Chapter 3

INDUSTRY, LABOUR AND EMPLOYMENT

Introduction

IIndustry has been performing sub-optimally in the country in recent times. During April- October, 2013, at the All India level, there was negative growth of 2.7 per cent and 0.3 per cent in Mining and Manufacturing over the same period in the previous year. Only the electricity sector showed a growth of 5.3 per cent in this period. Taken together, Industry (mining, manufacturing and electricity) remained stagnant. Negative growth was observed in Food products, Wood products, Rubber and Plastics Products, Basic metals and various machinery items. Capital goods industry showed a negative growth of 0.2 per cent in April- October 2013. This dismal performance of industry, due to a variety of reasons including low business expectations and high interest rates, has critical implications on Kerala, which is dependent on the supply of industrial inputs, intermediary goods and final consumption goods from the rest of the country. Any supply bottlenecks can push up input as well as output prices. Further, Kerala’s own industry, especially export oriented industry will also be dampened if industry in the rest of the country (and world) is stagnant, as there will be less demand for Kerala’s goods. This chapter brings out critical issues relating to State Public sector Industries, Micro, small and medium industries and traditional industries. Critical issues on labour and employment are brought out to show Kerala’s unique achievements on the labour front and concerns on the employment front.

In Kerala the manufacturing sector registered a growth rate of 12.4 per cent at current prices during 2012-13 compared to the growth rate of 15.4 per cent in the previous year. The contribution of income from manufacturing sector to GSDP at constant and current prices during 2012-13 was 7.7per cent and 7.6 per cent respectively. The income from manufacturing sector to GSDP and its growth rates from 2007-08 to 2012-13 are given in Appendix 3.1. The per centage contribution of Manufacturing sector to GSDP from 2007-08 to 2013-14 did not show a definite trend. A drastic decline can be observed during 2009-10 and after that there was an increase, which again declined during 2011-12 as shown in Fig.3.1

.

Industry

Minerals

Kerala is endowed with minerals such as Heavy Mineral Sands (Ilmenite, Rutile, Zircon, Monazite, Silimanite), Gold, Iron Ore, Bauxite, Graphite, China Clay, Fire Clay, Tile and Brick Clay, Silica Sand, Lignite, Limestone, Limeshell, Dimenstion Stone(Granite), Gemstones, Magnesite, Steatite etc. However, mining activities on large scale are confined mainly to a few minerals – Heavy Mineral Sands, China Clay and to a lesser extent Limestone/Limeshell, Silica Sand and Granite. In fact, Heavy Mineral sand and China Clay contribute more than 90% of the total value of major mineral production in the State. However, 75% of the mineral revenue comes from the minor minerals. Major industries in Kerala based on Major minerals are given in Box 3.1

Box 3.1

Mineral Based Industries in Kerala

• Indian Rare Earths Ltd., Chavara

• Kerala Minerals and Metals Ltd., Chavara

• Malabar Cements, Walayar

• Travancore Cements Ltd., Kottayam

• Kundara Ceramics, Kollam

• English Indian Clays Ltd. (EICL), Thiruvananthapuram

• Excel Glass Industry, Alappuzha

• Kerala Clays and Ceramic Products Ltd., Pazhayangadi, Kannur

.3.2 Unlike other states, due to the unique nature of the State of Kerala (non availability of land for mining, vast expanse of reserve forest and dense population) mineral resources cannot be exploited with ease. Mining, being a destructive activity, invites all kinds of environmental problems (lowering of water table, noise pollution, dust pollution, public safety, threat to flora and fauna, contamination of water, deterioration of river ecosystem etc.). However mining in the State cannot be stopped altogether as minerals (especially those of the category of building materials) are an integral part of infrastructure development of the State.

3.3 There are 83 major mineral mines that are mined in the State. Also there are 3924 licensed minor mineral quarries in the State. Government gets revenue from minerals mainly by way of royalty. Revenue collected during the year 2012-13 is ` 49.7 crore (` 12.33 crore from major minerals and ` 37.37 crore from minor minerals) which is 12 % higher than the previous year collection of ` 44.3 crore. Total area covered by mining leases is 3314.52 ha. The mineral wise details of area covered by mining leases are given in Appendix 3.2.

3.4 The production of various major and minor minerals in the state during 2012-13 and the royalty are given in Appendix 3.3. An analysis of revenue collection shows that Kollam district has the highest collection of ` 8.51 crore (17% of total revenue) followed by Ernakulam (12%). The least revenue collection of ` 1.21 crore is from Idukki (2%). The district wise collection of revenue from major and minor minerals are furnished in Appendix 3.4

Manufacturing

Fig.3.1

Contribution of Manufacturing Sector to GSDP at 2004-05 prices

Table 3.1

Plan Outlay and Expenditure (रin Lakh)

(` in Lakh)

