Chapter 3

INDUSTRY, LABOUR AND EMPLOYMENT

Introduction

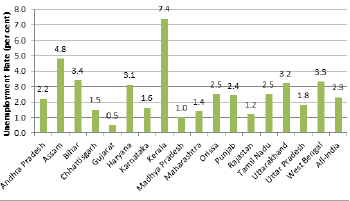

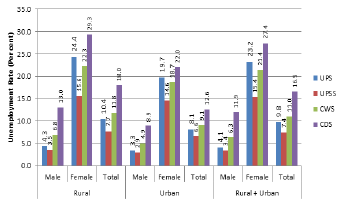

The rising number of unemployed persons in industrialized economies and need for employment generating activities, point to the central role that productive activity and jobs have in the life of individuals and countries. Employment arises out of the efforts of entrepreneurs and governments generating new businesses and economic activities. Sustained job creation depends on the ability of an economy to innovate and generate new activities characterized by higher value addition and productivity growth.

One of the key findings of UNIDO’s Industrial Development Report 2013 is that countries need to move from lower technology to higher technology sectors, from lower value-added to higher value added sectors and from lower productivity to higher productivity sectors. The report also underlines the critical need for international cooperation to achieve the structural change and economic growth required to combat poverty.

Section 1

Manufacturing

India accounts for 1.8 per cent of the world’s manufacturing output. World manufacturing growth was 3.4 per cent in the first quarter and 3.0 per cent in the second quarter of 2014-15, according to the United Nations Industrial Development Organization’s (UNIDO) Quarterly Report on World Manufacturing Production.

3.2 At the national level, the contribution of manufacturing sector to Gross Value Added (GVA) at constant prices (2011-12) during the 1st half of 2015-16 is ₹9.64 lakh crore. At current prices, manufacturing sector registered a growth of 6.9% for the first half of 2015-16 as compared to the growth of 12.2 percent in the first half of 2014-15. As per the estimates, the share of manufacturing sector to GVA is 17.62% at current prices.

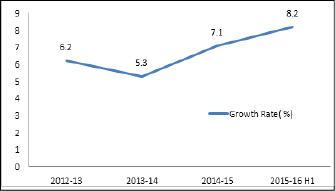

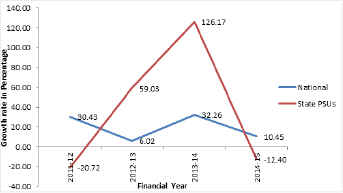

3.3 The trends in growth of manufacturing sector in India as per provisional estimate of GVA by economic activity at constant prices for a period from 2012-13 to 2015-16 (H1) is exhibited in Figure 3.1.

Fig 3.1

Growth of Manufacturing Sector in India

Source: Central Statistics Office

3.4 As per Quick Estimate of Gross Value Added (Economic & Statistics Department) the manufacturing sector of Kerala grew by 12.33 per cent at current prices during 2014-15 compared to 6.92 per cent in the previous year. At constant prices (2011-12), the sector registered a growth of 8.92 per cent in 2014-15 as against 1.97 percent in 2013-14. The share of manufacturing sector to GVA at constant and current prices during 2014-15 was 10.82 per cent and 10.19 per cent respectively. The income from manufacturing sector to GVA from 2011-12 to 2014-15 is given inAppendix 3.1.

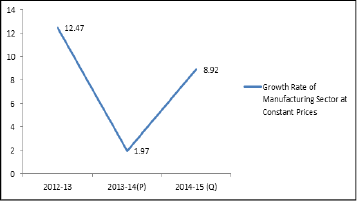

3.5 The trend in growth rate of income from manufacturing sector in Kerala on the basis of GVA at constant prices for the period from 2012-13 to 2014-15 is shown in Figure 3.2.

Fig 3.2

Rate of Growth of Manufacturing Sector - Kerala

Source: Directorate of Economics and Statistics

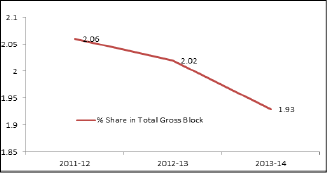

3.6 The income from manufacturing sector in Kerala which registered 12.47 per cent growth in 2012-13 witnessed a decline during 2013-14 (1.97 per cent) and recorded a moderate growth of 8.92 per cent during 2014-15.

Mining

3.7 India is a mineral rich country with large deposits of iron ore, barytes, rare earth and mineral salt. India produced 90 minerals, 11 metallic, 52 non metallic and 23 minor minerals in 2012-13. India was ranked 2nd in the production of Barytes, third in chromite, and coal and lignite, 5th in iron ore and steel (crude), 6th in bauxite ore, 7th in manganese ore and 8th in aluminium (crude) in the world in 2012. The number of mines in India which reported mineral production (excluding minor minerals, petroleum (crude), natural gas and atomic minerals) was 3318 in 2014-15 as against 3722 in 2013-14. The total value of mineral production (excluding atomic minerals) during 2014-15 has been estimated at ₹267637 crore as against ₹278150 crore during 2013-14.

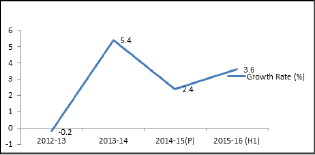

3.8 As per Provisional Estimate (PE) of Gross Value Added (GVA) at constant prices (2011-12) for 2014-15, mining and quarrying sector at national level grew by 2.4 per cent as against 5.4 percent in 2013-14.During the period April-September (H1) 2015-16, the mining and quarrying sector contributed ₹1.37 lakh crore to Gross Value Added (GVA) at constant prices. The sector grew by 3.6% as compared to 3% in the first half of 2014-15. At current prices, the sector contributed ₹1.43 lakh crore to GVA during 2015-16 (H1) with a minus growth rate of 0.1% as compared with the growth of 4.4% of 2014-15 (H1). The trend in national growth rate of Mining and Quarrying sector at constant prices is shown Figure 3.3.

Fig 3.3

National Growth Rate of Mining and Quarrying Sector

Based on GVA at Constant (2011-12) Prices

Source: Central Statistical Office

3.9 Mining and Quarrying sector at the national level showed a decline by -0.2 per cent in 2012-13, a growth of 5.4 per cent in 2013-14 and 2.4 per cent in 2014-15. In the first half of 2015-16, the sector registered a growth of 3.6 per cent.

Growth of the Mining Sector in the State

3.10 The contribution of Mining and Quarrying sector to Gross Value Added at constant prices is estimated at ₹220881 lakh during 2014-15 registering a growth of 21.85 percent compared to the previous year. The share of the sector in GVA at constant prices stood at 0.56 percent during 2014-15 as against 0.49 per cent in 2013-14.

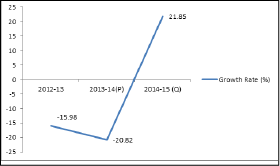

3.11 The growth of income from the sector as per estimate of GVA at constant prices (2011-12) from 2012-13 to 2014-15 is depicted in Figure 3.4.

Fig 3.4

Growth Rate of Income from Mining and Quarrying Sector in Kerala

Source: Directorate of Economics and Statistics

3.12 There are 83 major mineral mines that are operational in the State as on 31st March 2015. During 2014-15, 87 mining leases for major minerals, 532 quarrying leases, 6222 quarry permits in minor minerals and 1549 dealers license were granted. In 2014-15 there were 188 registered metal crusher units in Kerala.

3.13 The total area covered by mining leases as on September 2015 is 2233.37 hectares of which lime shell/seashell accounts for 1350.40 hectares, mineral sand 349.77 hectares, limestone 245.69 hectares, china clay 106.1 hectares. Area covered by graphite and bauxite are 1.25 hectares and 0.72 hectares respectively. Mineral wise details of area covered by mining lease are given in Appendix 3.2.

3.14 During 2014-15, 378.07 lakh tonnes of major and minor minerals were produced in Kerala. Among major minerals,china clay tops the list with 8.89 lakh tonnes followed by limestone (4.27 lakh tonnes), bauxite/laterite (2.98 lakh tonnes) and ilmenite (1.1 lakh tonnes). Among minor minerals highest production is granite building stone (244.44 lakh tonnes) followed by ordinary earth (45.77 lakh tonnes), ordinary sand (22.41 lakh tonnes), river sand (20.51 lakh tonnes) and laterite (15.87 lakh tonnes).

3.15 During 2014-15 an amount of ₹70.6 crore was received as royalty from minerals, of which ₹13.91 crore was from major minerals and ₹56.69 crore from minor minerals. During 2014-15 highest royalty among major minerals is from limestone (₹3.05 crore) followed by bauxite/laterite (₹3.01 crore), china clay (₹2.76 crore) and ilmenite (₹1.86 crore). Among minor minerals granite building stone stands first by contributing ₹39.11 crore as royalty followed by ordinary earth (₹9.15 crore) and laterite (₹2.54 crore) during 2014-15. The production and royalty of minerals in the State during 2014-15 are given in Appendix 3.3.

3.16 District wise analysis of revenue collection shows that Ernakulam district has the highest collection of ₹11.74 crore (16.63% of total revenue) followed by Palakkad ₹8.83 crore (12.51%) and Kollam ₹6.24 crore(8.84%). The least revenue collection of ₹1.62 crore (2.29%) is from Wayanad. The district wise collection of revenue from major and minor minerals is furnished in Appendix 3.4.

Section 2

Public Sector Undertakings

3.17 In India, Public Sector Enterprises have been set up with an objective of attaining higher economic growth with self-sufficiency in the production of goods and services with long term stability in economic activities. There were 234 operating Central Public Sector Enterprises (CPSEs) in India as on March 2014 (Public Enterprises Survey 2013-14). Out of these 163 had been profit making and 71 loss making.

