.4) |

54,49,104 (4.9)

|

71,85,160 |

82,76,665 (15.2) |

93,61,113 (13.1) |

2 |

Net National Income (NNI) |

43,10,195 |

45,72,075 (6.1) |

47,66,754 (4.3) |

64,22,359 |

73,99,934 (15.2) |

94,61,013 (13.3) |

3 |

Gross domestic product (GDP) |

49,37,006 |

52,43,582 (6.2) |

55,05,437 (5.0) |

72,66,967 |

73,99,934 (15.2) |

84,67,606 (13.3) |

4 |

Net domestic product (NDP) |

43,64,952 |

46,18,809 (5.8) |

48,23,087 (4.4) |

65,04,166 |

74,76,764 (15.0)

|

73,68,223 (15.1) |

5 |

Per capita Gross domestic product (`) |

41,627 |

43,624 (4.7)

|

45,238 (3.7) |

61,273 |

69,497 (13.4) |

77,740 (11.86) |

Note: The figures in Parenthesis shows the percentage change over previous year.

Q-Quick Estimate, P- Provisional Estimate

1.14 The details of GDP, NDP, GNI and NNI at current and constant (2004-05) prices from 2004-05 to 2012-13 with per cent change over previous year are given in Appendix 1.3, 1.4, 1.5 and 1.6. The sectoral distribution of GDP at constant (2004-05) prices and current prices with per cent change over previous year is given in Appendix 1.7 and Appendix 1.8

State Income

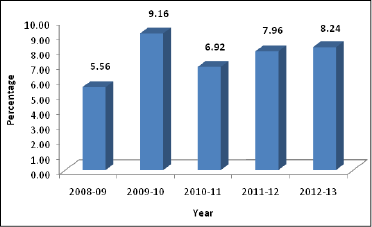

1.15 The quick estimate of Gross State Domestic Product (GSDP) at factor cost at constant (2004- 05) prices is ` 2,21,84,990 lakhs during 2012-13 as against the provisional estimate of

` 20495672 lakhs during 2011-12, registering a growth rate of 8.2 per cent in 2012-13 compared to nearly 8 per cent in 2011-12 (Fig. 1.4). At current prices the Gross State Domestic Product is

estimated at ` 34933832 lakhs (quick estimate) during 2012-13 as against the provisional estimate of`

` 30790606 lakhs during 2011-12 showing a growth rate of 13.4 per cent.

Fig 1.4

Growth Rate of GSDP at Constant (2004-05) Prices - Kerala

Source : Department of Economics and Statistics

1.16 The quick estimate of Net State Domestic Product (State Income) at factor cost at constant prices (2004-05) is `19607691 lakhs during 2012-13 compared to the provisional estimate of `18081208 lakhs during 2011-12, recording a growth rate of 8.4 per cent in 2012-13. At current prices the State Income is estimated at `30933162 lakhs (quick estimate) in 2012-13 compared to the provisional estimate of `27206498 lakhs during 2011-12. The growth rate of State Income at current prices is 13.7 per cent in 2012-13 compared to 16.7 per cent in 2011-12 (Table 1.2).

Table 1.2

State Domestic Product and Per Capita Income of Kerala

Sl. No |

Item |

Income (` in Lakhs) |

Growth Rate (Per cent) |

|||

|

2010-11 |

2011-12 (P) |

2012-13 (Q) |

2011-12(P) |

2012-13(Q) |

|

1 |

Gross State Domestic Product |

|||||

|

a) At Constant (2004-05) prices |

18985071 |

20495672 |

22184990 |

7.96 |

8.24 |

|

b) At Current prices |

26377330 |

30790606 |

34933832 |

16.73 |

13.46 |

2 |

Net State Domestic Product |

|

||||

|

a) At Constant (2004-05) prices |

16717844 |

18081208 |

19607691 |

8.15 |

8.44 |

|

b) At Current prices |

23317749 |

27206498 |

30933162 |

16.68 |

13.70 |

3 |

Per Capita State Income ( ` ) |

|

||||

|

a) At Constant (1999 2000) Prices |

55082 |

59052 |

63491 |

7.21 |

7.52 |

|

b) At Current Prices |

76529 |

88713 |

99977 |

15.92 |

12.70 |

Source: Department of Economics and Statistics

P: Provisional Estimate, Q: Quick Estimate

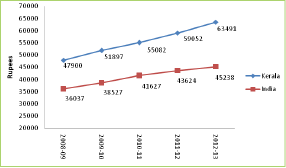

Per Capita State Income

1.17 As per the quick estimates in 2012-13, the per capita Gross State Domestic Product at constant (2004-05) prices was ` 63491 as against provisional estimate of `59052 in 2011-12,recording a growth rate of 7.5 per cent in 2011-12. At current prices, the per capita GSDP in2011-12 was `99977 registering a growth rate of 12.7 per cent over the previous year’s estimateof `88713. Fig. 1.5

shows that during the period 2008-09 to 2012-13, the per capita state income at constant prices was higher than the per capita national income.

Fig 1.5

Per Capita Income at Constant Price - Kerala and India

Source: Central Statistical Organization and Department of Economics and Statistics

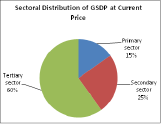

Sectoral Distribution of Gross State Domestic Product

1.18 During 2012-13, the contribution from primary, secondary and tertiary sectors to the GSDP at constant prices (2004-05) was 9.3 per cent, 23.9 per cent and 66.7 per cent respectively. At current prices, the primary, secondary and tertiary sectors contributed 15.1 per cent, 25 per cent and 59.9 per cent respectively to the GSDP during 2012-13 (Fig. 1.6). This difference in sectoral share between constant and current prices shows that inflationary trends in the primary sectors are much higher than in the secondary and tertiary sector.

Fig. 1.6

Sectoral Distribution of GSDP

1.19 While analysing the sectoral distribution of state income for the year 2012-13, it is seen that the contribution from primary sector and tertiary sector are decreasing.But secondary sector is showing an increase of 23.9 per cent from 21.8 per cent. The analysis of annual sectoral growth rate of Gross State Domestic Product shows that secondary sector recorded the highest rate of growth 18.83 per cent in 2012-13 at constant (2004-05) prices followed by tertiary sector (5.46 per cent) and primary sector showed a 4 per cent. The push factor for the growth of the secondary sector is mainly because of the growth in the construction sector which showing an increase to 25.3 per cent in 2012-13 from 9.21 per cent in 2011-12. At current prices, the secondary sector recorded a growth rate of 25.5 per cent, tertiary sector 11.2 per cent and primary sector 5.3 per cent in 2012-13. The details of sectoral distribution of GSDP with per cent during the last three years is given in Appendix 1.9, 1.10 and 1.11 and the details of GSDP, NSDP at constant and current prices during 2004-05to 2012-13 are given at Appendix 1.12, 1.13, 1.14 and 1.15

District-wise Gross State Domestic Product

1.20 District wise distribution of Gross State Domestic Product at factor cost at current prices shows that Ernakulam District continues to have the highest income of `4945329 lakhs in 2012-13 as against `4296901 lakhs in 2011-12 registering a growth rate of slightly over 15 per cent. At constant (2004-05) prices, this amounts to `3229135 lakhs during 2012-13 compared to `2941730 lakhs during 2011-12. The details are given in Table 1.3 below.