Sl. No. |

Sector |

Annual Plan 2011-12 |

Annual Plan 2012-13 |

Annual Plan 2013-14 |

||

1 |

Village & Small Enterprises |

Outlay |

Expdr. |

Outlay |

Expdr. |

Outlay |

i |

Small-scale Industries |

4060.00 |

2616.50 |

5505.00 |

4604.93 |

5755.00 |

ii |

Commerce |

10.00 |

10.00 |

75.00 |

75.00 |

90.00 |

iii |

Handicrafts |

226.00 |

226.00 |

300.00 |

348.25 |

431.00 |

iv |

Handloom & Power loom |

5767.00 |

6539.22 |

6832.00 |

5645.19 |

7676.00 |

v |

Coir Industry |

8205.00 |

8734.51 |

10070.00 |

9838.38 |

11137.00 |

vi |

Khadi & Village Industries |

928.00 |

928.00 |

1210.00 |

411.00 |

1331.00 |

vii |

Cashew Industry |

5200.00 |

4750.00 |

6500.00 |

6121.95 |

7150.00 |

viii |

Beedi Industry |

40.00 |

32.27 |

Nil |

Nil |

Nil |

|

Subtotal – VSE |

24436.00 |

23836.50 |

30492.00 |

27044.70 |

33570.00 |

2 |

Other Industries |

22030.00 |

15266.12 |

24067.00 |

23606.00 |

23934.00 |

3 |

Minerals |

162.00 |

58.22 |

211.00 |

187.16 |

432.00 |

|

Total : Industry & Minerals |

46628.00 |

39160.84 |

54770.00 |

50837.86 |

57936.00 |

Source: Finance Department, Govt. of Kerala

3.5 There was an increase of 17.5% in outlay provided for Industry and Minerals during 2012-13 over the previous year. The total outlay during 2013-14 is ` 579.36 crore which is 5.8% higher than the outlay in 2012-13. Upto November 2013, only 16.25 per cent of allocation under Village and Small Industry has been spent. Performance on the expenditure front in Other Industries and Minerals has also been low. Expenditure usually does pick up in the last quarter of the financial year

Public Sector Undertakings

3.6 Public Sector Enterprises, both at the Central level and at the State level have played a very important role in the industrialisation and the overall development of the country. State Public Sector Enterprises are one of the largest employers in the organised sector in the state.

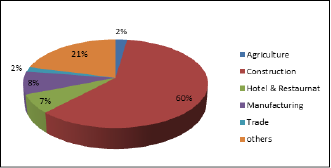

3.7 There are 44 PSUs under the Industries Department, of which 37 are in the manufacturing sector and 7 in the non-manufacturing sector. Sector wise number of PSUs is shown in Fig. 3.2.

Fig 3.2

Sector wise number of PSUs as on 31.3.2013

3.8 Public Sector Restructuring and Internal Audit Board (RIAB) constituted in 1993 executes State Owned Enterprise Reform Initiatives. Performance planning and monitoring of PSUs, Enterprise reconstruction, Capacity building / Recruitments in PSUs and Governance advisory support are the major responsibilities.

Box 3.2

Major Initiatives in PSUs during 2012-13

• For ensuring transparency in purchases, e-procurement was introduced from August 2012 in PSUs for all purchases above ` 1 lakh. Purchase worth ` 293.67 crores were made through e-procurement.

• E-payment was introduced as part of the e-procurement system.

• To co-ordinate all the activities of PSUs and Departments, a web based MIS portal was launched by Keltron.

• For speedy and timely completion of audit and for ensuring transparency in accounting, ERP system is being introduced in all PSUs.

• Various social and welfare measures for education, health, basic necessities like drinking water etc are being implemented by Malabar Cements Ltd., Kerala Minerals and Metals Ltd, Transformers and Electricals Kerala Ltd, Kerala State Industrial Development Corporation Ltd, Steel and Industrial Forgings Ltd and Kerala State Industrial Enterprises Ltd, as part of Corporate Social Responsibility initiatives of these PSUs.

• An MOU was signed with SAIL for a project worth ` 3250 crore for increasing the production of the new Titanium Sponge plant of Kerala Minerals and Metals Ltd, to 10000 MT.

• Keltron has set up Solar Power Panels in various jails. Establishment of solar panel by profit making PSUs is under progress.

• Kerala Cashew Development Corporation has started production of Chocolate coated cashew, a value added product. One Time Settlement with banks is under progress for settlement of long pending dues of cashew development and CAPEX.

3.9 During 2012-13, 22 PSUs have registered profit and 22 registered loss. The performance trend of PSUs during the last 5 years is given in Appendix 3.5. During 2013-14 (up to October 2013) PSUs have recorded a turnover of ` 1508.94 crore and a net loss of ` 90.05 crore. During 2012-13, PSUs have recorded a net profit of ` 75.25 crore. Details of PSU-wise turnover and profit/loss during 2012-13 are shown in Appendix 3.6. The number of loss making PSU’s have reduced from 26 to 22 and turned to profit making units. But the net profit has reduced from ` 222.87 crore to ` 75.25 crore, indicating higher cost of inputs.

Joint Stock Companies

3.10 The total number of joint stock companies in Kerala as on March 2013, is 21990 of which 93% are private limited and 7% public limited. During 2012-13, 2729 companies were newly registered (2680 private and 49 public) and 262 companies were wound up. Seven public companies were converted to private companies and 13 companies were converted from private to public. Details of joint stock companies working in Kerala are given in Appendix 3.7.

Box 3.3

Newly Registered Government Companies during 2012-13

1. Kerala State Minorities Development Finance Corporation Limited

2. Vision Varkala Infrastructure Development Corporation Limited

3. Kerala State Welfare Corporation For Forward Communities Limited

4. Kerala Medical Infrastructure Development Limited

5. Kerala Monorail Corporation Limited

Micro Small and Medium Enterprises (MSMEs)

3.11 The Micro, Small and Medium Enterprises (MSME) sector is fast emerging into a major income generating and employment providing sector in Kerala with relatively lower investment. Kerala is one of the main centres of MSMEs in the country. As per the MSME survey & Quick Results of 4th Census 5.62 per cent of all India share of MSME enterprise is in Kerala. MSME sector can lead the State economy by increasing exports through quality production techniques and products. Government provides various schemes in MSME sector, targeting various social groups like SC, ST, Women, Youth, Physically Handicapped etc. In Kerala, Government and banks are providing lot of facilities for MSME Sector.

3.12 Within the MSME Sector there is a significant increase of Micro Enterprises, both in terms of working enterprises and employment. There are over 6000 various MSME products ranging from traditional to high-tech items which are manufactured in this sector.