Central Sector Investment

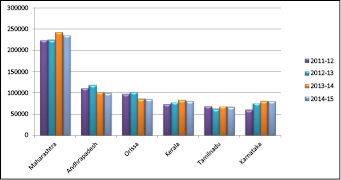

3.18 The aggregate real investment in Central Public Sector Enterprises (CPSEs) in India, measured in term ‘gross block’ increased from ₹1555575.29 crore in 2012-13 to ₹1757450.17 crore in 2013-14 registering a growth of 12.98 per cent over the previous year. Though the investment in CPSEs in the State in terms of gross block grew by 7.65 per cent from ₹31460.19 crore in 2012-13 to ₹33866.85 crore in 2013-14, its percentage share in total gross block decreased from 2.02 in 2012-13 to 1.93 in 2013-14 (Public Enterprises Survey 2013-14). State wise analysis shows that Maharashtra ranked first with the highest investment of ₹297280.93 crore (16.92%) followed by Andhra Pradesh ₹127586.55 crore (7.26.%) and Tamil Nadu ₹120155.09 crore (6.84%). Details of Central Sector Investment in Kerala from 2011-12 to 2013-14 are given in Appendix 3.5 and Central Sector Investment in selected states as on 31/03/2014 are given in Appendix 3.6.

3.19 The percentage share of investment received in Kerala from 2011-12 to 2013-14 is exhibited in Figure 3.5. It may be seen that the share of Kerala has been falling during the last three years.

Fig 3.5

Investment in CPSEs in Kerala

Source: Public Enterprises Survey 2013-14

State Public Sector Undertakings

3.20 In Kerala, there are 95 active State Level Public Enterprises (SLPEs) as on March 2014; 87 Government Companies and 8 statutory bodies. Among Government Companies 44 units were reported as profit making. As on March 2014, the total capital investment in public enterprises in the State was ₹34007.88 crore as against the investment of ₹29271.01 crore during the previous year.

3.21 Under Industries Department there are 44 SLPEs, of which 37 are in manufacturing sector and 7 in non-manufacturing/service sector. The performance trend of PSUs under Industries Department during the last 5 years is given in Appendix 3.7.

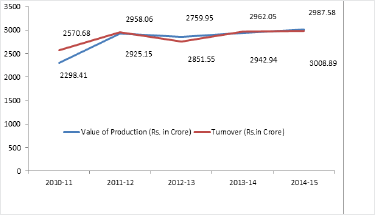

3.22 Total value of production in 44 SLPEs under Industries Department had increased from ₹2942.94 crore in 2013-14 to ₹3008.89 crore in 2014-15 registering a growth of 2.24 %, whereas their turnover grew by 0.86 percent only during 2014-15 compared to previous year. Details of PSU-wise turnover and profit/loss during 2013-14 are shown in Appendix 3.8. The performance trend of 44 SLPEs under Industries Department in terms of value of production and turnover from 2010-11 to 2014-15 is shown in Figure 3.6.

Fig 3.6

Value of Production and Turnover of SLPEs under Industries Department

Source: Public Sector Restructuring and Internal Audit Board

3.23 It may be seen that there is no significant variation in value of production and turnover for the last four years.

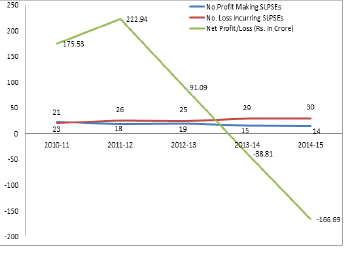

3.24 SLPEs under Industries Department numbering 14 reported profit during 2014-15 as against 15 in 2013-14. The profit made by them decreased from ₹108.16 Crore in 2013-14 to ₹74.5 crore in 2014-15. Major profit making units during 2014-15 are Kerala State Industrial Development Corporation Ltd (₹29.64 crore), Malabar Cements Ltd (19.28 crore) and Kerala Industrial Infrastructure Development Corporation (₹9.70 crore).

3.25 The number of loss making SLPEs had increased from 29 in 2013-14 to 30 2014-15 and the amount of loss from ₹146.97 crore to ₹241.19 crore. As a result, the net loss of SLPEs under Industries Department had increased from ₹38.81 crore in 2013-14 to ₹166.69 crore in 2014-15. Major loss making SLPEs during 2014-15 are Kerala State Cashew Development Corporation (₹33.79 crore), Transformers and Electricals Kerala Ltd. (₹27.62 crore), Kerala Minerals and Metals Ltd. (₹24.89 crore) Travancore Titanium Products Ltd. (₹24.25 crore) and Kerala State Textile Corporation Ltd.(₹24.08 Crore). Performance trend of 44 SLPEs from 2010-11 to 2014-15 is depicted in Figure 3.7.

Fig.3.7

Performance Trend of SLPEs under Industries Department

Source: RIAB

3.26 SLPEs under Industries Department which reported an increase in net profit from ₹175.53 crore in 2010-11 to ₹222.94 crore in 2011-12 witnessed a drastic decline to ₹91.09 crore in 2012-13 and then fell into net loss of ₹38.81 crore in 2013-14 and ₹166.69 crore in 2014-15. Unhealthy import of Titanium Dioxide from China, lack of modernisation and technology up gradation, tough competition from market etc adversely affected the performance of SLPEs. It is high time to initiate focussed and time bound action for bringing out drastic changes in the sector to improve the performance of SLPEs which will in turn stimulate the economic growth of the State.

Public Sector Restructuring and Internal Audit Board (RIAB)

3.27 RIAB, constituted in 1993, executes State Owned Enterprise Reform Initiatives. Major responsibilities of the agency are performance planning and monitoring of PSUs, enterprise reconstruction, capacity building / recruitments in PSUs and governance advisory support to SLPEs.

Box 3.1

Major Initiatives in PSUs during 2014-15

• As part of modernisation of PSUs, Kerala Electrical and Allied Engineering Co Ltd has initiated a Cast Resin Transformer project at its Eradikoode unit with an outlay of₹8.50 crores during the year.

• Modernisation and Expansion projects have been initiated by TRACO Cables Company Ltd,Kerala Drugs and Pharmasuticals Ltd, Steel Complex Ltd,Travancore Cochin Chemicals etc. during 2014-15.

• Keltron and its subsidiary units have initiated various development projects as part of expansion and modernisation during 2014-15 in line with Electronic Manufacturing Policy of Government of India.

• Reopened the Cherthala unit of Malabar Cements Ltd. Clinker was imported for the first time through Cochin Port and trial-run was done during this period.

• As part of performance improvements of PSUs, Performance and Audit Monitoring system have been strengthened through RIAB.

• Implementation of e-procurement with e payment system in PSUs ensured more transparency and competition in purchase.

• As part of corporate social responsibilities, PSUs have initiated various social welfare measures for the development of different sectors of the society.

Source: RIAB

Joint Stock Companies

3.28 There are 25863 Joint Stock Companies in Kerala as on March 2015, of which 24338 (94.10%) are Private Limited and 1525 (5.90%) Public Limited. Also, 1012 companies are newly registered from April to September 2015. During 2014-15, 1607 companies were newly registered (1575 Private Limited and 32 Public Limited) and 330 companies were wound up/dissolved/struck off during this period. Nine public companies were converted to private companies and 5 companies were converted from private to public. Total number of government companies as on March 2015 is 139(95 Public Limited and 44 Private Limited). Details of joint stock companies working in Kerala are given in Appendix 3.9.

Industrial Financing

Kerala Financial Corporation (KFC)

3.29 Kerala Financial Corporation has been playing a major role in industrialisation of Kerala through industrial financing. The main objective of Kerala Financial Corporation (KFC) is to promote rapid industrialisation of the State by extending financial assistance to Micro, Small and Medium Enterprises (MSME), in manufacturing and service sectors. Financial assistance is provided in the form of term loans, working capital loans and special schemes. KFC is a member of Credit Guarantee Fund Trust for Micro and Small Enterprises. Activities of the Corporation are the following.

- • Sanction of Term Loans to new Micro, Small and Medium enterprises in the manufacturing and services sector.

- • Sanction of Term Loans to existing industrial concerns and services sector units for expansion/modernisation/diversification.

- • Sanction of working capital loans to meet working capital requirements of industrial/service enterprises under special schemes.

- • Special schemes for Financial Assistance to Civil Contractors.

- • Special scheme for Financial Assistance for producing Feature Film and TV serials.

- • Special scheme for modernisation, up gradation and expansion of existing cinema theatres and establishment of new multiplexes.

- • Special scheme for purchase of laboratory equipments/waste management.

3.30 The Corporation sanctioned loan of ₹947.45 crore during 2014-15 and disbursed an amount of ₹657.09 crore in 2014-15. An amount of ₹427.52 crore was disbursed to various SSI units and ₹229.57 crore to other units during 2014-15. The Corporation reported profit (before taxation) of₹30.03 crore during 2014-15 as against ₹57.10 crore during 2013-14. Performance of KFC during the last five years is given in Appendix 3.10. The details of loan operations and industry-wise classification of loans during 2014-15 of KFC are shown in Appendix 3.11 and Appendix 3.12.

Kerala State Industrial Development Corporation (KSIDC)

3.31 Kerala State Industrial Development Corporation Ltd. (KSIDC), formed in 1961, was established for promotion and development of medium and large scale units in the State. KSIDC also plays a vital role in entrepreneurship development in the State.