Table 1.3

District-wise Distribution of Gross State Domestic Product

(र Lakhs)

Sl. No |

District |

Gross State Domestic Product at Factor Cost |

|||||

At Current Prices |

At Current Prices |

||||||

2011-12 (P) |

2012-13 (Q) |

Growth Rate (%) |

2011-12 (P) |

2012-13 (Q) |

Growth Rate (%) |

||

1 |

Thiruvananthapuram |

3353391 |

3803635 |

13.43 |

2272728 |

2449504 |

7.78 |

2 |

Kollam |

2336372 |

2643783 |

13.16 |

1520121 |

1633249 |

7.44 |

3 |

Pathanamthitta |

1274653 |

1427370 |

11.98 |

847806 |

917096 |

8.17 |

4 |

Alappuzha |

1948111 |

2228358 |

14.39 |

1319407 |

1422132 |

7.79 |

5 |

Kottayam |

2167872 |

2425327 |

11.88 |

1410863 |

1523671 |

8.00 |

6 |

Idukki |

1159028 |

1276889 |

10.17 |

692568 |

744363 |

7.48 |

7 |

Eranakulam |

4296901 |

4945329 |

15.09 |

2941730 |

3229135 |

9.77 |

8 |

Thrissur |

2934220 |

3357584 |

14.43 |

2024737 |

2199651 |

8.64 |

9 |

Palakkad |

2404540 |

2694909 |

12.08 |

1555586 |

1671301 |

7.44 |

10 |

Malappuram |

2401383 |

2720183 |

13.28 |

1581702 |

1707903 |

7.98 |

11 |

Kozhikode |

2639276 |

3031430 |

14.86 |

1786901 |

1940969 |

8.62 |

12 |

Wayanad |

623490 |

692095 |

11.00 |

388097 |

416701 |

7.37 |

13 |

Kannur |

2230384 |

2534644 |

13.64 |

1494164 |

1618452 |

8.32 |

14 |

Kasaragod |

1020985 |

1152296 |

12.86 |

659262 |

710863 |

7.83 |

|

GSDP |

30790606 |

34933832 |

13.46 |

20495672 |

22184990 |

8.24 |

P - Provisional Estimate, Q - Quick Estimate

Source: Department of Economics & Statistics

District-wise Per Capita Income

1.21 Growth rate at current prices does not eliminate the inflationary impact. When district level growth rate at constant prices, we compared the “real” GSDP growth rate may be observed as the inflationary impact has been eliminated. Ernakulam, Thrissur,Kozhikode and Kannur had higher real growth in GSDP than the State Average. Wayanad had a lower growth than other districts.

1.22 The analysis of district wise per capita income shows that Ernakulam district stands first with the per capita income of `94392 at constant (2004-05) prices in 2012-13 as against `86572 in 2011-12. The district wise per capita income with corresponding rank and growth rate is given in Table 1.4

Table 1.4

District-wise Per Capita Income at Constant (2004-05) Prices

Sl. No. |

District |

2011-12 (P) ` |

Rank |

2012-13 (Q) ` |

Rank |

Growth Rate ( per cent) 2012-13 |

1 |

Thiruvananthapuram |

64365 |

4 |

68903 |

4 |

7.78 |

2 |

Kollam |

54720 |

10 |

58393 |

10 |

7.44 |

3 |

Pathanamthitta |

65721 |

3 |

70600 |

3 |

8.17 |

4 |

Alappuzha |

59087 |

6 |

63262 |

6 |

7.79 |

5 |

Kottayam |

67376 |

2 |

72280 |

2 |

8.00 |

6 |

Idukki |

58150 |

7 |

62082 |

8 |

7.48 |

7 |

Eranakulam |

86572 |

1 |

94392 |

1 |

9.77 |

8 |

Thrissur |

62841 |

5 |

67807 |

5 |

8.64 |

9 |

Palakkad |

54410 |

11 |

58072 |

11 |

7.44 |

10 |

Malappuram |

37985 |

14 |

40742 |

14 |

7.98 |

11 |

Kozhikode |

56817 |

9 |

61307 |

9 |

8.62 |

12 |

Wayanad |

43606 |

13 |

46507 |

13 |

7.37 |

13 |

Kannur |

58003 |

8 |

62416 |

7 |

8.32 |

14 |

Kasaragod |

49309 |

12 |

52813 |

12 |

7.83 |

|

STATE |

59052 |

|

63491 |

|

7.52 |

P - Provisional Estimate, Q - Quick Estimate

Source: Department of Economics & Statistics

1.23 Table 1.5 reveals that the districtsErnakulam, Thrissur, Kozhikode and Kannurhad a much higher growth rate than the average growth in per capita income in 2012-13. However, the districts of Wayanad, Kollam, Palakkadand Idukki showed much lower growth in per capita income than the state average.

1.24 District wise and sectorwise analysis of GSDP reveals that Ernakulam district contributions in all the these sectors are highest. District-wise sectoral distribution of Gross State Domestic Product from 2010-11 to 2012-13 at current and constant (2004-2005) prices are given in Appendix 1.16, 1.17, 1.18, 1.19, 1.20 and 1.21.

NSDP - Southern States of India

1.25 In 2012-13, Kerala recorded 8.4 per cent economic growth rate, the highest among SouthernStates and much above the national average. Karnataka posted 6.4 per cent growth rate; AndhraPradesh 5.6 per cent and Tamil Nadu slightly above 4 per cent. The all-India average was 4.4 per cent, accordingto provisional figures available with the Central authorities (see Table 1.5). It may be seen that Kerala and Karnataka, have shown a higher growth in 2012-13 than in the previous year.

Table 1.5

NSDP of Southern States of India at constant Price (2004-05

र In Crores

State Name |

2010-11 |

2011-12 (P) |

2012-13 (Q) |

Growth Rate 2011-12 |

Growth Rate 2012-13 |

ANDHRA PRADESH |

332925 |

358801 |

378879 |

7.77 |

5.60 |

KARNATAKA |

240817 |

250831 |

266784 |

4.16 |

6.36 |

KERALA |

167184 |

180812 |

196077 |

8.15 |

8.44 |

TAMIL NADU |

359961 |

386768 |

402603 |

7.45 |

4.09 |

INDIA |

4364952 |

4618809 |

4823087 |

5.8 |

4.4 |

P - Provisional Estimate, Q - Quick Estimate

Source: Hand Book of statistics on the Indian Economy RBI (2012-13)

1.26 An analysis of the growth pattern of NSDP reveals that the Services sector continues to dominate the economy. Segments such as Transport, Communication, Trade, Hotels, Banking & Insurance and Real Estate performed relatively well. Compared to 2011-12, the secondary sector recovered marginally in 2012-13.

SECTION 3

Poverty

1.27 Poverty is a world wide phenomenon irrespective of whether the country is developed or not. Poverty may be defined as a state or condition in which a person or community lacks the financial resources and essentials to enjoy a minimum standard of life and well being. Poverty, food prices and hunger are inextricably linked. Millions live with hunger and mal nourishment because they simply cannot afford to buy enough food. The poor are those who are unable to achieve basic facilities like food, safe drinking water, shelter, access to information, education, health care, social status, political power or even have the opportunity to develop meaningful connections with other people in the society. This condition is absolute poverty, while relative poverty refers to the inadequacy of income when compared to the average standard of living .

1.28. The Planning Commission estimates the levels of poverty in the country on the basis of consumer expenditure survey conducted by National Sample Survey Office (NSSO) of Ministry of Statistics and Programme Implementation. From NSSO 66th round onwards Tendulkar Method of estimation is used for poverty estimation in India. As per the latest data released by the Planning Commission of India in July 2013, the poverty ratio fell spectacularly from 37 per cent in 2004-05 to 22 per cent in 2011-12. This raised 138 million people above extreme poverty. This methodology has been widely questioned by both experts and common people. Since several representations were made suggesting that the Tendulkar Poverty Line was too low, the Planning Commission, in June 2012, constituted an Expert Group under the Chairmanship of Dr.C. Rangarajan to once again review the methodology for the measurement of poverty. The report is expected in the middle of 2014.

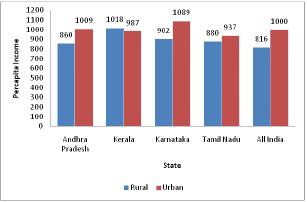

1.29. The state specific poverty line 2011-12 for Kerala is fixed at monthly per capita income of `1018 for rural areas and ` 987 for urban areas which is above the per capita income of 23 other states.The corresponding figures for Karnataka, Tamil Nadu and Andhra Pradesh are`902 for rural and `1089 for urban, `880 for rural and `937 for urban and `860 for rural and `1009 for urban respectively are given in Fig. 1.7. The poverty ratios for the period 2004-05 and 2011-12 based on Prof. Suresh Tendulker method on Mixed Reference Period of estimation pertaining to Kerala, other southern states and All India are given in Fig. 1.8 below.