3.13 MSMEs play a critical role in innovation, and have ability to experiment with new technologies on small scales. However, they often suffer from funds, lack of entrepreneurial spirit, inability to take technology developments risks and face the difficulty of attracting skilled manpower. The industries coming under this sector are handicrafts, Handloom, Khadi, Food processing industries, Garment making and Textile industries, industries related to coir/wood/bamboo/Plastic/rubber/ leather/ clay products etc.

3.14 The Industrial and Commercial Policy 2011 will strive to convert Kerala State into an entrepreneurial society from a wage earning society. (www.kerala.gov.in\docs\policies\ draftic_policies11

Draft Industrial and Commercial Policy in Kerala - 2011

National Manufacturing Policy (NMP)

3.15 National Manufacturing Policy notified in November , 2011, with the objective to enhance the share of manufacturing in GDP to 25% and create 100 million jobs over a decade, gives importance to rationalization and simplification of business regulations, NIMZ, Incentives for SMEs, Industrial training & skill upgradation measures etc.

Profile of the MSME Sector

3.16 The number of New Enterprises filed Memorandum under MSMED Part II during the year 2012-13 was 13043. Out of which 413 MSMEs are by SC, 66 by ST and 3122 by Women. The number of new enterprises that filed Memorandum during 2012-13 shows 18 per cent increase against 11079 of the previous year. Investment on the sector decreased by 3 per cent from ` 190642.75 lakh of the previous year to ` 185074.41 lakh in 2012-13 while employment generated increased by about 4 per cent from 79181 to 81964. The value of goods and services produced in 2012-13 has been increased by 6 per cent ie, ` 621424.55 lakh over ` 584985.35 lakh in the previous year. The details are in Appendix 3.8.

3.17 During the current year (as on 30.11.2013) 9048 new enterprises have filed memorandum with an investment of ` 134207.07 lakh to provide employment to 54707 persons. The details are given in Appendix 3.9.

3.18 The total number of SSIs/MSMEs registered in Kerala as on 31.3.2013 is 219444 against 205987 in the previous year indicating a growth of about 7 per cent. Out of the total SSIs/MSMEs, 4 per cent are promoted by SCs, approximately 1 per cent by STs and 25 per cent by women entrepreneurs. The total investment was ` 1212674 lakh in 2012-13 against ` 1083169 lakh in the previous year, with an increase of almost 12 per cent and the total number of employment generated was 1103126 indicating more than 8 per cent over the previous year which was 1021162. Details of enterprises are given in Appendix 3.10.

Performance of the sector for the past 5 years

3.19 Investment, number of new units, production & employment in MSME sector over the past years is shown in the figure 3.3 and 3.4. The employment & production has been increased over the period while investment decreased. The details is given in Appendix 3.11.

Fig 3.3

Investment, Production & Employment in MSME sector over

the past years from 2007-08 to 2012-13

Fig 3.4

New units and Investment in MSME sector over last 5 years

District wise achievements

3.20 District wise analysis reveals that during the year under review, Ernakulam occupies highest position in all aspects with 1878 new MSME units and Idukki was at the lowest position except in total investment. Idukki has only 193 new MSME units. The Wayanad District shows the minimum investment of ` 3296.74 lakh. But the maximum number of SSI/MSME units are in Thiruvananthapuram with 29720. Thrissur at second position.

3.21 Details of enterprises that filed memorandum & District-wise details of enterprises which filed memorandum in Kerala during 2012-13 and 2013-14 (up to 30.09.2013) are given in Fig 3.5.

Fig 3.5

District wise investment, Value and Employment of

Enterprises registered in Kerala during 2012-13

Box 3.4

Major schemes/initiatives of the Annual Plans 2012-13 & 2013-14

Entrepreneurship Support Scheme(ESS)

Provide assistance to entrepreneurs in Fixed Capital Investment and Technology Acquisition to start new enterprises with special attention to women, SC/ST categories, Thrust Industries and enterprises starting in Wayanad and Idukki Districts.

Infrastructure Development under MSME sector – Multi storied Galas

Development of industrial galas for the benefit of MSME entrepreneurs, with quality infrastructure like roads, power, water, waste management etc. through PPP mode. It is envisaged to construct Multistoried Industrial Estates and an exhibition cum convention centre.

Capacity Building

Other than giving emphasis on skill development, the scheme provides Industrialization support/ other industrial promotion activities and creation of Business Incubation services.

Development of Commerce

Assistance to conduct research studies and evolve long term policy frame work for the sustained growth of commerce sector, Conduct or participate in national and international events/exhibitions and Institute awards for MSME sector.

MSE-Cluster Development Programme

This is a Centrally Sponsored Scheme of cluster development for micro, small and medium enterprises and provide assistance for sourcing of raw material, mutual credit guarantee for sourcing loans, common brand creation, marketing, setting up of CFSC, training, quality testing etc. Infrastructure development is also incorporated in this programme.

Achievements

In the plan period, State Government created appropriate investment climate to attract private investment to MSME sector by providing assistance such as working capital, adequate infrastructure, skill development training and financial assistance for technology upgradation and participation in fairs & marketing. The Government also implemented schemes/programmes on revival and strengthening of existing industrial enterprises/units, modernization, product diversification and value addition. KINFRA started and established several new Initiatives in Food Processing through Food parks.

Industrial Co-operative Societies

3.22 In Kerala, the total number of working Industrial co-operative societies as on 31.3.2013 was 621 against 582 in the previous year. Out of which, 151 Societies were registered by women. The details are given in Appendix 3.12.