3.32 KSIDC has sanctioned 11 projects involving a capital investment of ₹232.57 crores with direct term loan assistance of ₹108.76 crores in the financial year 2014-15. Out of projects sanctioned, four are in Ernakulum, three in Thiruvananthapuram, two in Alappuzha and one each in Palakkad and Malappuram districts. The new projects are expected to generate employment for 10,000 persons directly and indirectly. The Corporation has also registered ₹43.19 crores disbursement and ₹ 92.90 crores in recovery. The total income of the Corporation has come to ₹50.25 crores during 2014-15. Majority of projects financed by the Corporation during 2014-15 are from tourism and manufacturing sectors. The Corporation has also sanctioned projects in IT sector, logistics, infrastructure and agro processing sectors etc. Details of investment and employment made in KSIDC units during 2014-15 are given in Appendix 3.13. The physical and financial performance of KSIDC during 2014-15 is given in Appendix 3.14. Details of allotment of land in KSIDC Industrial Parks as on 30-9-2015 is given in Appendix 3.15.

Box 3.2

Major Projects Initiated by KSIDC

• Petrochemical Park, Kochi- to promote petroleum chemical and petrochemical investment.

• Mega Food Park ,Cherthala

• Electronic Hardware Park at Kochi – a world class manufacturing and R&D facility

for Electronic Sector.

• Life Sciences Park for setting up state-of-the-art manufacturing and R&D facility

for Biotechnology, Nano Technology, Contract Research etc.

• Titanium Sponge Project at Kollam

• Supplementary Gas Infrastructure Project

• Coconut Industrial Park, Kuttiyadi

• Organic Industrial Park, Kodungallor

• Light Engineering Industrial Park, Palakkad.

3.33 KSIDC conducted ‘Young Entrepreneurs Summit” (YES) on 12th September 2014- for promoting young entrepreneurs especially from student community focusing on sectors in which the State offers significant possibilities for entrepreneurship viz, Food Processing, Marine Processing, Life Sciences, Health care etc. The Corporation also organized Global Agro Meet along with BIOFACH INDIA-2014 at Kochi for creating common platform for farmers, processors and retailers. KSIDC has also initiated a new mission called Women Entrepreneurs Mission (WE Mission) to attract and encourage women entrepreneurship in the State and organized “WE Summit-2015”. About 1500 women entrepreneurs from across the State participated in the summit.

3.34 KSIDC has also initiated a special finance assistance scheme known as “Angel Fund/Seed Fund” to promote entrepreneurship among youth making them as job providers rather than job seekers and has made a total disbursement of ₹1.35 crore to 14 ventures as on 31st March 2015.

Kerala Industrial Infrastructure Development Corporation (KINFRA)

3.35 Development of industrial infrastructure plays a vital role in industrial development of a nation. In order to create conducive infrastructure for accelerating industrial development in the State, Government of Kerala established Kerala Industrial Infrastructure Development Corporation (KINFRA) in 1993. The corporation has been focussing on industrial infrastructure development by setting up industrial parks, townships, zones etc. The Industrial Parks developed by KINFRA have facilities like developed land or built up space, dedicated power, continuous water supply, communication facilities etc., in addition to supporting social infrastructure facilities like administrative block, bank, post office, round the clock security etc. The parks provide a ready-made manufacturing environment for easy start up of industrial units with minimum time and cost.

3.36 KINFRA has completed infrastructure development in 12 key industrial sectors with world – class infrastructure in 19 Industrial Parks, of which 9 are catering exclusively to the Small & Medium Enterprises Sector. Some of the notable achievements are the successful completion of International Apparel Park at Thiruvananthapuram, Export Promotion Industrial Park at Ernakulam, Infotainment Park and the Film & Video Park at Thiruananthapuram and Food Processing Industrial Park at Malappuram.

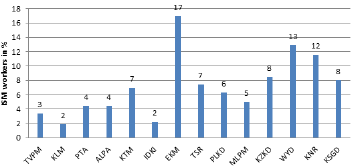

3.37 KINFRA has promoted investments in the State and created investment friendly climate within its Parks, contributing significantly to the State’s economy. As on September 2015, 637 industrial units have been started in the various Industrial Parks of KINFRA with total investment of₹1486.50 crore with direct employment of 25754. KINFRA has also implemented a Single Window Clearance system in all the Parks. The Single Window Clearance system operating in the Parks are helping the investors to establish their units without hassles. The details of allotments in KINFRA Industrial Parks as on 30/09/2015 are given in Appendix 3.16.

Box 3.3

Ongoing and New Projects of KINFRA

• Industrial Park, Ottappalam

• Industrial Park, Piravanthoor

• Industrial Park, Mattannur, Kannur

• Gem and Jewellery Park, Thrissur

• Spices Park, Muttom, Thodupuzha

• Nano – Tech Zone, Hi tech Park, Kalamassery

• KINFRA Business Park, Kollam

• Global Ayurveda Village, Thiruvananthapuram

• Mega Food Park, Palakkad

• Foot Wear Park, Ramanattukara

• Trade and Convention Grounds, Ernakulam

• Industrial Development Zone

• Defence Park, Ottapalam (New Project)

Source: KINFRA

Section 3

Micro Small and Medium Enterprises (MSMEs)

3.38 Worldwide, micro, small and medium enterprises (MSMEs) act as the engine of economic growth and for promoting equitable development. MSMEs play a critical role in innovation and have ability to experiment with new technologies on small scales.

India - Micro, Small & Medium Enterprises

3.39 The MSME sector in India is diverse in terms of its size, levels of technology employed and range of products and services produced. Starting from village industries, the products from the sector span to auto components, micro-processors, electronic components and electro-medical devices. MSMEs have shown a consistent growth of 11% till 2010-11, whereas growth rate was 19% in 2011-12 and 14% in 2012-13.

3.40 As per the Fourth All India Census of the MSME total number of MSM enterprises were 3.61 crore, of which 0.16 crore are registered enterprises. These MSMEs, contribute 37.5 per cent of India’s GDP, have a critical role in boosting industrial growth and ensuring the success of the Make in India programme. A number of schemes are being implemented by Ministry of MSME, Government of India, for the establishment of new MSMEs and growth and development of existing ones. These include:

(a) Prime Minister’s Employment Generation Programme,

(b) Micro and Small Enterprises-Cluster Development Programme,

(c) Credit Guarantee Fund Scheme for Micro and Small Enterprises,

(d) Performance and Credit Rating Scheme,

(e) Assistance to Training Institutions, and

(f) Scheme of Fund for Regeneration of Traditional Industries

3.41 During Twelfth Five Year Plan an outlay of ₹24,124.00 crore has been allocated for Ministry of MSME, which represents an increase of 133.53% over the XIth Five Year Plan allocation of ₹10,330.00 crore.The Ministry of MSME has been allocating outlays of ₹2251.00 crore, ₹2610.00 crore and ₹2612.51 crore for the years 2013-14, 2014-15 and 2015-16 respectively under Plan for promotion of MSMEs in the country.

The Micro, Small & Medium Enterprises Development Act, 2006

3.42 India is one amongst very few countries which has a legal framework for the MSME Sector in the form of MSMED Act 2006, as per which investment limit for Micro, Small & Medium enterprises are specified for Manufacturing and Service enterprises.

Box 3.4

Udyog Aadhaar Memorandum (UAM) a simplified registration format for MSMEs

The Ministry of Micro, Small & Medium Enterprises in September-2015 under the MSME Development Act, 2006 has notified that every MSME unit shall file Udyog Aadhaar Memorandum (UAM). This is a path breaking step to promote ease-of-doing-business for MSMEs in India as the UAM replaces the filing of Entrepreneurs’ Memorandum (EM part-I & II) with the respective States/UTs. The entrepreneurs in the MSME sector can file UAM on http://udyogaadhaar.gov.inonline, if they have an Aadhar number and will instantly get a unique Udyog Aadhaar Number (UAN). The UAM can be filed in offline mode (i.e. on paper form), with the General Manager (GM) of the concerned District Industries Centre (DIC).

MSME in State

3.43 In Kerala, the Micro, Small and Medium Enterprises (MSME) sector contributes to the process of economic growth, employment generation and balanced regional development. It has the potential to emerge as a strong, vibrant and globally competitive sector in the State’s economy. Kerala, with its excellent connectivity, communication network, availability of highly or average skilled human resources and developing industrial infrastructure, is best suited for the growth of the micro, small and medium scale enterprises.

3.44 The potential of IT industry in the MSME sector is big as the State offers best connectivity with broadband reach in almost all parts of the State. It is estimated that the share of Tier-III cities in the IT industry in India is expected to grow up from 10 per cent now to 80 per cent. Consultancy firm KPMG has suggested that the State can become an economic growth driver of the country by tapping its SME and IT sectors.

3.45 The Micro Small and Medium Enterprises sector help in industrialisation of rural & backward areas, targeting various social groups like SC, ST, Women, Youth, Physically Handicapped etc. thereby, reducing social/regional imbalances, assuring more equitable distribution of income and wealth. This sector contributes enormously to the socio-economic development of the State. As per the MSME survey & Quick Results of 4th Census, 5.62% of all India share of MSME enterprises is in Kerala.

3.46 The industries coming under this sector are handicrafts, Handloom, Khadi, Food processing industries, Garment making and Textile industries, industries related to coir/ wood/ bamboo/ Plastic/ rubber/ leather/ clay/ small scale manufacturing, electronic/electric components, etc.