Table 1.7

Per Capita Income- Rural and Urban Sectors during 2011-12

Source: Planning Commission of India –Press Note on Poverty Estimates 2011-12

Table 1.8

Statewise Poverty Estmation 2004-05 & 2011-12

Poverty Line

1.30 For each State the urban poverty line for 2011-12 is derived by updating 2004-05 poverty line using price indices specifically constructed for 2004-05 and 2011-12. Rural poverty line is then derived from urban poverty line of the respective State by applying urban-rural price differential. For the first time, Kerala’s rural poverty line is higher than urban poverty line.

Price Indices

1.31 Prices are computed from value and quantity data of household consumer expenditure surveys conducted by NSSO. This has been done for food commodities and some of the other commodity groups like clothing, bedding, footwear, fuel and light etc for which both value and quantity data is collected in these surveys (category -1). Price indices are then computed from the median prices of these commodities to get the inflation during the period. For other items (category –II), the inflation is computed from the ‘miscellaneous commodities’ group of consumer price indices [(CPI-AL) in rural areas and CPI - IW in urban areas].

Comparison – Urban/Rural

1.32 i. For Category – 1 items, which have a weight of around 78 per cent in the basket, the prices in urban areas are much higher than rural areas in most of the states. This difference is very low for Kerala. For Kerala this differential is only 5 per cent whereas in Karnataka it is 16 per cent and in Uttar Pradesh it is 21 per cent.

1.33 ii. The difference in Urban and Rural Poverty Line for Kerala was low in the base year (2004-05) as compared to other States. For Kerala, urban poverty line was higher than rural poverty line by only 9 per cent as compared to 41 per cent in Karnataka, 30 per cent in Andhra Pradesh and 27 per cent in Tamil Nadu.

1.34 iii. An important factor that is causing this type of situation in Kerala is that the NSSO uses administrative divisions for defining rural areas, which are not notified as urban but has charecteristics of urban areas and are in many cases treated as urban by the Census.

Factors such as decentralization, pension to vulnerable groups, effective public distribution systems, women neighbourhood oriented programmes of Kudumbashree, implementation of major CSS etc. have contributed effectively for reducing the rural – urban disparity in poverty.

1.35 Various schemes on Poverty Reduction have been dealt with in other chapters of the Review. While Kerala is better off than most other states in terms of average poverty estimates, there are still several pockets of deprivation in the state, for eg., among tribal population and fishermen communities. Greater central assistance and appropriate livelihood programmes in these pockets are required to ensure that poverty is reduced throughout the state. Estimating poverty on the basis of per capita income or per capita monthly expenditure alone will not give a clear and accurate indication of multi-dimensional poverty. Unemployment, lack of access to drinking water, landlessness, marginalisation, disabilities – all these are correlated with poverty in the Kerala context.

1.26 Poverty Index: Every two years, a survey is conducted for assessing the urban poor by Community Development Societies using the poverty index following non-economic criteria with nine risk factors reflecting the poverty situations of families. The neighbourhood community verifies these factors with the identified families. The nine risk factors of the poverty index are furnished below.

• Less than 5 cents of land/no land

• Dilapidated house/no house

• No sanitary latrine

• No access to safe drinking water within 150 meters

• Women headed household

• No regular employed person in the family

• Socially disadvantaged groups SC/ST

• Mentally retarded/disabled/chronically ill member in the family

• Families without colour TV

Any family having 4 or more such risk factors is classified as family at risk of poverty.

1.27 The magnitude of urban poverty has been increasing due to stagnation in manufacturing industry resulting in lower income for urban dwellers. Due to rapid increase in land price and construction costs, a good number of the urban people in Kerala are forced to live in slums. Availability of drinking water and sanitation facilities is grossly inadequate. Urbanization is an important aspect in the process of economic and social development and is associated with many problems such as migration from villages to towns, relative cost of providing economic and social services in the towns of varying sizes, provision of housing for different sections of the people, provision of facilities like water supply, sanitation, transport and power, pattern of economic development, location and dispersal of industries, civic administration etc. Several schemes are being implemented by the Department of Urban Affairs/municipalities/corporations to provide urban infrastructures.

1.28 Only one-fourth of households in slums have electricity. The composition of the poor has been changing. While rural poverty is getting concentrated in the agricultural labour and artisan household, urban poverty results in casual labour households

1.29 Various poverty alleviation programmes both rural and urban sectors that are being implemented are given in other chapters of the review. There are many agencies and Government Departments whose mandate is to eradicate poverty in Kerala.

Kudumbashree Mission and Alleviation of Poverty

1.30 This Community Based Organisation is a three-tiered structure with its apex tier anchored in the local self governments. Neighbourhood Groups (NHGs) comprising of 10-20 women, Area Development Societies (ADS) within wards of LSGs and Community Development Societies (CDS) – Registered Society as the Federation of ADS within the LSGIs form the three tiers.

SECTION 4

Urbanization in Kerala

1.36 Kerala is known for its unique settlement pattern with independent houses on individual plots scattered across the habitable areas. In Kerala, one cannot clearly distinguish a rural area from an urban area because of the pecularity of the settlement pattern. Urbanisation in Kerala is not limited to the designated cities and towns. Barring a few panchayats in the hilly tracks and a few isolated areas, the entire state depicts the picture of an urban-rural continuum.

1.37 As per 2011 provisional census figures total urban population of Kerala is 15932171. Kerala was positioned in the 19th rank in the level of urbanisation among the states of India as per the 2001 Census. But in 2011 Census data, Kerala was ranked 9th. The urban content of population of Kerala has reached to 47.72 per cent in 2011 from 13.48 per cent in 1961. Ernakulam (68.1 per cent) is the most urbanised district of Kerala and Wayanad (3.9 per cent) is the least urbanised district . Details of urban and rural population in Kerala are given in Appendix 1.22.

1.38 Rapid expansion of urban population necessitates the creation and maintenance of critical urban infrastructure facilities, strengthening of urban governance, long term strategic urban planning, addressing the basic needs of the urban poor etc. In addition to this, more effort is needed to keep the cities and towns environmentally sustainable.

SECTION 5

Prices

1.39 The level of prices for essential commodities and services determine the well being of the people.A modest increase in the price level isacceptable, sometimes even desirable. Kerala being a consumer state, faces high volatility incommodity prices as a result of heavy dependence on neighbouring states for consumption goods. Due to the cost-push and demand-pull factors, the economy has very high inflation, which adversely affectsthe welfare of the people, especially the vulnerable communities.

Consumer Price Index

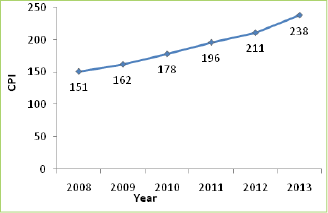

1.40 Consumer Price Index of agricultural and industrial workers in Kerala went up in 2013 compared to the corresponding period of 2012. The inflationary hike is shown in Fig.1.9.

Fig. 1.9

Consumer Price Index Numbers of Kerala 2008 to 2013

(Base year 1998-99 = 100)

1.41 Prices are monitored at 17 centres in Kerala (Appendix 1.23). State wide inflation based on CPI was 27 basis points between 2012 & 2013. Maximum CPI was at Pathanamthitta at 255, while the lowest was at Thrissur 224. When the percent of variation over the previous year is concerned, Kasaragod experienced the maximum fluctuation of 16.75 per cent, while Palakkad showed the lowest increase of 9.26 per cent. A look at the inflation data reveals that the following centres viz., Munnar, Eranakulam, Chalakkudi, Thrissur, Palakkad, Malappuram, Kozhikkode, Meppady and Kannur experienced a price increase that was lower than the state average. During the period from January to October 2013, the average retail prices of essential commodities has shown a fluctuating trend. Considerable fluctuation in prices was observed in different months of 2013 in the case of rice, green gram, Dhall, red gram, onion etc. The details are shown in Appendix 1.24.