Industrial Development Plot / Areas

3.23 Directorate of Industries and Commerce (DIC) is providing and developing infrastructure facilities for small scale sector in the state. At present there are 38 DA/DP s under DIC having a total acquired area of 2478.51 Acre. A total of 2176 working units are working in these DA/DPs which was 2019 in the previous year. The details are given in Appendix 3.13

Mini Industrial Estates

3.24 The total number of Mini Industrial estates under DIC as on 31.3.2013 is 88 and the total number of SSI units are 753. (94 and 780 as on 31.03.2012). Out of which 659 units are working . The total number of employees under these units is 3153. The Income generated from these units is ` 2908.96 lakh. (2012 -Out of which 663 units were working. The total number of employees under the units were 3345. The Income generated from these units amounted to ` 11952.86 lakh during 2011-12. ) The details are given in Appendix 3.14.

Common Facility Service Centres

3.25 There are two Common Facility Service Centres at Changanassery and Manjeri under Directorate of Industries & Commerce. These CFSCs provide services like Quality Control testing as per National and International Standards, Design and fabrication of moulds, dies and machineries, Maintenance of costly machines used for rubber and plastic product manufacturing, Conducting EDPs and seminars on rubber and plastic based industries etc. Also they extend new technical information, advice on product diversification and assist research scholars and students for their Project works of in the field of Chemistry, Rubber Technology, Polymer Chemistry by utilising the facilities of the centres.

Entrepreneurship Development

.3.26 Entrepreneurship is a process of identifying and starting a business venture, sourcing and organizing the required resources and taking both the risks and rewards associated with the venture. In Kerala, entrepreneurship is restricted to trade, transport and tourism, all of which are low knowledge-intensive sectors. The labour scenario in Kerala is also very challenging for entrepreneurs. It is envisioned that Kerala will be a knowledge economy by 2030.

Bank Credit to SSI / MSME Sector

3.27 RBI issued a master circular with the enactment of MSMED Act 2006, to all Scheduled Commercial Banks stating that the Bank Loans to Micro and Small enterprises, both Manufacturing and Service are eligible to be classified under Priority Sector advance and provide direct Finance to Manufacturing Enterprises, Loans for food and agro processing, Service Enterprises, Export Credit, Khadi and Village Industries Sector (KVI) and Rehabilitation of sick Micro and Small Enterprises. Public sector banks have been advised to open at least one specialised MSME branches in each district for Lending to MSME Sector.

3.28 As per State Level Bankers’ Committee (SLBC), the highest body of bankers in the State, report, the outstanding bank credit to various sectors by the commercial banks in Kerala at the end of March 2013 was increased by 17 per cent ie. ` 175087 crore against ` 149293 crore in the previous year. The outstanding flow of credit to MSME sector was ` 23563 Crore which shows an increase of 14 per cent from ` 20593 crore in 2012-13. The status of flow of credit to various sectors is given in Appendix 3.15.

Small Industries Development Bank of India (SIDBI)

3.29 Small Industries Development Bank of India (SIDBI) is the principal financial institution for the promotion, financing and development of MSME industries. It also acts as the nodal agency for the scheme sponsored by Government of India in this regard.

Kerala Small Industries Development Corporation (SIDCO)

3.30 Kerala Small Industries Development Corporation was established for strengthening the Small Scale Sectors in the State by providing infrastructure facilities, distribution of scarce raw materials, marketing the products etc. Execution of construction works for Industries department and public sector undertakings is another activity of SIDCO and there are some manufacturing units under SIDCO. There are 17 major industrial estates and 877 units are working in these estates. These working units provides nearly 7239 employment opportunities as on 31.03.2013 which is about 1 per cent more than that of the previous year. Besides, there are 36 mini industrial estates under SIDCO as on 31.03.2013.About 604 employees are working in 285 working units all over the state. Details of SIDCO are given in Appendix 3.16, 3.17, 3.18 and 3.19.

Institutes for Skill Development and Training

Kerala Institute for Entrepreneurship Development (KIED)

3.31 Kerala Institute for Entrepreneurship Development (KIED) is a Public Sector Training Institute registered under The Travancore-Cochin Literary, Scientific and Charitable Societies Registration Act. The institute is aimed to create awareness, finding the factors for the poor entrepreneurship culture and sorting out the issues for the development of entrepreneurial culture in Kerala. KIED is a premier institute promoted by Government of Kerala and Government of India for promotion and development of entrepreneurial activities in the State.

3.32 The institute conducts various programmes for developing the spirit of entrepreneurship among the people such as Entrepreneurial Awareness Campaign, Seminars, Workshops, Research etc leading to more and more self employment thereby developing the people of Kerala as an enterprising society.

Kerala State Self Entrepreneur Development Mission (KSSEDM)

3.33 The Kerala State Self Entrepreneurship Development Mission aims at inculcating entrepreneurial confidence among the youth of the State through a process of selecting persons with aptitude and earnestness, training them meticulously and enabling them to avail of finance on easy terms from Banks/Financial Institutions. The youth will be given opportunities in the agriculture and IT sectors. In a Panchayat-level scheme aimed at educated unemployed youth, KSSEDM providing training and soft loans to 10 select entrepreneurs in each Panchayat up to ` 20 lakh to start an enterprise.

Indus Entrepreneurs (TiE)

3.34 The Kerala Chapter of the Indus Entrepreneurs (TiE), a global not-for-profit organization, was registered in March 12, 2003 for providing advice, guidance and assistance to budding entrepreneurs by successful & experienced entrepreneurs and professionals.

Kerala State Small Industries Association (KSSIA)

3.35 Kerala State Small Industries Association establishes fellowship and co-operation among Small scale industrialists to protect their interests, publish journals, facilitate exchange of information etc.