3.47 The Directorate of Industries and Commerce of Government of Kerala acts as a facilitator for industrial promotion and sustainability of MSME sector and traditional industrial sector in the State with the help of Directorates of Handloom & Textiles, Directorate of Coir and Khadi & Village Industries Board. A total amount of ₹2373.74 Crore have been provided for the development of Industry and Minerals, during the first four years of 12th plan.

State Budget –2015-16- Announcements

3.48 Highlights of 2015-16 State budget announcements in industry sector are:

• Encouraging entrepreneurship in the State is one of the seven themes focused on State budget

2015-16.

• The State budget 2015-16 gives priority on new initiatives for the development of a culture of

entrepreneurship and establishment of business incubation centres to coordinate entrepreneur

promotion activities for creating more employment opportunities, in the industry sector.

• It is proposed to establish Trade Facilitation Centres in selected district industries centres to promote

trade in products like Handloom, Handicrafts, Coir etc. to enhance traditional industries sector.

Kerala Perspective Plan 2030 – Vision & Initiatives

3.49 The Mission outlined in Kerala Perspective Plan 2030 under Micro, Small and Medium Sector is “Kerala’s evolution into knowledge–driven competitive economy with spirit of entrepreneurship, innovation, social inclusion, tolerance and diversity”. The measures/schemes initiated in integration with perspective plan is shown in Box 3.5.

Box 3.5

Kerala Perspective Plan 2030 – Initiatives

Measures/Schemes initiated in integration with Perspective Plan 2030

Improving infrastructure in existing DA/DP’s, Construction of multi storied Industrial Estates & Assistance for promoting industrial area/plots in private sector

• Infrastructure investments on PPP mode

• Promoting mutual trust between government and entrepreneurs through partnerships

• Involve real world entrepreneurs

• Promote private investments

• Develop eco –friendly parks

Entrepreneur Support Scheme & Start up subsidy for creation of new employment opportunities

• Encourage technology up gradation and product innovation

• Promotion of microfinance

Business incubation Centres in Handloom, Power loom and DIC.

• Involve real world entrepreneurs

• Promote entrepreneurial learning in an informal learning environment.

• Increase visibility and emphasise the role of entreneurship in creating new jobs.

State Profile of the MSME Sector

3.50 The number of New Enterprises filed Memorandum under MSMED Part II in Kerala during the year 2014-15 was 15455, 3.05% more than that of previous year which was 14997. Out of 15455, 600 (4%) MSMEs were registered by SC, 85 (0.5%) by ST and 3735 (24%) by women. Investment on the sector increased by 7.57% to ₹238794.75 lakh from ₹222412.30 lakh in the previous year while employment generated decreased by 5% from 87789 to 83500 numbers. The value of goods and services produced in 2014-15 increased by 5.4% to ₹711975.39 lakh from₹675597.11 lakh in the previous year. The details are given in Appendix 3.17.

3.51 In Kerala, during the current year (as on 30.09.2015) 6915 new enterprises have filed memorandum with an investment of ₹157799.62 lakh to provide employment to 38280 persons. The details are given in Appendix 3.18.

3.52 As on 31.03.2015, the total number of working SSIs/MSMEs registered in Kerala is 249696. Out of the total SSIs/MSMEs, 4% were promoted by SCs, 0.7% by STs and 25% by women entrepreneurs. The total investment was ₹1673851.70 lakh while the total value of goods and services produced was ₹6444288.56 lakh which indicates an increase of 26% over ₹50848.27 lakh of previous year. The total number of employment generated was 1274385 as on 31.03.2015. The details are given in Appendix 3.19.

Performance of the Sector

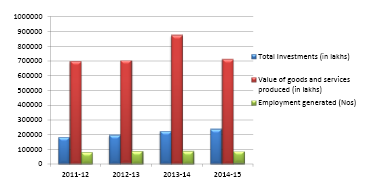

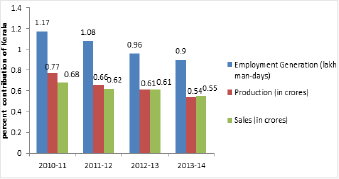

3.53 Trends in investment, production & employment in MSME sector over the period from 2011-12 to 2014-15 is shown in Figure 3.8. Number of MSMEs registered for the same period is shown in Figure 3.9.

Fig 3.8

Investment, Production & Employment in MSME sector over the last 4 years

Source: Directorate of Industries & Commerce

3.54 The investment in the sector during the period from 2011-12 to 2014-15 has increased on an average by 9.8%. During 2014-15, the investment went up by 7.37% than that of the previous year. The trends shows that there was a significant increase in investment during 2013-14, ie. by 12.38% as against 2012-13. But the value of production shows an enormous increase of 25% during 2013-14 and employment generation shows an increase of 1.6%, against the previous year. The value of production and employment generation were at their peak during 2013-14. This is an outcome of the ‘self employment generation’ and ‘entrepreneur support’ programs/schemes initiated in 2012-13 by the State Government with keen focus on enhancing entrepreneurship opportunities and awareness among young skilled generation of the State, in addition to the self employment schemes of the Central Government such as PMEGP, SFURTI etc.

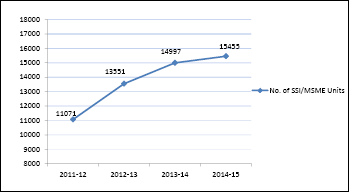

Fig 3.9

MSME units registered in MSME sector over the last 4 years

Source: Directorate of Industries & Commerce

3.55 The number of MSME units has steadily been increasing at a rate of 12.04% on an average during the period 2011-12 to 2014-15 and the total number of units registered as on 2014-15 was 15455 as against 14997 in 2013-14.

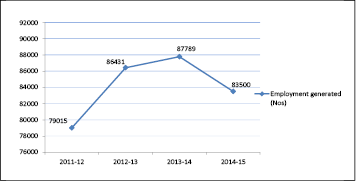

Fig 3.10

Employment generated in MSME sector over the last 4 years

Source: Directorate of Industries & Commerce

3.56 Figure 3.10 shows the employment generated over last 4 years. There has been increase in employment generation for the period from 2011-12 to 2013-14. But the employment generated has decreased by 4.88% in 2014-15. This trend shows that the MSME sector in the State is more capital intensive rather than labour intensive. The details of number of units, investment in the sector, value of production and employment generation from 2007-08 to 2014-15 are given in Appendix 3.20.

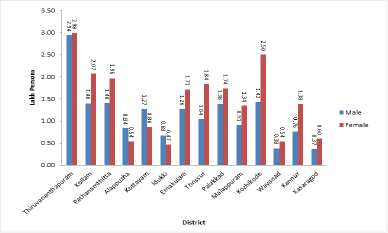

District wise achievements

3.57 District wise analysis reveals that during the year under review, Ernakulam occupies highest position in all aspects with 2248 new MSME units and 15468 numbers of employment generated and Idukki was at the lowest position with 302 new MSME units and 1608 numbers of employment generated. Wayanad District shows the minimum value of goods and services produced of ₹7837.90 lakh.

Sector wise achievements

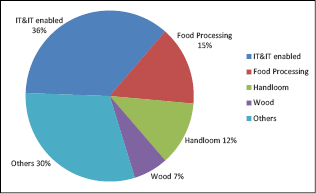

3.58 Sector wise analysis shows that IT & IT enabled services units registered higher number of units in the MSME sector at 5546. The number of food processing units is 2315 and number of handloom units is 1876 among a total of 15455 units registered during 2014-15. The details are shown in Figure 3.11. Details of sector wise MSME units registered during 2014-15 are given in Appendix 3.21.

Fig 3.11

MSME Units registered in 2014-15

Major State Plan Schemes and achievements

3.59 During 2014-15 State Government implemented various schemes successfully for improving the industrial environment of the state through development of industrial infrastructure, promoting entrepreneurship and providing skill development. Following are the major schemes and achievements.

Sl No |

Scheme Name |

Achievements 2014-15 |

| 1 | Infra- structure Development Schemes | These schemes intend to promote development of infrastructure in the industrial parks, estates, Development Areas/Plots with quality infrastructure like roads, power, water, waste management etc. & develop new multi-storied industrial estates, industrial parks, common facility centres for clusters etc. During 2014-15, the functional industrial estates at Changanasseri & Manjeri were upgraded and road work as part of infrastructure development in the Anthur Development Plot(DP), Kannur was initiated. An outlay of ₹2430.00 lakh was provided for the year 2015-16 for implementing the schemes. |

| 2 | Entrepreneur Support Scheme (ESS) | The scheme intends to provide extensive support to MSMEs and give one time support to entrepreneurs, with regard to special categories like women, SC/ST, etc., with more flexibility of operation and clear guidelines. During 2014-15, assistance was provided to 785 units/entrepreneurs under this scheme, Trivandrum district is at the top position with 120 numbers. An outlay of ₹4000 lakh was provided during the year 2015-16 for ESS. |

| 3 | Capacity building programme | The scheme intends to promote Entrepreneurial/ industrial promotional activities and skill development training in Micro, Small and Medium Enterprises. Under the scheme following events were conducted • Industries Extension Officer (IEO) induction training & training for Government officers. • Skill development training to fifty youth in each district in selected areas. • 4 training workshops for ED clubs at Kerala Institute of Entrepreneurship Development (KIED) to create in-depth awareness of personal entrepreneurial characteristic. • 420 Entrepreneurs Awareness Programme for 20,000 entrepreneurs in block/ municipality/ corporation. • Organised various industrial promotional activities like seminars, work shops, interactive meetings, Technology clinic in all districts for entrepreneurs. An outlay of ₹750 lakh was provided during the year 2015-16 for the scheme. |

Organized & Unorganized sector

3.60 As per the latest Census, Fourth All India Census of Small Scale Industries (SSI)/Micro, Small & Medium Enterprises (MSME) sector, conducted by Ministry of Micro, Small and Medium Enterprises,the total number of unregistered MSMEs functioning in the country stands at 346.12 lakh. In MSME sector the number of registered enterprises in Kerala was 1.50 lakh while unregistered enterprises was 20.63 lakh and employment in registered sector was 6.21 lakh numbers while in unregistered sector it was 43.4 lakh.