Wholesale Price Index

1.42 Wholesale price index of agricultural commodities increased by 973 points in Kerala in 2013 (up to September) compared to the corresponding period of 2012. The weighted contribution of important agricultural commodities to Wholesale Price Index had increased by 18.98 per cent in 2013 compared to the corresponding period in 2012 (Appendix 1.25).

1.43 During 2013 (up to September) price rise of 24.58 per cent is seen for food crops and 5.61 per cent for non-food crops compared to the same period during the previous year. Among food crops, highest price rise is seen for Fruits and Vegetables (33.67 per cent) and lowest for condiments & spices (4.24 per cent). Efforts are required to promote cultivation of vegetables and fruits. The month-wise wholesale price index of agricultural commodities in Kerala is given in Appendix 1.26.

Price Parity

1.44 Index of prices received and price paid by farmers reveals that price fluctuations have been disadvantageous to farmers over the years as is evident from the higher prices they paid than received (Appendix 1.27).

Factor Prices

1.45 The average daily wage rate of both skilled and unskilled workers in Kerala has doubled over a period of five years. The average daily wage rate of carpenter increased by 16 per cent and that of mason by 14 per cent during the year under review. The average daily wage rates of skilled workers are given in Appendix 1.28. Similarly, while there is a hike in the average daily wage rates of paddy field workers in agricultural sector, a gender disparity is seen in the wage structure (Appendix 1.29).

SECTION 6

State Finances

1.46 Despite making several attempts at fiscal consolidation, the improvements attained in key deficit indicators during the period 2002-03 to 2010-11 could not be sustained in 2011-12 and 2012-13 due to various external and domestic compulsions. Though the global and national economy shows some signs of recovery from economic recession, impact of the slowdown on all sectors of the economy and its downward pressure on growth are still visible. This has an adverse impact on buoyancy of revenues. Along with this, persistent high level of inflation has pushed up Government expenditure. Fiscal consolidation targets in 2011-12 and 2012-13 were therefore not achieved. This period was characterized by large increase in committed expenditure on account of salaries, pensions, increased devolution to LSGs and increased payments for welfare schemes and subsidies necessitated by pro-poor policies of Government. One of the remarkable features during this period was considerable growth in capital expenditure even amidst fiscal constraints created by rise in revenue expenditure. Growth in overall expenditure during 2011-12 was phenomenal at 31.21 per cent owing to absorption of carry forward liabilities of salaries and pension revision. In 2012-13 growth in expenditure again moderated to the level of 16.37 per cent. In 2011-12 Revenue Deficit GSDP ratio increased to 2.55 per cent and in 2012-13 it reached the level of 2.57 per cent. Fiscal Deficit-GSDP ratio during this period stood at 4.07 per cent and 4.13 per cent respectively.

1.47 The Central government also had difficulties in following the FRBM targets in 2011-12 and 2012-13 due to slow growth trajectory of the economy. The Central Government introduced the new fiscal parameter of “Effective Revenue Deficit” in 2011. This new fiscal indicator denotes revenue deficit net of the revenue expenditure by way of grants for creation of capital assets. In the State’s context a significant portion of State’s devolution to LSGs and grants to various autonomous bodies intended for creation of capital assets of durable nature. The funds so devolved for capital creation has to be appropriately separated from revenue expenditure for and Effective Revenue Deficit assessed accordingly. In terms of Effective Revenue deficit, State’s fiscal performance gives a relatively stable picture. The revenue deficit in 2012-13 was ` 9351.45 crore. When the expenditure of ` 3150.37 crore incurred for providing grants for creation of capital assets is deducted, the Effective Revenue Deficit will be ` 6201.08 Crore., in 2012-13, which is 1.71 per cent of GSDP.

1.48 The major deficit indicators of the State for the period from 2007-08 to 2013-14 BE is shown in Table 1.6

Table 1.6

Major Deficit Indicators

(`. in Crore)

Year |

Revenue Deficit |

Fiscal Deficit |

Primary Deficit (-)/ Surplus (+) |

GSDP |

|||

Amount |

% to GSDP |

Amount |

% to GSDP |

Amount |

% to GSDP |

||

2007-08 |

3784.84 |

2.16% |

6100.21 |

3.48% |

-1770.56 |

-1.01% |

175141.08 |

2008-09 |

3711.67 |

1.83% |

6346.21 |

3.13% |

-1686.52 |

-0.83% |

202782.79 |

2009-10 |

5022.97 |

2.17% |

7871.60 |

3.39% |

-2579.12 |

-1.11% |

231998.67 |

2010-11 |

3673.87 |

1.36% |

7730.46 |

2.87% |

-2040.80 |

-0.76% |

269473.79 |

2011-12 |

8034.26 |

2.55% |

12814.77 |

4.07% |

-6521.17 |

-2.07% |

315205.67 |

2012-13 |

9351.45 |

2.57% |

15002.47 |

4.13% |

-7797.66 |

-2.15% |

363305.26 |

2013-14 BE |

2269.97 |

0.54% |

11872.64 |

2.82% |

-4199.16 |

-1.00% |

420479.00 |

Source: Finance Department, Govt. of Kerala

1.49 A low rate of Revenue Deficit to Fiscal Deficit indicates that a sizeable portion of borrowed funds go for capital expenditure. This ratio has been fluctuating since 2007-08. In 2012-13, it decreased to 62.33 per cent from 62.70 per cent in 2011-12. The persistence of high ratio of revenue deficit to fiscal deficit indicates that the major portion of borrowed funds is used to meet requirements under revenue account. Revenue Deficit of ` 9351.45 crore. was the major contributor to the Fiscal Deficit of ` 15002.47 crore. in 2012-13. Like previous years, the major portion of fiscal deficit in 2012-13 was financed mainly through Internal Debt (`10231.01 crore) comprising mostly Market Borrowings and accruals from Provident Funds and Small Savings (` 3685.55 crore).

1.50 As per the Kerala Fiscal Responsibility (Amendment) Act 2011, the State Government was committed to achieve a Revenue Deficit target of 0.9 per cent of GSDP, a fiscal deficit target of 3.5 per cent of GSDP and to restrict State’s total debt liabilities to 32.3 per cent of GSDP in 2012-13. State’s total debt liability relative to GSDP for the financial years 2011-12 and 2012-13 was 28.37per cent and 28.51 per cent respectively. Thus the target of 32.3 per cent and 31.70 per cent set by the KFR (Amendment) Act 2011 with respect to debt liability for the financial years 2011-12 and 2012-13 was achieved. But deficit targets have not been met.

1.51 The important financial indicators for Government of Kerala for the period from 2007-08 to 2013-14 BE are given in Appendix 1.30.

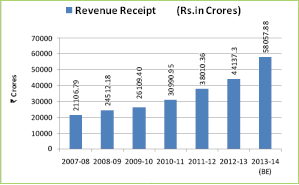

Revenue Receipts

1.52 State’s own tax and non-tax revenues, Share of central taxes and Grants-in-aid from Centre constitute the Revenue receipts of the State. The revenue receipts of the State in proportion to GSDP has shown marginal improvement in 2012-13 to 12.15 per cent from 12.06 per cent in 2011-12. However growth rate of revenue receipts declined sharply. In 2012-13 total revenue receipts of the State was ` 44137.30 crore with an increase of ` 6126.94 crore over that of ` 38010.36 crore. in 2011-12. The growth recorded in 2012-13 was 16.12 per cent against 22.65 per cent in 2011-12. The reason for decrease in the growth of revenue receipts in 2012-13 is mainly attributed to reduction in central government transfers to State. Also, in the case of State’s own tax revenue, targeted collection could not be achieved owing to impact of general macro-economic instability. The economic slowdown has weakened the main areas of economy like construction, automobiles, real estate and also affected general consumption by the public, consequently inflicting deep impact on revenue mobilization of the State. The trend in Revenue Receipts from 2007-08 to 2013-14 BE is given in Fig. 1.10.