Industrial Cluster Development

3.36 Industrial clusters are increasingly recognised as an effective means of industrial development and promotion of small and medium-sized enterprises. For MSME participants, clusters play an important role in their inclusiveness, technology absorption, efficiency improvement and availability of common resources. The Ministry of Micro, Small and Medium Enterprises (MSMEs) adopted the cluster approach as a key strategy for enhancing the productivity and competitiveness as well as capacity building of small enterprises.

3.37 The major clusters in Kerala are Rubber cluster, Rice millers cluster, Furniture cluster, Plastic cluster, Plywood cluster, Terra Tile cluster, Wood cluster, Ethnic food processing cluster, General engineering cluster, Printers cluster, Natural Fibre & allied products cluster, Automobile cluster, and Note books cluster.

3.38 The Ministry of MSME, Government of India provides financial assistance for setting up of Common Facility Centers (CFC) in various clusters under MSE-CDP scheme. Government of India has sanctioned assistance for a total amount of ` 5492.25 lakh for setting up CFC in 7 clusters, (work is progressing on 4 of them) of which Government of India share is ` 3593.91 lakh, Government of Kerala share is ` 1084.00 lakh and balance is the share of consortium.

MSME Development Institute, Thrissur & Cluster Development in Kerala

3.39 MSME-Development Institute, Thrissur, Kerala (MSME-DI, Thrissur), is the field outfit of Development Commissioner(MSME) under the Ministry of MSME, Government of India to take care of the needs of MSME sector in the State of Kerala and the Union Territory of Lakshadweep in the area of Techno-economic and managerial consultancy services.

3.40 The institute has conducted 165 tailor made development training programme on Entrepreneurship Development, motivation campaigns, Business Skill Development, Entrepreneurship Skill Development, Management Development and Special Skill Development and several Educational Seminars and other awareness programmes during 2012-13. 6625 persons benefited through these programmes. and 188 units are benefited through service workshop. The institute has been providing technical consultancy to the units for acquiring ISO 9000/14000 scheme and also providing reimbursement to the extent of 75 per cent of the expenses incurred by the units under the scheme.

3.41 MSME-DI, Thrissur has taken up 13 clusters for development. The clusters which are in various stages of development are in the areas of Wood, Plywood, Furniture, Rubber, Terratile, Rice Mill, Plastic, Printers, Ethnic Food, Natural Fibres and General Engineering. Details are given in Appendix 3.20.

Kerala Bureau of Industrial Promotion (K-BIP)

3.42 Kerala Bureau of Industrial Promotion(K-BIP) is designated as the nodal agency of Ministry of MSME, GOI for the cluster development projects in the state. The programmes undertaken by K-Bip includes Industrial Cluster Development in association with Directorate of Industries and Commerce, Food Processing Certification (HACCP), Participation in National/International/Regional fairs on behalf of Industries Department, Govt.of Kerala.

Central Govt. Schemes & Programmes

Prime Minister’s Employment Generation Programme (PMEGP)

3.43 Government of India introduced PMEGP Scheme, ie, credit linked subsidy programme from 2008-09 by merging the two schemes viz,PMRY and REGP.The Khadi and Village Industries Commission (KVIC) was approved as the nodal agency for implementation of the scheme at national level. In Kerala, State KVIC Directorate, State Khadi and Village Industries Board(KVIB), District Industries Centres (DICs) and bankers are the agencies for implementation of the scheme. A target of 568 number of units were allocated to DICs and 2480 applications were received during the year 2012-13, 123% increment compared to 1112 during 2011-12. The banks sanctioned 1304 applications about 53% more than 851 in the previous year and provided Margin Money of `1513.44 lakh which is 30% more than ` 1162.13 lakh in 2011-12. Details are given in Appendix 3.21 and 3.22.

Micro & Small Enterprises-Cluster Development Programme (MSE-CDP)

3.44 The Micro & Small Enterprises-Cluster Development Programme of the Ministry of MSME, Government of India aims at enhancing the productivity and competitiveness as well as capacity building of Micro and Small Enterprises (MSEs) and their collectives in the country. The main objectives of the programme are to support the sustainability and growth of MSEs by addressing common issues, building capacity of MSEs and creating sufficient infrastructural facilities & common facility centres.

Industrial Infrastructure Upgradation Scheme (IIUS)

3.45 The central sector scheme Industrial Infrastructure Upgradation Scheme (IIUS) of Ministry of Commerce& Industry aims to enhance international competitiveness of the domestic industry by providing quality infrastructure through Public-Private Partnership approach in clusters/locations which have greater potential to become globally competitive. Priority will be given to develop clusters having small industry concentration.

Credit Guarantee Scheme

3.46 This scheme is implemented with the objective of facilitating flow of credit to the MSEs, particularly to Micro Enterprises.

Credit Linked Capital Subsidy Scheme for Micro and Small Enterprises (CLCSS) for MSEs

3.47 This scheme aims at facilitating technology upgradation of MSEs by providing 15 per cent capital subsidy for purchase of plant and machinery.

Food Processing - A major MSME sector

3.48 Food processing industry is a sunrise sector that has gained prominence over the recent years. As per Annual Survey on Industry results, in India, the contribution of food processing sector to GDP has been growing faster than that of the agriculture sector. Declared a priority sector, food processing has been allowed a 100 per cent FDI by the Government of India. In Kerala, it has the potential for sustainable and more inclusive growth, diversification, possibility of generating substantial employment and further advancement in respect of industrial development in urban and rural areas. The FPI in Kerala spreads over both organized as well as unorganized sectors. Spices, pickles and the marine products are the major food product export from Kerala. Two thirds of Kerala’s export income comes from processed food. Dairy products, Fish/Meat products, Rice & wheat products, Ready to eat/ Ready to cook products and bakery products, masala powder, Coconut & other oils, Ayurvedic medicines, Fruit juices etc. are the major food items produced in the State.