Employment in MSME Sector

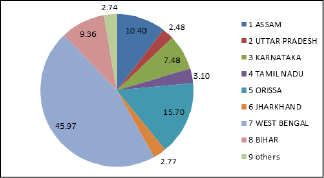

3.61 As per the latest Census (Fourth All India MSME Census) as well as data extracted from Economic Census 2005 conducted by CSO, MoSPI, the total number of persons employed in the sector increased to 805.24 lakh in entire country. Kerala was at 6th position with 49.62 lakh people while UP (92.36 lakh) & West Bengal (85.78 lakh) were on top. Employment in MSME sector in Tamil Nadu (at 3rd position) and Karnataka were 80.98 lakh and 45.72 lakh respectively.

Industrial Co-operative Societies

3.62 In Kerala, the total number of working industrial co-operative societies as on 31.3.2015 was 405 against 566 in the previous year (28% fall in the year). Out of 405, 114 Societies were registered by women. The details are given in Appendix 3.22. During 2014-15, 19 societies were registered.

Industrial Development Plot / Areas

3.63 Directorate of Industries and Commerce (DIC) is providing and developing infrastructure facilities for small scale sector in the State. At present there are 37 Development Area / Development Plots under DIC having a total acquired area of 2405 acre, in which one has not yet commenced functioning and another one has not developed. A total of 1797 units are functioning in these DA/DPs in 2014-15 compared to 2176 in the previous year. The details are given in Appendix 3.23.

Mini Industrial Estates

3.64 The total number of mini industrial estates under DIC as on 31.3.2015 is 89 and the total number of SSI units are 777. The employment in the 683 units that are working is 3400. The details are given in Appendix 3.24.

Industrial Estates under SIDCO

3.65 Kerala Small Industries Development Corporation (SIDCO) provides infrastructure facilities such as land, work shed, water, distribution of scarce raw materials to the units in the small scale sector. There are 17 major industrial estates, which include 830 working units, under the administrative control of SIDCO. These working units provided employment to nearly 7376 people as on 31.03.2015. Besides, there are 36 mini industrial estates under SIDCO in which about 1303 employees are working in 289 units all over the State. Details of industrial estates under SIDCO are given in Appendices 3.25, 3.26 and 3.27.

Promotional Events / Exhibitions – Achievements of the MSME sector during 2014-15

3.66 The Directorate of Industries and Commerce conducted/participated in 27 Exhibitions / Fairs /Expos inside Kerala with 1219 stalls in 2014-15 and generated an income of ₹11.14 crore. The DIC represented Kerala in one international exhibition outside Kerala with 26 stalls. Details are given in Appendix 3.28. Following are the major activities undertaken by the Department of Industries during 2014-15.

• Conducted Industrial exhibition in 13 districts, Machinery Exhibition in 3 districts & Rubber Expo at CFSC, Manjeri.

• Participated in 34th India International Trade Fair (IITF) -2014 at PragathiMaidan, New Delhi, from November 14th to 27th, 2014.

• Business to Business MEET for MSME conducted at Kochi on 26/2/2014 to 28/02/2014.

• Conducted induction training for IEOs & training for Government officers.

• Imparted skill development training to fifty youth in each district in selected areas.

• Conducted 4 training workshops for Entrepreneurship Development (ED) clubs at Kerala Institute of Entrepreneurship Development (KIED) to create in depth awareness of personal entrepreneurial characteristic.

• Organised various industrial promotional activities like seminars, workshops, interactive meetings etc. for entrepreneurs

• Technology clinic for entrepreneurs conducted in all districts.

• Entrepreneurs Awareness Programme for entrepreneurs conducted in block/ municipality/

corporation wise (420 programmes with around 20,000 participants).

• Organised Entrepreneurs Development Programme for entrepreneurs in 14 districts, District and Taluk level seminars organised for entrepreneurs & seminar for entrepreneurs, on biodegradable plastics, conducted in all districts.

• Potential survey conducted in all districts for updating useful data, local mapping, preparation of reports, project profiles and entrepreneur’s guide.

• Conducted Kerala bamboo fest at Cochin.

• Assisted to start new venture under Prime Minister’s Employment Generation Program (PMEGP) scheme involving financial assistance of ₹1052.16 lakh to the entrepreneurs (Employment generated-3942, No of projects-678).

Bank Credit to SSI / MSME Sector

3.67 As per the State Level Bankers’ Committee (SLBC) report, the outstanding bank credit to various sectors by the commercial banks in Kerala at the end of March 2015 increased by about 13.9% ie. ₹218706 crore against ₹192010 crore in the previous year. The outstanding flow of credit to MSME sector was ₹35730 crore with an increase of 11.4% over ₹32069 Crore of previous year. The status of flow of credit to various sectors is given in Appendix 3.29.

3.68 Financing MSMEs, which have been largely dependent on promoter’s resources and loans from banks/financial institutions, particularly knowledge based enterprises has some issues as these industries do not create tangible assets. SIDBI has played a critical role in developing the MSME venture eco-system in the country. SIDBI has so far contributed to the corpus of 75 venture capital funds that have catalysed investment of more than ₹5600 crore to more than 472 MSMEs.

3.69 The total MSME credit of SIDBI as on March 31, 2014 was ₹61,271 crore, with cumulative financial assistance provided by the Bank aggregating ₹37 crore, benefiting more than 340 lakh units/persons. Details are given in Appendix 3.30.

Box 3.6

MSME Amendment Bill, 2015

The Ministry of Micro, Small and Medium Enterprises Development (Amendment) Bill, 2015 proposes to (i) enhance the existing limit for investment in plant and machinery considering changes in price index and cost of inputs consistent with the emerging role of the MSMEs in various Global Value Chains, (ii) include medium enterprises apart from small enterprises in section 7(9) to enable the aforesaid category of enterprises to avail the benefits and become competitive, and (iii) empower the Central Government to revise the existing limit for investment, by notification, considering the inflation and dynamic market situation

Entrepreneurship Development

3.70 Entrepreneurial activity is a pillar of economic growth, across countries. For evidence of the economic power of entrepreneurship, we need look no further than the United States, where young firms have shown to be a more important source of net job creation than incumbent firms. In both developed and developing countries, fostering entrepreneurship for sustainable development could improve and create more sustainable consumption and production systems overall. Educating current and potential entrepreneurs enables them to create viable alternatives to existing production and consumption systems that fail to adequately address sustainability issues, such as environmental deterioration along the supply chain and overall quality of life. Entrepreneurial education fosters innovation and helps entrepreneurs build better products, processes, and services. It is especially effective when it takes into account the social, economic and ecological complexities of development, the values of sustainability, and a long-term perspective.

3.71 As per World Bank SME database, where annual data was collected from 136 countries, India is at 6th position in the number of new limited liability companies (98029 numbers) registered during the year 2014. The top 5 countries are UK, Russia, Australia, Hong Kong-China, and Chile. But India stands at 126th position in new business density with 0.12. (Business density is the number of newly registered firms with limited liability per 1,000 working-age people (ages 15-64) per calendar year). See Table 3.2.

Table 3.2

Top ten countries with newly registered limited companies

No. |

Economy |

New business density |

Number of new limited liability companies |

1 |

United Kingdom | 12.9 |

5,37,658 |

2 |

Russian Federation | 4.2 |

4,27,388 |

3 |

Australia | 14.91 |

2,31,920 |

4 |

Hong Kong SAR, China | 31.3 |

1,67,280 |

5 |

Chile | 8.03 |

98,406 |

6 |

India | 0.12 |

98,029 |

7 |

France | 2.26 |

94,927 |

8 |

Italy | 2.32 |

91,853 |

9 |

Spain | 2.97 |

91,544 |

10 |

Korea, Rep. | 2.3 |

84,676 |

Source: World Bank SME database, 2014

3.72 In Kerala, entrepreneurship is promoted in low knowledge-intensive sectors such as trade, transport and tourism, as well as knowledge-intensive sectors such as IT, IT enabled services, engineering etc. The labour scenario in Kerala is very challenging for entrepreneurs.

Box 3.7

ASPIRE - Central Government Programme

A Scheme for Promotion of Innovation,

Rural Industry and Entrepreneurship (ASPIRE)

ASPIRE was launched on 16.03.2015 with an objective to set up a network of technology centers, incubation centres to accelerate entrepreneurship and also to promote start-ups for innovation and entrepreneurship in rural and agriculture based industry with a fund of ₹210 crores.

• The planned outcomes of ASPIRE are setting up Technology Business Incubators (TBI), Livelihood Business Incubators (LBI) and creation of a Fund of Funds for such initiatives with SIDBI.

• 1st LBI set up in April-2015 under ASPIRE within a month of launching the Scheme. The first batch of 107 youth has been trained and skilled through it.

• 19 LBIs have been approved till September 2015 and another 9 LBIs & 2 TBI is ready to be approved.