Fig 1.10

Trends in Revenue Receipts

Source: Finance Department, Govt. of Kerala

1.53 The composition of revenue receipts is estimated to be continue without much variation in the current year as per BE 2013-14 and the actual against it upto 31.10.2013. The actual revenue receipts of ` 44137.30 crore in 2012-13 constituted 91.68 per cent of the budget target of ` 48141.59 crore. Revenue buoyancy is an indicator of the growth of revenue in relation to the growth of GSDP. The buoyancy of revenue receipts that declined consistently to 0.45 in 2009-10 from 1.53 in 2006-07 improved steadily in two subsequent years. It increased to 1.33 in 2011-12 from 1.16 in 2010-11. In 2012-13, it declined to 1.06. The details of Revenue Receipt from 2007-08 to 2013-14 BE is given in Appendix 1.31.

State’s Own Tax Revenue

1.54 The main sources of State’s Own Tax Revenue are Sales Tax including Value Added Tax (VAT), Stamps and Registration fees, State Excise Duties, Motor Vehicle Tax and Land Revenue tax. The receipt from State’s Own Tax Revenue in 2012-13 was ` 30076.61 crore, which was 93.63 per cent of the targeted revenue. Receipts from Sales Tax and VAT (` 22511.09 crore) contributed around 75 per cent of the total SOTR, followed by 10 per cent from stamp duties and registration fees

(` 2938.37 crore), 8 per cent from State Excise Duties (` 2313.95 crore), 6 per cent from Taxes on Vehicles (` 1924.62 crore) and (0.4 per cent) from Land Revenue (`.121.58 crore).

1.55 The receipts from Sales Tax including Value Added Tax (VAT) registered growth consistently in 2011-12 and 2012-13. The growth rate in 2011-12 and 2012-13 was 19.62 per cent and 18.86 per cent. The receipts from stamp duties and registration fees recorded a negative growth of (-) 1.61 per cent in 2012-13 against 17.01 per cent growth in 2011-12. This is mainly due to decrease in land transactions due to sluggishness of the economy coupled with relaxation granted in stamp duty to certain types of transactions. Receipt from Motor Vehicle tax has shown substantial increase of 21.26 per cent in 2012-13 compared to 19.21 per cent in 2011-12. This buoyancy in receipt was due to rationalization of tax structure of motor vehicles brought in 2011. The growth rate of revenue from State Excise Duties doubled in 2012-13 registering 22.87 per cent growth as against 10.81 per cent in 2011-12. Revenue from land tax showed phenomenal hike in 2012-13. Receipt under this item during 2012-13 was `128.58 crore registering growth rate of 100.13 per cent over previous year’s receipts. This was attained by revision of rate of land tax after long gap. The details of State’s Own Tax Revenue from 2007-08 to 2013-14 BE is given in Appendix 1.32.

State’s Own Non-Tax Revenue

1.56 The major contributors of State’s Non-Tax Revenue are State Lotteries, Forest revenues and receipts from various social developmental services. Receipt from SONTR gone up remarkably in 2011-12 and 2012-13 and to a certain extent redeemed the shortfall in receipts from other major sources. The growth exhibited during 2012-13 was 61.97 per cent against 34.25 per cent recorded in 2011-12. It was just 4.24 per cent in 2010-11. As per cent of GSDP, the receipt from State’s non-tax revenue increased significantly to 1.16 per cent in 2012-13 from 0.82 per cent in 2011-12. The buoyancy of non-tax revenue has also shown improvement in 2012-13. The buoyancy reached the level of 4.06 in 2012-13 from 2.02 in 2011-12.

1.57 Major portion of receipts under State’s own non-tax revenue in 2011-12 and 2012-13 was from State lotteries. Introduction of daily lotteries in 2011-12 paved the way for huge rise in collection of revenue from lotteries. Growth of receipt under state lotteries was at a rate of 108.44 per cent in 2012-13 compared to 124.47 per cent in 2011-12. Sales proceeds from forest produces, interest receipts, fees and fines etc have contributed significantly to SONTR in 2011-12 and 2012-13.

1.58 State’s Non-Tax Revenue in 2012-13 was ` 4198.51 crore. Of this, gross receipt from lotteries was ` 2673.77 crore. This constitutes 63.68 per cent of the total Non tax revenue of the State. This was followed by ` 472.78 crore (11.26 per cent) from Social Developmental Services, ` 237.33 crore (5.65 per cent) from Forest revenue and ` 172.41 crore (4.11 per cent) from debt services. The details of State’s Own Non Tax Revenue from 2007-08 to 2013-14 BE is given in Appendix 1.33.

Central Transfers

1.59 Central Transfers comprises of share in central taxes and grants in aid from Centre. The share of States in the net proceeds of shareable central taxes during the 13th FC period from 2010-11 to 2014-15 is 32 per cent. Out of this, State’s share is 2.34 per cent. The considerable fall in the transfers from Centre has affected the performance of State finances to a great extent in 2012-13. Against the budget estimate of `12523.97 crore, the actual Central transfer received was ` 9862.18 crore, which was 78.75 per cent of the budget estimates. Growth in Central government transfers in 2012-13 was very meager. It was just 1.68 per cent compared to 32.17 per cent in 2011-12.

1.60 The share of Central Transfers in total revenue receipts of the State was as high as 29.51 per cent in 2007-08. It declined steadily and reached the level of 22.34 per cent in 2012-13. However it had shown a little upward growth of 25.52 per cent in 2011-12 in between this period. The central transfers as per cent of GSDP have also declined to 2.71 per cent in 2012-13 from 3.08 per cent in 2011-12. Out of the total central transfers, the receipts under share in central taxes and central grants were ` 6840.65 crore and ` 3021.53 crore respectively. In 2012-13, the growth rate of share of central taxes dropped to 14.19 per cent from 16.50 per cent in 2011-12. During the same period, the receipt from central grant in aid declined substantially. It declined to 18.54 per cent in 2012-13 against 68.86 per cent increase in 2011-12. The details of Central Transfers from 2007-08 to 2013-14 BE is given in Table 1.7.

Table 1.7

Central Transfers: 2007-08 to 2013-14 (BE) (र in Crore)

Year |

Share in Central Taxes & Duties |

Grant-in-aid and other receipts from Centre for Plan and Non-plan |

Total Transfers |

|||

Amount |

Annual Growth Rate (%) |

Amount |

Annual Growth Rate (%) |

Amount |

Annual Growth Rate (%) |

|

2007-08 |

4051.70 |

26.14 |

2176.59 |

3.88 |

6228.29 |

17.35 |

2008-09 |

4275.52 |

5.52 |

2687.19 |

23.46 |

6962.71 |

11.79 |

2009-10 |

4398.78 |

2.88 |

2233.38 |

-16.89 |

6632.16 |

-4.75 |

2010-11 |

5141.85 |

16.89 |

2196.62 |

-1.65 |

7338.47 |

10.65 |

2011-12 |

5990.36 |

16.50 |

3709.22 |

68.86 |

9699.58 |

32.17 |

2012-13 |

6840.65 |

14.19 |

3021.53 |

-18.54 |

9862.18 |

1.68 |

2013-14 (BE) |

8143.79 |

35.95 |

6221.42 |

105.90 |

14365.21 |

45.66 |

Source: Finance Department, Govt. of Kerala

Revenue Expenditure

1.61 Expenditure on salaries, pension, debt charges, subsidies and devolutions to the Local Self Government institutions are the main constituents of revenue expenditure. Expenditure on operational and maintenance cost for the upkeep of the completed projects and programmes are also accounted under the revenue account. Grants provided by the State to meet salaries and pension liabilities of employees in the Universities and State autonomous bodies and also the pension liabilities of employees of Panchayat Raj Institutions are classified under revenue expenditure. Major portion of funds devolved to local bodies from the revenue account of the State government is utilized for the creation of capital assets of durable nature. Also a significant share of grant-in-aid set apart for universities and autonomous institutions are meant for creation of capital assets.