3.49 Kerala Industrial Infrastructure Development Corporation (KINFRA) has set up exclusive Food Processing Parks to suit the specific needs of the food processing sector and they offer space for food processing units in their Industrial parks also. Out of these Mazhuvannur (Ernakulam) and Kakkancherry (Malappuram) food processing parks are having the highest number of units. KINFRA provides 4114 sq.ft space for 132 food Processing Units with an investment of ` 26979 lakh.

3.50 The National Centre for Hazard Analysis Critical Control Point (HACCP) Certification in association with K-BIP has initiated the process of auditing and certification of 41 food processing and allied units from the State and outside the State. Out of this, NCHC has successfully audited and certified 25 food processing units and the remaining is under progress. Surveillance audits are being conducted at regular intervals.

Box 3.5

State Food Processing Mission, Kerala

The Government of Kerala has nominated KINFRA as the Nodal Agency for State Food Processing Mission in Kerala for implementation of centrally sponsored scheme “National Mission on Food Processing” under Ministry of Food Processing Industries, Govt. of India. Setting up of new food processing units, modernization/expansion of existing ones, development of cold chain infrastructure, human resource development for food processing sector, proper infrastructure for abattoirs/meat shops, development of primary processing centres and collection centres in rural areas for assisting farmers, promotional activities etc are the thrust areas covered under State Food Processing Mission. The Mission has sanctioned ` 3.72 crore in 2012-13 and ` 2.00 crore till November in 2013-14 under various schemes. KINFRA is also the Nodal Agency for Ministry of Food Processing Industries, Govt. of India.

General Promotional Activities and Exhibitions

3.51 The Directorate of Industries and Commerce conducted/participated in 31 Exhibitions /Fairs /Expos inside Kerala with 1125 stalls in 2012-13 and generated an income of ` 13.04 Crore. The DIC represented Kerala in 8 national/international Exhibitions/ Fairs/ Expos outside Kerala with 17 stalls. Details are given in Appendix 3.23.

3.52 Government of Kerala has organised several Promotional Activities/ programmes and expos in co-ordination with Directorate of Industries & Commerce and other departments as follows:

Industry Institution Linkage Expo (Illuminate 2012), an Industry Institution Linkage Expo at Manjeri, Malappuram from April 2 to 4, 2012.

• Emerging Kerala 2012, at Hotel Le Meridian, Ernakulam from September 12 to 14, 2012.

• Kerala Bamboo Fest 2012, 9th edition at Jawaharlal Nehru Stadium Ground, Kaloor, Kochi from December 6 to 9, 2012.

• Nilambur Handicrafts Skill Development Fair 2013, concurrent to Pattulsav Tourism Festival at Nilambur from January 8 to 18, 2013.

• Kerala Agri Food Pro Meet 2013, at Jawaharlal Nehru Stadium Ground, Kaloor, Kochi from February 17 to 19, 2013

• Educational Industry Institution Linkage Expo (Illuminate 2013), at Malappuram from April 19 to May 1, 2013.

Fig 3.6

Result of Exhibition & Fairs conducted by Department of

Industries & Commerce inside the State

Outlook - MSME Sector

3.53 Lack of space, poor quality infrastructure and lack of sufficient entrepreneurial spirit are the main constraints in Micro, Small and medium scale industrial development in the state. Hence State should concentrate on design oriented and value based industries by clearly assessing the latest market trends and finding ways to collect adequate raw material

.

3.54 In a densely populated state like Kerala, multi-storied industrial galas/ parks built, where required are ideal. Land pooling techniques can be used on uncultivable / unused land identified at district level for this purpose and the cost of Government land should be rationalized.

3.55 The labour productivity and output per unit of capital in Kerala has always been less than the national average. Also the labour scenario under active trade unions in Kerala is very challenging for entrepreneurs. To improve entrepreneurial spirit among people, awareness programmes based on specific, innovative studies in small industries, diversity of products, technical know-how and value addition should be promoted. Financial Assistance to new worthy entrepreneurs for preparing good project reports, gaining technical know how and for maintenance of imported machines in the industrial units should be ensured.

3.56 Industrial effluent is a big issue. The focus would continue to be pollution free, power saving, Green and Eco-Friendly light manufacturing / traditional industries, with ethical and fair labour standards.

3.57 The traditional sector should be enhanced by producing value added, innovation driven, design oriented, socially and environmentally sustainable products like hand worked fabrics as these are a market niche, a small market segment in which the product features aimed at satisfying specific market needs, as well as the price range, production quality and the demographics that is intended to impact. The skill development programmes, cluster development, enhanced wage rates and trained private players for better profit making management could attract the young generation. Thus the structure of industry should be shifted from resource driven to efficiency driven in long run. It is important to assess actually how much people get benefitted from the traditional sector.

Traditional Industries

Textile Industry

3.58 Kerala’s textile industry comprises of traditional handloom sector, powerloom sector, weaving and spinning sector.

Handloom Sector

3.59 The Handloom Sector in Kerala stands second to the coir sector in providing employment among the traditional industries of the State. The Handloom Industry in the State is mainly concentrated in Thiruvananthapuram and Kannur District and in some parts of Kozhikode, Palakkad, Thrissur, Ernakulam, Kollam and Kasaragod Districts. The Industry is dominated by the Co-operative sector, covering 94 per cent of total looms. The remaining 6 per cent of Handlooms units are owned by Industrial entrepreneurs. The Co-operative sector consists of factory type and cottage type societies. There were 664 registered Primary Handloom Weavers Co-operative Societies in the State as on November, 2013, indicating a 12 per cent increase from March 2012. Of the 664 registered Primary Handloom Weavers Co-operative Societies, 153 are factory type and 511 are Cottage type societies. Of these 664 societies, 431 are in working condition as in November 2013. Details are given in Appendix 3.24.