Promoting Skill Development

3.73 Staff training and vocational and continuous on-the-job training ensure a constant upgrading of workers’ skills. In India, Ministry of Micro, Small and Medium Enterprises provided entrepreneurship and skill development training to 16,87,324 persons during the 11th Plan and 11,58,562 persons during the first two years of the 12th Plan, through various institutions like MSME-Development Institutes, KVIC, Coir Board, NSIC etc.

3.74 MSME-Development Institute, Thrissur, Kerala (MSME-DI, Thrissur), has conducted 81 tailor made development training programmes in 2014-15 viz., 5 Entrepreneurship Development Programmes, 25 Industrial motivation campaigns, 36 Entrepreneurship Skill Development programmes, 1 Management Development programmes and 14 skill development programmes. 2894 persons benefited through these programmes. Details are given in Appendix 3.31.

Skill Development & Training Institutes in Kerala

| MSME Development Institute, Thrissur, Kerala (MSME-DI, Thrissur) | Institute under the Ministry of MSME, Government of India takes care of the needs of MSME sector in the State of Kerala and the Union Territory of Lakshadweep in the area of Techno-economic and managerial consultancy services. It conducts need based development training programme on Entrepreneurship, Business Skill & Management and other awareness programmes. |

| Kerala Institute for Entrepreneurship Development (KIED) | A Public Sector Training Institute aimed to create awareness for entrepreneurs and sort out the issues for the development of entrepreneurial culture. The institute conducts various programmes for developing the spirit of entrepreneurship among the people such as Entrepreneurial Awareness Campaign, Seminars, Workshops, Research etc. |

| Kerala Academy of Skill excellence (KASE) | Setup by Government of Kerala to implement focused and specialised skill development programmes in domains from traditional industries to knowledge economy. |

| Kerala Institute of Labour and Employment (KILE) | Constituted by Government of Kerala for training and research in labour and allied subjects. |

Industrial Cluster Development

3.75 Industrial clusters are increasingly recognised as an effective means of industrial development and promotion of small and medium-sized enterprises. For MSME participants, clusters play an important role in their inclusiveness, technology absorption, efficiency improvement and availability of common resources. The Ministry of Micro, Small and Medium Enterprises (MSMEs) adopted the cluster approach as a key strategy for enhancing the productivity and competitiveness as well as capacity building of small enterprises.

3.76 The State has already adopted the cluster development approach for industrialisation to reap the benefits of agglomerations through transformation of the traditional systems of activities or industrial districts to new networks ready for competition and innovation. The State supports cluster development through MSME-DI, Thrissur and K-Bip. The Common Facility Centres which are in various stages of development in the State are in the areas of Wood, Plywood, Furniture, Rubber, Terratile, Rice Mill, Plastic, Printers, Ethnic Food, Agriculture Implements and General Engineering. The State has identified about 75 SME clusters and they are at different stages of development. Central Government agencies like Coir Board, SISI, and NGOs like Federation of Industrial Clusters etc. are also taking initiative in Cluster Development.

Box 3.8

Agglomeration Economies

In urban economics, economies of agglomeration means the benefits that firms obtain by locating near each other (‘agglomerating’). This concept relates to the idea of economies of scale and network effects. As more firms in related fields of business cluster together, their costs of production may decline significantly (due to presence of competing multiple suppliers, greater specialization and division of labour). Even when competing firms in the same sector cluster, there may be advantages because the cluster attracts more suppliers and customers than a single firm could achieve alone. Agglomeration economics causes the formation and growth of cities. China, Republic of Korea and Singapore are the countries which reap the benefits of agglomeration.

Financial Package for rural industries - Prime Minister’s Employment Generation Programme (PMEGP)

3.77 A national level credit linked subsidy scheme, namely, ‘Prime Minister’s Employment Generation Programme (PMEGP)’was introduced for generating an estimated 37.38 lakh additional employment opportunities by setting up of micro-enterprises in the non-farm sector in rural as well as urban areas. During the period from 2008-09 to 2013-14, 2.48 lakh units have been assisted with margin money subsidy of ₹4745.15 crore to create employment for an estimated 22.29 lakh persons in the country. For 2014-15 an outlay of ₹1418.28 crore has been earmarked for the scheme. During 2015, ₹860.51 crore has been released by the Ministry as margin money under PMEGP out of which ₹528.32 crore has already been disbursed by the banks and 24126 new enterprises providing employment to 170983 persons have been benefited under the Scheme. There is more than 50 per cent increase over the previous year in terms of funds disbursed by the banks, no of projects with funds disbursed and the employment generated.

3.78 The Khadi and Village Industries Commission (KVIC) was approved as the nodal agency for implementation of the scheme at national level. In Kerala, State KVIC Directorate, State Khadi and Village Industries Board (KVIB), District Industries Centres (DICs) and bankers are the agencies for implementation of the scheme. A target of 730 number of units were allocated to DICs. As on 31.05.2014, applications worth ₹1509.28 lakh were pending for subsidy release for want of funds. As per directions of 20th SLMC, DIC had not recommended any applications in 2014-15 except SC/ST applications to meet sub category target. The banks sanctioned 707 applications and provided Margin Money of ₹1052.18 lakh. Though financing banks had sanctioned 707 applications in 2014-15, margin money has been released for 678 applications only. Details are given inAppendix 3.32. During 2015-16 upto September 2015, 461 applications worth ₹696.55 lakh were sanctioned by bank. Details are given in Appendix 3.33.

Box 3.9

Cluster branding in China

A cluster economy is made up of professional towns and villages, functioning as production hubs focusing on one product/industry,and creating highly specialised large clusters. In China, the cluster policy focuses on branding clusters on the basis of their speciality. These are, for instance, Shengze textiles, Wujiang Hengshan sewing machines, Ningbo costumes, Wenzhou shoes, Shaoxing synthetic textiles, Haining leather coats, Yiwu small commodities, Yongkang hardware and so on and so forth. Small firms in the cluster are those employing up to 300 workers and medium ones have 300 to 2000 workers. Most clusters are developed such that they have entire value chains augmented within the cluster. Each firm is specialised and is connected with other firms through production networks. This increases efficiency and survival rate and reduces cost. These clusters thus have strong forward and backward linkages through value chains.

Section-4

Food Processing

3.79 The developed world’s food basket consists of 80 per cent of processed food, while the share is only 1.3 per cent in India. The Government of India has set a target of raising the share of processed food in the total food basket to 10 per cent in 2015 and 25 per cent in 2025. India’s food processing sector ranks fifth in the world in exports, production and consumption. The contribution of the food processing industry to the gross domestic product at 2004-05 prices in 2012-13 amounts to ₹845.22 Billion. During 2014-15, the sector constituted as much as 9.0 per cent and 10.1 per cent of GDP in manufacturing and agriculture sector, respectively. Food processing sector has grown at 7.1 per cent during this period under review.

Initiatives of Ministry of Food Processing Industries –MoFPI

3.80 The Ministry of Food Processing Industries is implementing various schemes for providing impetus to the development of food processing sector, viz. Infrastructure Development for Food Processing with the components of (i) Mega Food Park (ii) Cold Chain (iii) Setting-up/Modernization of Abattoirs, Scheme for Quality Assurance for setting up of Food Testing Laboratories and Technology Up gradation Scheme.Government has de-linked National Mission on Food Processing (NMFP) in the States from Central Government support with effect from 01.04.2015. However, NMFP is being supported by the Central Government in UTs. Some of the initiatives taken by the Ministry include the following.

• The Scheme of Mega Food Park was launched to provide modern infrastructure for food processing units in the country. Presently, 39 Mega Food Parks have been granted approval, two of which are in Kerala.

• The Cold Chain Scheme was launched to provide integrated cold chain and preservation infrastructure facilities without any break, from the farm gate to the consumer. Government has approved 138 cold chain projects during 2009-2015.

• An allocation of ₹2800.00 crore has been made for the Scheme of Infrastructure Development for Food Processing during the 12th Five Year Plan.

• A Food map of India identifying surplus raw material has been prepared and uploaded on the Ministry website. Idea is to identify the surplus and deficient areas in the country of various agricultural and horticultural produce so as to plan processing clusters by means of setting up processing facilities under current schemes.

• The services of pre-conditioning, pre-cooling, ripening, waxing, retail packing, labeling of fruits & vegetables have been exempted from Service Tax w.e.f. 01/04/2015.

• The Indian Institute of Crop Processing Technology (IICPT) which is a pioneer Research and Development and Educational Institution under the MoFPI, Goverment of India, was upgraded as a national institute and called as Indian Institute of Crop Processing Technology.

• National Institute of Food Technology, Entrepreneurship and Management (NIFTEM) located at Kundli, Haryana is an autonomous organisation under the MoFPI, which imparts B.Tech, M.Tech, Ph.D courses and research work in food technology & engineering and also conducts Skill Development trainings and outreach programmes for the benefit of students, farmers and entrepreneurs. It has conducted 104 such programmes skilling 8469 persons. NIFTEM has trained 44 persons under the Pradhan Manthri Kaushal Vikas Yojana (PMKVY) scheme.

• NIFTEM has also initiated a unique initiative “Village adoption program” for linking rural entrepreneurs and farmers. So far, 9 visits have been accomplished under this programme covering 39 villages across 18 States. And recognizing the efforts of this, NIFTEM was awarded the Agriculture Leadership Award for the year 2015 in the area of promoting rural entrepreneurship in the sector.

Food Processing in Kerala

3.81 As per the Kerala Perspective Plan 2030, food processing sector in the State enjoys a revealed comparative advantage among other Indian states. The industry is also one of the largest employment creators, with growth in direct employment in the organised food processing sector standing at 6.05% between 2010-11 and 2011-12. In terms of employment, the total number of persons engaged in registered food processing units in MSME sector was 14.68 lakh. The contribution of food processing sector to GDP has been growing faster than that of the agriculture sector.