1.62 The level of expenditure in social and economic sector has important implications on human development and long-term prospects of the economy. Fiscal priority for social and economic services is clearly evident from relatively higher developmental expenditure. Expenditure on Social and Economic services together constitutes developmental expenditure. Funds devolved to Local Self governments for expansion and development and maintenance of assets is reckoned as developmental expenditure. The committed expenditure consisting of debt charges, expenditure on pension payments and administrative services together form non-developmental expenditure of the State.

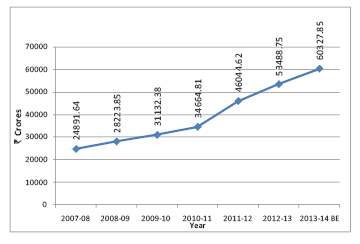

1.63 The growth in revenue expenditure was relatively higher in 2011-12. Impact of arrear payments on account of pay and pension revision in 2011-12 pushed up growth in Non plan revenue expenditure to the level of 33.64 per cent. But it moderated to 14.54 per cent in 2012-13. Growth in plan expenditure was 28.57 per cent in 2012-13 compared to 26.97 per cent in 2011-12. Total revenue expenditure in 2012-13 was ` 53488.75 crore. Of this, plan expenditure was ` 6849.33 cr and non-plan expenditure ` 46639.42 crore. The ratio of revenue expenditure relative to GSDP almost shown sign of stabilization during the last few years with marginal year to year variation but for in 2010-11. It was 14.61 per cent in 2011-12 and 14.72 per cent in 2012-13. However it was 12.86 per cent in 2010-11. The trend in Revenue Expenditure from 2007-08 to 2013-14 BE is given in Fig. 1.11.

Fig. 1.11

Revenue Expenditure (र in crore)

Source: Finance Department, Govt. of Kerala

1.64 In 2012-13 salary expenditure as proportion of total revenue expenditure was 32.26 per cent whereas it was 34.81 per cent in 2011-12. Pension expenditure as per cent of total revenue expenditure was 16.58 per cent in 2012-13 compared to 18.90 per cent in 2011-12. Interest payment as per cent of total revenue expenditure came down to level of 13.67 per cent in 2011-12 and to 13.47 per cent in 2012-13 from 16.41 per cent in 2010-11. Expenditure on salaries pension and interest form the lion share of revenue expenditure. In 2011-12, it constituted 67.37 per cent of the total revenue expenditure. It came down significantly in 2012-13 to 62.31 per cent. Committed expenditure comprised of salaries, pension, interest, devolution to LSGs and subsidies. Expenditure on committed liabilities constitutes 74 per cent of revenue expenditure and consumed 83 per cent of the revenue receipts of the State during 2012-13. State’s concerted efforts to intervene in the market to curb rising prices of essential commodities due to persistent inflation and policy initiative to bring all weaker sections of society under social security net was also a major reason for the increase in revenue expenditure. The details of Revenue Expenditure (item wise) from 2007-08 to 2013-14 BE is given in Appendix 1.34 and 1.35 and expenditure on interest, pension and salary from 2007-08 to 2013-14 BE is given in Appendix 1.36.

1.65 The details of Revenue Expenditure is shown in the Table 1.8.

Table 1.8

Trend in Revenue Expenditure from 2009-10 to 2012-13 (र in Crore)

Year |

2009-10 |

2010-11 |

2011-12 |

2012-13 |

||||

Expenditure |

As per cent of TRE |

Expenditure |

As per cent of TRE |

Expenditure |

As per cent of TRE |

Expenditure |

As per cent of TRE |

|

i. Salaries |

9764.15 |

31.36 |

11031.97 |

31.82 |

16028.82 |

34.81 |

17257.41 |

32.26 |

ii. Pension |

4705.5 |

15.11 |

5767.49 |

16.64 |

8700.3 |

18.90 |

8866.89 |

16.58 |

iii. Interest |

5292.48 |

17.00 |

5689.66 |

16.41 |

6293.6 |

13.67 |

7204.81 |

13.47 |

iv. Devolutions to 000LSGDs |

2689.65 |

8.64 |

2978.87 |

8.59 |

3896.76 |

8.46 |

4739.33 |

8.86 |

v. Subsidies |

440.83 |

1.42 |

623.7 |

1.80 |

1014.43 |

2.20 |

1265.19 |

2.37 |

Committed Expenditure total (i to v) |

22892.61 |

73.53 |

26091.69 |

75.27 |

35933.91 |

78.04 |

39333.63 |

73.54 |

Others |

8239.76 |

26.47 |

8573.12 |

24.73 |

10110.71 |

21.96 |

14155.12 |

26.46 |

Total |

31132.37 |

100.00 |

34664.81 |

100.00 |

46044.62 |

100.00 |

53488.75 |

100.00 |

Source: Finance Department, Govt. of Kerala

1.66 It is note-worthy that there is consistent improvement in the share of developmental expenditure in total revenue expenditure since 2010-11. In 2010-11 share of developmental expenditure in revenue expenditure was 54.58 per cent. This ratio increased to 55.33 per cent in 2011-12 and further reached the level of 56.95 per cent in 2012-13.

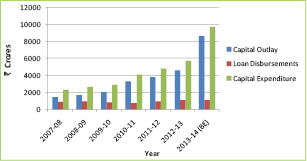

Capital Expenditure

1.67 High quality infrastructure is the backbone of any economy. Investment for improving infrastructure is essential for maintaining the growth prospects of the economy. Infrastructure financing remains a constraining factor due to deficit in resources to finance revenue expenditure. The State has already taken strong policy initiatives to create a conducive environment for attracting long- term investment in the State and determined efforts are taken to explore alternative financial sources for funding major infrastructural projects of the State. The share of government spending on capital projects was marginal till recently. A positive change in this spending pattern is visible now. In the last three years, the proportion of capital expenditure in total expenditure has shown perceptible improvement. This ratio now stepped up to the level of around 10 per cent. With a 19.48 per cent growth, expenditure on capital outlay of the State increased to ` 4603.29 crore in 2012-13 from ` 3852.92 crore in 2011-12. Capital outlay - GSDP ratio also improved to 1.27 per cent in 2012-13 from 1.22 per cent in 2011-12. The trend in Capital Outlay, Loan Disbursement and Capital Expenditure from 2007-08 to 2013-14 BE is given in Fig. 1.12 and also given in Appendix 1.37.

Fig 1.12

Trends in Capital Expenditure

(र Crores)

Source: Finance Department, Govt. of Kerala

1.68 Public Works continued to remain the major segment of capital outlay with 46.55 per cent of the total capital outlay in 2012-13 followed by Irrigation (7.40 per cent), Agriculture and allied activities (4.17 per ent) and Industries (5.95 per cent). The expenditure on loan disbursements increased to `1136.15 crore in 2012-13 from ` 998.54 crore. Its growth rate dropped to 13.78 per cent in 2012-13 from 31.09 per cent in 2011-12. The capital expenditure and total expenditure from 2007-08 to 2013-14 BE are given in Appendix 1.38.

Debt Profile

1.69 Borrowings which are repayable and on which interest accrues are classified as debt. Debt of the State comprises of internal debt, loans and advances from Central Government and liabilities on account of Small Savings and Provident Fund Deposits, etc. Increasing gross fiscal deficit has led to increasing debt liabilities of the State. However level of debt in terms of GSDP has shown declining trend in recent years. But the annual growth rate of debt, which was 10.86 per cent in 2010-11 increased to 13.66 per cent in 2011-12 and further to 15.82 per cent at the end of 2012-13. Outstanding debt liabilities of the State at the end of 2012-13 were ` 103561 crore. Debt-GSDP ratio has declined consistently to 28.37 per cent in 2011-12 from 35.11 per cent in 2004-05. But the trend reversed and growth of debt rose slightly to 28.51 per cent in 2012-13. The debt-revenue receipts ratio has dropped from 253.86 per cent in 2010-11 to 235.25 per cent in 2011-12 and further down to 234.63 per cent in 2012-13. The debt sustainability of the State is evident from the above fiscal indicators. The debt of the state from 2007-08 to 2013-14 BE is given in the Table 1.9.