3.60 The major varieties of products produced in the handloom sector of the State are dhothis, furnishing material, bed sheets, shirting, saree and lungi. These items contribute about 67 per cent of the total production of handlooms sector. About 80 per cent of the major items are produced in the southern region followed by Northern region (12 per cent) and Central region (6 per cent). Of the total production, nearly 95 per cent is contributed by the co-operative sector.

Box 3.6

Traditional Industries in Approach Paper to Twelfth Five Year Plan (2012-17) - Kerala

• Efforts of the Government shall be towards revamping the sector and making them sustainable.

• Thrust areas identified are enhancing export earnings, technology upgradation, product diversification / value addition, market promotion and skill development.

Box 3.7

Major schemes introduced in Annual Plan 2012-13

1) Self Employment under Handloom Sector

The aim is to attract new generation entrepreneurs by providing training, marketing support and margin money to set up units.

2) Weavers / allied workers motivation programme

The scheme aims to motivate weavers / allied workers to enhance production by providing attractive incentives.

3) Establishment of Handloom Village and Integrated Handloom Village

The aim is to provide assistance to build infrastructure for establishing Handloom Villages and Integrated Handloom Villages in the state to showcase the rich old craftsmanship, evolution of the industry, and the processes/ activities involved in making handloom products.

Government Assistance extended for the development of handloom industry, by way of loan and grant in the 12th Plan and 2012-13 is shown in Appendix 3.25.

3.61 The total value of production shows an increase of 10 per cent from 202.14 crores in 2011-12 to 222.87 crores in 2012-13. The total number of weavers employed has increased from 49930 in 2011-12 to 50433 in 2012-13. The number of women employed is also increased from 20784 in 2011-12 to 21434 in 2012-13. The total number of employment generated has increased from 90.32 lakh man days in 2011-12 to 105.86 lakh man days in 2012-13. Details are given in Appendix 3.26 and in Fig 3.7.

3.62 The membership in Kerala Handloom Workers Welfare Fund Board is 32297. As per the Handloom Census of India 2009-10, (Ministry of Textiles, Govt of India) there are around 12,000 Handloom Households in Kerala. Assuming an average of two active weavers per family, the total number of weavers in the state would be about 24000. As per the report of the Survey on Handloom Sector in Kerala 2009, there were 469 societies in Kerala. The total membership in these societies was 65964, of which only 57,405 (87%) were active in the industry. Hence there existed an ambiguity regarding the size of employment in the sector. To solve the issue, a new scheme ‘Detailed Survey on Handloom Industry in Kerala’ has been initiated in Annual Plan 2013-14.

Fig 3.7

Production and Employment in Handloom sector

Promotional measures of handloom sector

3.63 Promotional measures of handloom sector such as procurement, sales and marketing of handloom fabrics are being undertaken by two state level organisations namely Hantex and Hanveev.

3.64 Hantex is the apex society of handloom co-operative societies in the state. Number of PHWCS registered under Hantex is 504. Despite grants and loans being given to the society, the organisation is running at a loss as per the balance sheet of the year 2012-13. The working results of Hantex are given in Appendix 3.27.

3.65 Hanveev is a PSU setup to assist handloom weavers outside the co-operative fold by providing necessary raw materials at reasonable price and making arrangements for marketing their products. This organisation is also running in losses. The working results of Hanveev are given in Appendix 3.28 & 3.29. Hanveev conducted 30 exhibitions during 2012-13 and the sales turnover was `1646.29 lakh.

Box 3.8

Issues in the Handloom sector – As identified by the 12th Plan Working Group Report on MSME and Traditional Industries (Kerala)

1. Low productivity due to lack of technology intervention & poor market segmentation

2. Competition from cheap power loom fabrics and dumping of cheap fabric from outside state.

3. Lack of emphasis on quality and innovative designs of handloom products in market.

4. Lack of product diversification in accordance with new trends.

5. Difficulty in getting workers due to low wages & difficulty to avail credit facility.

6. Lack of working capital and fluctuation in hank yarn price.

7. Weak performance of apex societies and organizations.

Textile Sector – Spinning Mills

3.66 The Textile Industry in Kerala is spread over in public sector as well as in Co-operative Sector and there exists 13 Spinning Mills jointly in the public/ co-operative sector.

3.67 Kerala State Co-operative Textile Federation (TEXFED) has 7 Co-operative Spinning Mills as members. Five of them are administered by the Government and two have elected boards. Spinning Industry in Kerala is facing deep crisis due to high cost of inputs, competition from power loom sector and loss of market share. The Mills in Co-operative Sector slipped into the huge accumulated losses amounting to ` 132.52 crore. From 2006 onwards the Government has placed great emphasis on the day to day activities of these mills. Efforts are on to bring a turnaround towards profitability and imbibing financial discipline.

3.68 An amount of about ` 43 crore have already been provided to these mills in the Eleventh Five Year Plan Period, including the NCDC approved revival packages of Malappuram and Cannanore Co-operative Spinning Mills. The 4 spinning mills under KSTC show a declining trend in production. The first phase modernisation of Malappuram and Cannore Co-operative Spinning Mills have been completed and second phase modernisation has started.

3.69 The Co-operative Spinning Mills in the State were formed with a social objective to provide raw material support to the traditional handloom weavers of the state. This support has been stopped in 1999. Instead an integrated approach for the industry has been put in place with establishment of three hank yarn production centres by the Government at Cannanore, Alleppey and Trichur Co-operative Spinning Mills to provide raw material support to the weavers.