3.82 Food Processing has been recognized as a priority sector in Kerala due to its potential for sustainable and more inclusive growth, diversification, possibility of generating substantial employment and further advancement in respect of industrial development in urban and rural areas. Dairy products, fish/meat products, rice & wheat products, ready to eat/ ready to cook products and bakery products, masala powder, coconut & other oils, ayurvedic medicines, fruit juices etc. are the major food items produced in the State.

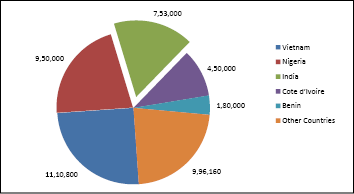

3.83 Food processing sector in Kerala has always made significant contribution to food exports. Kerala has been a major exporter of spices, marine products, cashew, coffee, tea and pickles. Two thirds of Kerala’s export income comes from processed food. Exports of food products from Kerala account for approximately 15 to 20% of the Indian export sector. Marine products lead the list of food products exported from the State, followed by spice products & cashew.

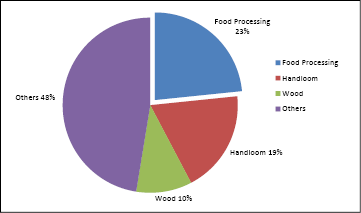

3.84 In Kerala, number of food processing units registered during 2014-15 is 2315, which is at the top position. The share of food processing units in the registered sector is shown in the Figure 3.12

Fig 3.12

Food Processing Units registered in 2014-15

Source: Directorate of Industries & Commerce

3.85 Infrastructure facilities so far developed in this sector are the 3 Food Parks at Kozhikode, Ernakulam, Pathanamthitta districts, Seafood Park in Alappauzha district, Incubation Centre at Kakkancherry, Kozhikode, Proposed Food Parks, Mega Food Park, Wayanad, Spices Park, Idukki and two Quality Control Laboratories. There are food processing units, including catering/canteen units, among 31000 MSME units under Kudumbasree.

3.86 Kerala Industrial Infrastructure Development Corporation (KINFRA) is the state agency engaged in the promotion of food processing industry in the State. KINFRA has set up exclusive Food Processing Parks to suit the specific needs of the food processing sector and they offer space for food processing units in their 19 Industrial parks, as the demand for space is high. Out of these Mazhuvannur (Ernakulam) food processing park has 30 units with 792 workers and Kakkancherry (Malappuram) food processing park has 23 units with 760 workers. KINFRA Food parks at Malappuram, Mazhuvannur, Adoor and Aroor were approved by MoFPI. Details of KINFRA food parks are given in Appendix 3.34.

3.87 Under the Mega Food Parks Scheme of Ministry of Food Processing Industries, “In-Principal” approval has been accorded to Mega Food Park, Cherthala, Alappuzha under KSIDC and Mega Food Park, Palakkad under KINFRA on 31.03.2015, out of 38 Mega Food Parks in the country.

Quality Management in Food Processing Industries

3.88 The National Centre for HACCP Certification (NCHC) in association with K-BIP has initiated the process of auditing and certification of food processing and allied units from the State and outside the State. NCHC imparted training programmes on Food Safety (HACCP) system to Government officials nominated from various departments.

Section-5

Traditional Industries

Handicrafts

3.89 Handicraft industry is one of the traditional industries of Kerala, providing employment to artisans. Eighty percent of these artisans are from socially and economically backward classes. Kerala has the tradition of making beautiful handicrafts with ivory, bamboo, palm leaves, seashells, wood, coconut shells, clay, cloth, coir, metals, stone, lacquer ware and so on. Many old handicraft classics can be seen in palaces, old heritage homes and museums in the State.

Importance of Handicraft Industry

3.90 Kerala State Handicrafts Apex Co-operative Society (SURABHI), Handicrafts Development Corporation and Artisans Development Corporation are the major promotional agencies in the handicraft industry. SURABHI is the apex organization of primary handicrafts co-operatives established with a view to uplift the artisans by marketing their products through the primary co-operatives and implementing welfare schemes with the assistance from State and Central Governments..The turnover of the society during the year 2014-15 was ₹337.33 lakh. Apex society received an amount of ₹100 lakh during the year under the scheme, “Assistance to apex organisation in handicrafts sector”. This was primarily used for conducting exhibitions and repair works of showrooms. There are 47 societies and SURABHI made a profit of ₹11.09 lakh from 12 exhibitions and fairs in the year 2014-15. Details are given in Appendix 3.35. The renovation of marine drive show room and Thrissur show room were completed. The construction of administrative block at craft development centre is entrusted with Construction Corporation and the work is progressing.

3.91 Handicrafts Development Corporation of Kerala (HDCK) is engaged in procuring and marketing handicraft products by giving fair returns to artisans through Sree Moolam Shashtyabdapurthi Memorial Institute (SMSMI) and Kairali emporia spread all over India. At present it is having a net work of 19 such sales emporia other than SMSMI. HDCK has been running a Common Facility Service Centre (CFSC) at Thiruvananthapuram for artisans who engage in development wood crafts. HDCK received an amount of ₹50.00 lakh during the year 2014-15 under the Scheme “Assistance to apex organisation in handicraft sector” which was utilised for organising exhibitions cum sales . This benefitted more than 5000 handicrafts artisans (both directly and indirectly). HDCK made a profit of ₹25.99 lakh from 42 exhibitions and fairs in the year 2014-15.Details are given in Appendix 3.36. The Kerala Artisans Development Corporation (KADCO) is one of the State agencies providing assistance to artisans for establishing production units, promoting marketing of products and providing employment opportunities through schemes of trade fairs and marketing centres.

Bamboo Industry

3.92 Bamboo is a highly productive renewable & eco friendly resource and has several applications. It is widely used in environment protection, as a nutrient food, high-value construction material and in about 1,500 other applications. It is estimated that about 2.5 billion people use bamboo in one form or the other at the global level. Advanced research activities are conducted to utilize bamboo for efficient fuel generating system.

3.93 From a raw material known as the “poor man’s timber” bamboo is currently being elevated to the status of “the timber of the 21st century”. India has a vast diversity of bamboos with 136 species. Next to the North East region, Western Ghats is the area which has the second largest diversity of bamboos. It is estimated that 8 million artisans are dependent on bamboo craft for their livelihood and the annual turnover of the bamboo sector is estimated to be around ₹2400 crores, in India.

3.94 In Kerala, 28 species of bamboo are found. Bamboos from the Kerala forest are being supplied mainly to the pulp and rayon units under concessional rates. It is estimated that there are about one lakh people in the State dependent on bamboo for their livelihood. A unique feature of the Kerala bamboo scene is that 67.3% of the extracted bamboo comes from home gardens rather than from the forests. Recent data from the panchayats indicate that there has been a great drain in the number of artisans from the sector to semi skilled and unskilled jobs in the tertiary sectors like construction.

3.95 The Kerala State Bamboo Corporation Ltd. was established in 1971 in Kerala to develop and promote industries based on Bamboo, reed, cane and rattan. Kerala State Bamboo Corporation’s main activity is collection of good quality reeds from Government forests and distributing these reeds to the registered mat weavers of the Corporation, throughout the State, on credit basis and procuring woven mats made of these reeds at reasonable prices, thus providing employment and regular means of livelihood to these weaver sections of the society. Bamboo mats, Bamboo ply, Flattened board, Flooring tiles are the main products. The artisans in the weaving sector around Angamali region is supported by the Kerala State Bamboo Corporation. An Innovation Centre for Bamboo Development and Development of Premium Designs for Mementos is being set up. The major achievements during the year under review was the introduction of bamboo furniture / fabrication of eco friendly huts on a turnkey basis, participation in National Games by supplying signboards, gazebo, pavilion etc. to turn the event green.

Kerala State Bamboo Mission

3.96 Kerala State Bamboo Mission (KSBM) constituted in the year 2003 is designated as the Bamboo Development Agency (BDA) of the State for implementation of the various schemes of the National Bamboo Mission (NBM), under the Department of Agriculture & Cooperation, Ministry of Agriculture and Farmers’ Welfare, Government of India. KSBM has four Sub-Committees namely Propagation of Bamboo, Technology Intervention and R & D, Marketing & Livelihood and Design & Training.For ensuring effective implementation and monitoring of the Schemes, State Bamboo Steering Committee (SBSC) was constituted with the Additional Chief Secretary (Forest & Wildlife) as its Chairman.

3.97 The interventions initiated after the formation of KSBM include promoting cultivation of bamboo, creation of new designs for innovative products in the handicrafts sector along with appropriate skill development, promotion of bamboo based modern industries supported by technology adaptation and development. It is expected that this will bring in greater business opportunities at various levels, especially among women and hence improve the living standards of the rural people, there by contributing to the overall growth of the sector.