Table 1.9

Debt of the State

Year |

Internal Debt |

Growth Rate |

Small Savings, Provident Fund, Others |

Growth Rate |

Loans and advances from Central Government |

Growth Rate |

Total |

Growth Rate |

2007-08 |

34019.00 |

13.51% |

15858.00 |

9.11% |

5533.00 |

3.00% |

55410.00 |

11.10% |

2008-09 |

38814.00 |

14.10% |

18447.00 |

16.33% |

6009.00 |

8.60% |

63270.00 |

14.19% |

2009-10 |

43368.00 |

11.73% |

21296.00 |

15.44% |

6305.00 |

4.93% |

70969.00 |

12.17% |

2010-11 |

48528.10 |

11.90% |

23786.06 |

11.69% |

6359.08 |

0.86% |

78673.24 |

10.86% |

2011-12 |

55397.39 |

14.16% |

27625.10 |

16.14% |

6395.69 |

0.58% |

89418.18 |

13.66% |

2012-13 |

65628.41 |

18.47% |

31310.65 |

13.34% |

6621.78 |

3.54% |

103560.84 |

15.82% |

2013-14(BE) |

77031.97 |

17.38% |

29729.97 |

-5.05% |

7359.44 |

11.14% |

114121.38 |

10.20% |

Source: Finance Department, Govt. of Kerala

1.70 Internal debt dominates debt liabilities. Market borrowings and loans from financial institutions mainly constitute the internal debt of the State. Central government loans and accruals from State Provident fund deposits are the other sources State’s debt. The debt profile has undergone a change from 2005-06. The loan from the Centre and borrowing from NSSF has gone down sharply. With the centre stopping lending to States, following the 12th Finance Commission recommendations and the sharp fall in NSS collections from 2006-07, the borrowing has largely been through open market borrowings. The share of internal debt in the total debt liabilities of the State comes to 63.37 per cent in 2012-13. The growth rate of internal debt in 2012-13 was 18.47 per cent. Outstanding debt under internal debt increased to` 65628.41 crore in 2012-13 from ` 55397.39 crore in 2011-12. The liabilities under small savings, PF, etc. come to around 30 per cent of the total liabilities. The liabilities under Small savings, PF, etc at the end of 2012-13 was ` 31310.65 crore. It shows an increase of ` 3685.55 cr over

` 27625.10 crore of 2010-11. The outstanding liabilities under Loans and Advances from the centre at the end of 2012-13 were ` 6621.78 crore. The gross and net retention of debt in 2012-13 was `14142.65 crore and 6929.83 crore respectively. The debt profile of the State from 2007-08 to 2013-14 BE is given in Appendix 1.39.

1.71 The existing reality is that the State economy faces challenges from global and national front. The recent nationalization policies implemented in the Gulf countries would impose added pressure on State economy. However, the State’s growth has always stood ahead of national average.

Contingent Liabilities

1.72 To overcome the ceilings on fiscal deficits and revenue deficits set by the Fiscal Responsibility Act the State Government is giving guarantees to the borrowings of public sector undertakings and other institutions instead of funding them directly through the budget. These contingent liabilities also become the debt obligations of the state in the event of default by borrowing public sector units for which Government is a guarantor. The Outstanding Guarantees during 2012-13 is `11482.25 crore. The outstanding guarantees of the State Government from 2007-08 to 2012-13 are shown in Table 1.10.

Table 1.10

Outstanding Guarantees of Kerala

(र in Crore)

Year |

Amount guaranteed |

Amount Outstanding |

2007-08 |

14871.08 |

8317.3 |

2008-09 |

11385.55 |

7603.32 |

2009-10 |

10225.78 |

7495.00 |

2010-11 |

12625.07 |

7425.79 |

2011-12 |

11332.25 |

8277.00 |

2012-13 |

11482.25 |

9099.50 |

Source: Finance Department, Govt. of Kerala

Thirteenth Finance Commission Award

1.73 The Thirteenth Finance Commission had recommended, among other things, grants aggregating to ` 6371.5 crore for the State for the award period 2010-15. The State Level Empowered Committee (SLEC) and High Level Monitoring Committee (HLMC), constituted as per the stipulations in the guidelines issued by Government of India (GoI), have already approved the Perspective Action Plans for 2010-15 and Annual Action Plans for the years 2010-11, 2011-12, 2012-13 and 2013-14 in most of the cases enabling the implementing departments to take up and complete the projects within the stipulated time frame.

1.74 The Thirteenth Finance Commission treated Kerala, along with Punjab and West Bengal, as a debt stressed state, setting targets for Revenue Deficit, Fiscal Deficit and debt as a proportion of GSDP. While the state has been able to meet the targets with respect to the debt ratio, RD and FD targets are still distant. Three trends of recent years are worrisome and call for serious action. Firstly, over 80 per cent of the borrowings go for the repayment of past debt and interest payments. Second, the persistence of RD leaves little of the borrowings towards capital spending. Third, the persistently higher share of salary, pension and interest payments in total revenue expenditure and the declining share of the State in Finance Commission Award have not helped to improve the fiscal situation. Mobilisation of larger tax revenue would have helped. But recent years have shown a decline in the share of state’s own tax revenue in the state’s revenue receipts. Further, the share of sales tax including VAT in tax revenue, which showed a five per cent point increase during the five years till 2011-12, has flattened out.

Fourteenth Finance Commission

1.75 The Indian federal polity is characterized by larger taxation powers for the Centre and higher expenditure responsibilities of States. Articles of the Constitution between 268 and 275 have designed a well-structured system whereby States can benefit from the Centre’s taxation power to address the cost disabilities and fiscal capacities of the States. Aid to the States is what the makers of the Constitution had in mind. The Finance Commission constituted every five years is the authority which makes the award governing the flow of resources from the Centre to the States. The Fourteenth Finance Commission notified on 2nd January 2013 would be making the awards for the period 2015-16 to 2019-20. The Commission visited Kerala on 18-19 December 2013 to hear the views of the various stake holders in the State.

1.76 Kerala has been getting a raw deal in the devolution of taxes in the recent past, the share of the State coming down from 3.05% during 2000-05 (XIth Finance Commission) to 2.34% during 2010-15 (XIIth Finance Commission). One of the reasons for such a drastic reduction has been the adoption of income distance or fiscal capacity distance in the devolution formula with a fairly high weight. The Memorandum submitted by the State has demanded a raise in the devolution from 32% of the divisible pool to 50% and highlighted the need for reworking the devolution formula by upholding the principle of horizontal fiscal equalization. Instead of arbitrarily fixing weights for indicators such as population, income distance, tax effort, area and fiscal discipline, the Commission should be adhering to the principle of equalization and derive appropriate weights. Further, cost disabilities arising out of forest area, urbanization, ageing population and effective density should be incorporated in the formula. The Memorandum has submitted that the injustice done to Kerala by the previous Commissions in not awarding post devolution non plan revenue deficit grants under Article 275 should be corrected and grants be awarded for addressing the issues of forest conservation (including Western Ghat restoration), wetland preservation, and heritage conservation and upgradation of the government departments.

1.77 Kerala is in the forefront of decentralization. Around 25% of plan funds are transferred to the local bodies with remarkable results. The multidimensional poverty index for Kerala is one of the lowest among the States largely owing to the efforts of the local bodies. The Memorandum has demanded raising the share of the local bodies to 5% of the divisible pool. The innovative approaches taken in arguing Kerala’s case was appreciated by the Commission.

SECTION 7

Banking

1.78 Adequate and affordable capital is critical for development of the economy. Kerala boasts of a well-developed banking infrastructure. Commercial, Nationalised, Co-operative banks and a large number of grameen banks have sprung up within the state. Although, Kerala has only 1per cent of the total land area, it has 4 per cent of bank branches. This indicates that people of the state are highly financially literate. Kerala has largest number of bank branches among the semi urban areas in the country. At the end of March 2013, Kerala had total 5207 branches and there was an increase of 424 branches compared to March 2012. As on June 2013, total no of bank branches has also increased to 5262.Despite Kerala’s small size, this is on par with large states like Bihar, Punjab and Rajasthan (Appendix 1.40). As on March 2013, banks in Kerala increased disbursement of advances to

` 171712 crore over the previous year’s figure of `151525 crore (13.3 per cent). Maharashtra is a topmost state for disbursing the advances in the country (Appendix 1.41).

1.79 Deposit mobilization is an inevitable activity of all banks for augmenting credit flow to the development and priority sectors of the state. Overall Bank deposits in Kerala increased by 16.77 per cent from ` 200572 crore in March 2012 to ` 234217 crore in March 2013. Scheduled Commercial Banks in Kerala accounted for 3.32 per cent of deposits of the country (Appendix 1.42). As on June 2013, Bank Deposits have been hiked to ` 239744 crore.

NRI Deposit

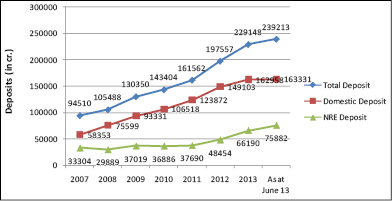

1.80 The NRI deposits increased by nearly `10000 crore during the period of April to June 2013 mainly due to the depreciation of the Rupee. Total NRI Deposits which stood at ` 48454 crore in March 2012 jumped to ` 75882 crore in June 2013 (nearly 57 per cent increase). NRE deposits constitute 36.6 per cent increase as on March 2013 over same period of the previous year. (Appendix 1.43). The private sector banks have mobilized major chunk of the NRI deposits followed by the State Bank of Travancore (Appendix 1.44). Fig.1.13 shows the growth of Bank Deposits in Kerala including NRE deposit.

Fig 1.13

Bank Deposits in Kerala(र in Crore)

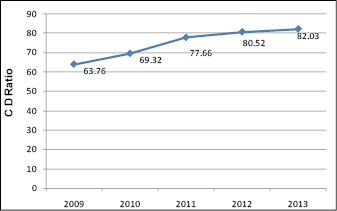

Credit Deposit Ratio (CDR)

1.81 In early 2000, Credit Deposit Ratio (CDR) of the Public Sector Banks in Kerala was very low. During

this period, banks were reluctant to disburse loans for education , housing , self employment etc for fear of growing Non-Performing Asset (NPA) in the Banking Sector. In view of effective interventions by the Central and State Governments, bank managements were forced to extend loans to needy groups relaxing their policies. As per RBI data , credit of Public Sector Banks in Kerala grew by 16 per cent as on March 2013 to `121700 crore, while aggregate deposits went up to14 per cent during the same period reflecting an increase in CD ratio from 80.52 in March 2012 to 82.03 in March 2013 (Appendix 1.45). & ( Fig 1.14). On the other hand, Credit Deposit ratio is low in Kerala (82), unlike Tamil Nadu and Andhra Pradesh where the CD ratio is above 1, indicating that banks in Kerala have idle funds for which there is inadequate demand. CD ratio in Kerala has been increasing over the last three years. Though low, Kerala’s CD ratio is greater than All India average

Fig 1.14

Credit Deposit Ratio of the Public Sector Banks in Kerala

Credit Flow to the Priority Sectors

1.82 During the year 2012-13, advances to the following priority sectors viz. Agriculture and Small & Micro Enterprises, increased by ` 13712 crore as against ` 14461 crore (5.5 per cent) added during the corresponding period of previous fiscal. Against the mandatory norm of 40 per cent under priority sector advances, 56.72 per cent of the total advances of the banks in the State as on March 2013 were to priority sector. However, there was a slight decrease in the disbursement of advances to priority sectors during 2012-13 when compared to the previous year which was 57.34 per cent.

Housing Loans

1.83 During 2012-13, banks in Kerala including Private Sector Banks sanctioned an amount of 26639.68 crore to 715797 beneficiaries as housing loan against ` 23191.79 crore to 623165 beneficiaries during 2011-12 (SLBC: 2013) showing about 15 per cent growth in total housing loan sanctioned

Educational Loans

1.84 In order to support students from economically weaker section of the society, Department of Education, Ministry of Human Resource Development, Government of India has launched an interest subsidy scheme. The MoHRD has appointed Canara Bank as the Nodal Bank for the Scheme. At the end of March 2013, ` 8294.54 crore was sanctioned to 380295 students and the per cent increase of education loan and beneficiaries during March 2012 was 15 and 6 respectively over the last year (SLBC: 2013).The Ministry of Finance has finalized the modalities of the Credit Guarantee Fund Trust (CGFT) for Higher Education to be set up with a corpus of ` 2500 crore. The High point of the credit guarantee trust initiative is that the students (with annual family income below ` 4.5 lakh) will be able to avail education loans up to` 7.5 lakh without giving any collateral security or third party guarantee.

Advances to Weaker Sections and SC/STs

1.85 During 2012-13, an amount of ` 35934.99 crore has been disbursed to 4122926 beneficiaries of weaker sections in the state. Corresponding figures in 2012-13 was ` 29658.12 crore to 3590688 indicating 21 per cent of growth in the amount sanctioned. During 2012-13 the advances to SC/STs was ` 4155.08 crore to 354048 beneficiaries against ` 3672.87 crore to 311892 beneficiaries in the previous year. Although there is increase in the total amount sanctioned, the number of beneficiaries decreased compared to the previous years.

Micro finance

1.86 Micro finance is general terms to describe financial services that have access to typical banking services. It generally targets poor women. By providing access to financial services through women-making women responsible for loans, ensuring repayment through women, maintaining accounts for women, providing insurance coverage through women-micro finance programmes send a message to households as well as to communities. In Kerala More than 4 lakh Self Help Groups (SHG) maintaining their savings bank accounts with ` 2397.97 crore in various banks as on March 2013, against ` 625.49 crore in 2011-12. (SLBC:2013)

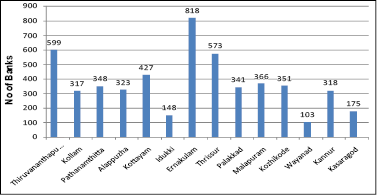

District –wise analysis of Banking Statistics

1.87 The District-wise details of banking statistics in Kerala (Fig:1.15) reveals that Ernakulam district with 818 branches holds the largest number of branches followed by Thiruvananthapuram with 599 branches. In Wayanad and Idukki districts, the credit intake exceeded considerably against the deposits (Appendix.1.46). The disbursement of credit against deposit in Pathanamthitta district was very low with the C.D ratio of 31.1 per cent

Fig 1.15

District Wise Bank Branches in Kerala

Financial Inclusion Plan (FIP) 2013-16

1.88 The first three-year Financial inclusion plan of banks for the period 2010-2013 has ended. Although there has been reasonable progress in the penetration of banking services and opening of basic bank accounts, the number of transactions through ICT-based Business Correspondent (BC) outlets is still very low. To continue the process of ensuring access to banking services to the excluded, banks have been advised to draw up a 3-year Financial Inclusion Plan for the period 2013-16.

Annual Plan 2013-14

1.89 Annual Plan (2013-14) of the State is formulated based on specific guidelines. While formulating the plan, critical review of the performance of ongoing schemes during 2012-13 was held. The recommendations of the respective Working Groups were also considered for formulating new schemes. In order to avoid proliferation of schemes, attempts have been made to reduce the number of schemes and wherever possible, schemes having similar nomenclature have been proposed under a single head as an ‘umbrella’ scheme. Care has also been taken to drop unproductive schemes. Likewise, as a step towards Gender Responsive Budgeting, efforts were made to categorise specific need based programmes to address the concern of women/girls.

Box 1.1

Highlights of Annual Plan 2013-14

• Comprehensive Fallow Land Cultivation programme with people’s participation.

• Establishment of Hi-Tech Agriculture Training Centre

• Kasaragod package

• Zoological Park / Wild Life Protection and Research Centre

• Infrastructure development of Government Colleges.

• Scheme for Comprehensive Mental Health Programme

• Burns Units in 5 Medical Colleges

• Deceased Donor Multi Organ Transplantation

• Creation of sculptures in major cities

• Establishment of IIT in Linguistic Minority Area

• Replacement of old pipes of existing water supply schemes