Box 3.10

Kerala Bamboo Missions – Major Interventions in 2015 -16

| Kerala Bamboo Fest 2015 | The Department of Industries & Commerce in association with Kerala Bureau of Industrial Promotion (K-BIP) and Kerala State Bamboo Mission (KSBM) organized the 12th edition of ‘Kerala Bamboo Fest’ at Marine Drive, Kochi from December 4 to 8, 2015. The fest overall conveyed the importance of using natural items as bamboo in day to day activities. |

| Facilitated participation of Bamboo artisans / craftsmen in various Regional / National Events | During the financial year 2015 - 16, KSBM facilitated participation of Bamboo artisans / craftsmen in four Regional Events and three National Events as a result of which artisans were able to find new markets for their products. |

| Trainers Training Programme to Bamboo Artisans / Craftsmen | KSBM organized 6 days residential Quality Enhancement Training Programme at Wayanad, participated by 20 artisans from various Bamboo Groups / organizations. This helped them in achieving better productivity, quality and finishing. |

| Bamboo Innovation Centre | Kerala State Bamboo Mission (KSBM) in association with Kerala State Bamboo Corporation (KSBC) is setting up Bamboo Innovation Centre at the premises of KSBC, Angamaly, Ernakulam. It aims at the dissemination of need based knowledge, support service, conduct need based training etc. to the bamboo sector. |

| Development of Supply chain of treated Bamboo | Kerala State Bamboo Mission (KSBM) in association with Kerala State Bamboo Corporation (KSBC) is in process of development of Supply Chain of Treated Bamboo to the beneficiaries through the Depots of KSBC to ensure uninterrupted availability of the raw materials. |

| Providing Tools / Equipments as Common Facilities | The groups represented in the Quality Enhancement Training Programme have trained their groups and provided general tools and equipments as groups Common Facility .This will help them to improve their productivity, finishing and capacity to meet the demands of the market. |

Textile Industry

3.98 The textile sector in Kerala is limited in the sense that the spinning mills in Public-Private-Cooperative sectors are concentrating on spinning and weaving. The production and sales of vivid varieties of clothing are basically confined to Handloom and Khadi sectors.

Handloom Sector

3.99 The average handloom cloth production in India from 2008-09 to 2013-14 was 6900 million sq. meters per year with an average growth rate of 1.79 percent. The sector provides employment to 43.31lakh persons engaged in about 23.77 lakh handlooms. The production in the handloom sector recorded a figure of 7116 million sq. meters in the year 2013-14.The total cloth production in the sector till 30th September 2014 is 3547 million sq. meters. (Source: Annual Report 2014-15, Ministry of Textiles, Government of India).

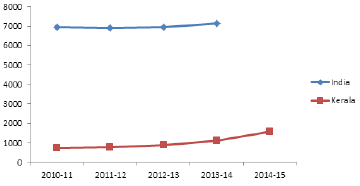

3.100 The average handloom cloth production in Kerala for the period 2011-12 till 2014-15 is 32.65million sq. meters per year with an average growth rate of 12.61 percent. There was a significant increase in the cloth production during 2014-15 as compared to the previous year.ie, 18.27 percent. The status of cloth production, both in India and Kerala for the period from 2010-11 to 2013-14 and Kerala for the year 2014-15 is shown in Figure 3.13.

Fig 3.13

Cloth Production by Handloom Sector (in million sq.meters)

Source: Annual Report 2014-15, Ministry of Textiles.

3.101 The growth rate of cloth production in Kerala is far better than that of the country as a whole. But the contribution of the State to national cloth production is only 0.473 percent. The year wise details of production and productivity under handloom industry in Kerala for the period from 2010-11 to 2014-15 is provided in Appendix 3.37.

3.102 As regards Central Assistance to the States, from the period from 2001-02 to 2013-14, the state of Tamil Nadu occupies first place followed by Andhra Pradesh, Gujarat, West Bengal, Rajasthan, Kerala, Uttar Pradesh, Haryana and Madhya Pradesh. Kerala occupied 6th position till 2013-14.

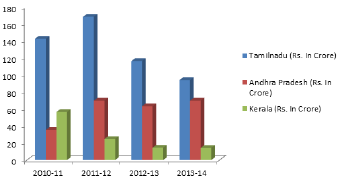

3.103 The status of Southern states with respect to Central Share released is presented in Figure 3.14. It may be noted that Karnataka does not figure among the top 10 states and thus has not been represented in the figure. 3.14

Fig 3.14

Handloom Sector Central Assistance Released to States

Source: Ministry of Textiles, Various Annual Reports, G.O.I.

3.104 In the financial year 2014-15 too, the State received a Central Assistance to the tune of ₹14.75 crore and utilized the same. The Central release to the states depends on parameters like number of handloom weavers and allied workers, number of units and number of handlooms. Tamil Nadu and Andhra Pradesh are the leading southern states in terms of these parameters in India.

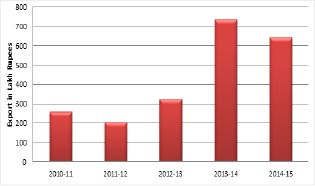

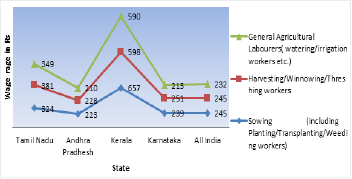

3.105 The state-wise status of number of handloom weavers and allied workers, units and number of handlooms is exhibited in Figure 3.15.

Fig 3.15

South Indian State-wise details of Handloom Units, Workers and Looms

Source: Handloom Census Report 2009-10, International Journal of Multi

Disciplinary Research and Development

3.106 Kerala is lagging behind other southern states in terms of number of handloom weavers, number of units and number of handlooms. Moreover, the number of adult workers as per the Handloom Census 2013 is 14,518 which is only 0.38% of the all India total. Out of the 14,518 adult workers, 74.29% are females whereas the per cent female weavers at all India level is 77.47%. (Source : EPRA Inter National Journal of Economic and Business Review)

3.107 Out of ₹5540.5 lakh allotted to the handloom sector for the year 2013-14, an amount of ₹5174.54 lakh was utilized, percent utilization being 93.4%. This is inclusive of ₹795.40 lakh utilized for the revival reform package, which was a Centrally Sponsored Scheme with central share of 80%. As against the outlay of ₹4691.50 lakh during 2014-15, the expenditure registered is ₹4783.62 lakh (101.96%). Out of this, the utilization under revival package was ₹395.01 lakh. In 2015-16, the expenditure booked as on 05-01-2016 is ₹3677.38 lakh (92%), against the allocation for the year, ₹4004.51 lakh. But the revival package has been discontinued with effect from the financial year 2015-16 and is not in force. The year wise details of assistance (₹in lakh) extended by way of loan and grant for the development of handloom industry for the period from 2013-14 to 2014-15 is given in Appendix 3.38.

Box 3.11

Major Achievements

1. Under the Revival, reform and restructuring package for handloom sector, 233 PHWCS, Hantex and 5 Individual weavers have benefitted. A total amount of ₹.209.52 core was provided for this package.

2. Assistance was given for the modernization of Handloom Co-Operative and Apex Societies. In 2014-15, an amount of ₹.871.56 lakh was utilized under the scheme extending assistance for MDA-71PHWCS, Margin money -7yarn banks, Work shed maintenance-10 societies, Value Added Products-26 Societies, Technology upgradation Assistance-51 societies, Weaving accessory-1888 weavers, Revitalization -5PHWCS and 2 apex societies.

3. Skill upgradation training for handloom weavers was conducted and 110 weavers from different parts of the State have benefitted during 2014-15.

4. Weavers / allied workers motivation programme intends to motivate weavers/allied workers to improve productivity by providing attractive incentives. 15,000 weavers have benefitted under this programme. An amount of ₹300 lakh had been utilized for this purpose in the year 2014-15.

3.108 Since the data on handloom sector based on the Handloom Census of India 2009-10, (Ministry of Textiles, Govt. of India) and the State Departmental figures differed in terms of the number of handloom households, number of societies, total membership, production etc, a ‘Detailed Survey on Handloom Industry in Kerala’ has been initiated in Annual Plan 2013-14 and is being conducted by Centre for Management Development. The objectives of the Survey are the following,

• To ascertain both physical as well as financial structure of the handloom sector.

• To obtain the details regarding the number of household and non household weaving units, production of handloom textiles, type of looms, consumption of yarn, number of working days, earnings of the members, bank details and the physical assets of all societies, ownership of looms, sales, exports, wages etc.

• To study the socio economic impact on weavers who benefited from implementation of various developmental activities.

• To study the financial assistance received in each co-operative society under various schemes (loan, share and grant) and present outstanding dues.

• To study problems faced by the primary co-operative societies due to higher rate of working capital interest, blockage of funds with HANTEX/HANVEEV and State Government.

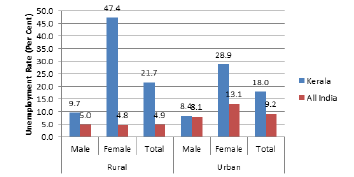

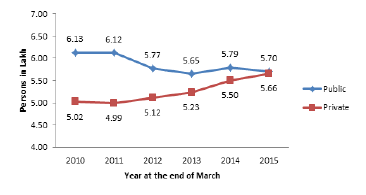

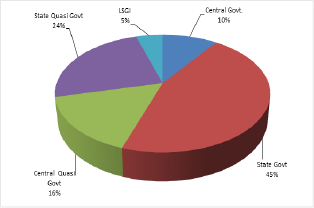

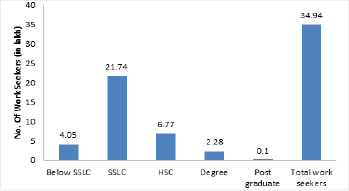

3.109 The survey is also intended to ascertain the reasons for the disparity in figures reported by the Directorate of Handloom & Textiles. The survey report is awaited. Category and year wise details of handloom co-operative societies within the State for the period from 2010-11 to 2014-15 as furnished by Directorate of Handloom and Textiles is given in Appendix 3.39.