Issues of the spinning sector

3.70 The main handicaps faced by the Mills were the lack of working capital and non availability of raw materials. The Government has put in place a centralised purchase system to procure cotton for the entire textile sector through professionally constituted committee comprising of RIAB, TEXFED and KSTC. The sale of yarn through the depot is also monitored by the committee. Consequently raw material cost has come down heavily, sufficient savings are being generated due to which revenue and turnover has improved.

3.71 Majority of textile spinning mills in the State are over 25 years old and are obsolescent. Even though partial modernization has been done in certain units, it was not at par with the industry standards.

Power loom

3.72 In the power loom sector there are 21 working co-operative societies. Out of the 963 powerlooms in the State, 68 per cent are in the co-operative sector and the rest in the private sector. Comparing the figures for 2011-12 and 2012-13 it is noted that the production of cloth and the value of production has declined in the case of Co-op Sector, and increased in the case of the rest. Details are given in Appendix 3.30.

3.73 The five integrated power loom co-operative societies in the state at Calicut, Wayanad, Neyyattinkara, Kottayam and Malappuram have been accelerated by providing budgetary support.

3.74 The Calicut Integrated Power loom Co-operative Society Ltd., has been converted as a textile park comprising all the segments of a composite mill, with semi automatic and automatic powerlooms together. A modern processing unit to process yarn for both handloom and power loom with modern facilities and a garment making unit with state of art technology and professionally trained manpower is also functioning in this project.

3.75 In Wayanad, the remotest district in Kerala which is lacking industrial initiatives, rehabilitation cum industrial project is functioning. As part of it, a powerloom production centre has started in Thirunelli for tribal women folk for providing training. This will be converted as an employment generating centre in Powerloom & Handloom for adivasi women. Integrated Power loom Co-operative Societies in Neyyattinkara and Kottayam has also been activated and are in the process of production of grey cloth and some conversion orders for export market. The sizing unit functioning at Kottayam is activated as a common facility centre for all the integrated power loom Co-operative societies in the state.

Handicrafts

3.76 Handicraft industry is one of the traditional industries of Kerala, providing employment to Artisans. Eighty per cent of these artisans are from socially and economically backward classes. Kerala has the tradition of making beautiful handicrafts with ivory, bamboo, palm leaves, seashells, wood, coconut shells, clay, cloth, coir, metals, stone, lacquer ware and so on. Many old handicraft classics can be seen in Palaces, old heritage homes and museums in the State.

Importance of Handicraft Industry

3.77 Kerala State Handicrafts Apex Co-operative Society (SURABHI), Handicrafts Development Corporation and Artisans Development Corporation are the major promotional agencies in the handicraft industry. SURABHI is the apex organization of primary handicrafts co-operatives established with a view to uplift the artisans by marketing the product produced by the primary co-operatives and implementing welfare schemes with the assistance from State and Central Governments.

3.78 Handicrafts Development Corporation of Kerala is engaged in procuring and marketing handicraft products by giving fair returns to artisans through SMSE Institute and Kairali emporia spread all over India. At present it is having a net work of 19 such sales emporia. HDCK also owns a Common Facility Service Centre (CFSC) at Thiruvananthapuram where lot of artisans are provided with the facilities for the development of crafts. The Kerala Artisans Development Corporation (KADCO) is one of the State agencies to provide assistance to artisans for establishing production units, promoting marketing of products and providing employment opportunities through schemes of trade fairs and marketing centres.

Bamboo Industry

3.79 The importance of Bamboo as an Eco-friendly raw material capable of meeting multifarious needs of the people at large is gaining global acceptance. From a raw material known as the “ poor man’s timber” bamboo is currently being elevated to the status of “the timber of the 21st century”. A unique feature of the Kerala bamboo scene is that 67.3 % of the extracted bamboo comes from home gardens rather than from the forests.

3.80 The Kerala State Bamboo Corporation Ltd. was established in 1971 in Kerala to develop and promote industries based on Bamboo, reed, cane and rattan. Kerala State Bamboo Corporation’s main activity is collection of good quality reeds from Government forests and distributing these reeds to the registered mat weavers of the Corporation, throughout the State of Kerala, on credit basis and procuring woven mats made of these reeds at reasonable prices, thus providing employment and regular means of livelihood to these weaver sections of the society. Bamboo mats, Bamboo ply, Flattened board, Flooring tiles are the main products.

Box 3.9

Handicrafts Sector in Annual Plan 2012-13& 2013-14

Major Objectives

Share Capital Contribution to Handicrafts Primary Co-operative Societies

To provide Share Capital Contribution to Handicrafts Primary Co-operative Societies for strengthening their equity base. The scheme helps to acquire additional assets which will create more employment and quantify the production.

Assistance to Apex Organizations in Handicrafts Sector

For extending assistance based on definite projects to the following Apex organizations in the Sector.

Entrepreneur Assistance Scheme in Handicrafts/Artisans Sector

To provide term loan to those beneficiaries not belonging to backward classes or minorities, but who are below poverty line and are artisans, on the same terms and conditions as given by NBCFDC and NMFDC.

Establishment of Common Facility Service Centers for Handicrafts

For giving training in handicrafts, quality testing, machine based job works, dyeing, polishing and printing works, modernisation of handicrafts units, development and promotion of new designs and establishment of CFSCs.

Development of Bamboo related Industries

For conducting skill upgradation training programmes for artisans and craftsmen in making diversified and value added products of bamboo, for increasing the sales of bamboo products by promotional activities inside the State like participation in regional and state exhibitions, Organize ‘Kerala Bamboo Fest’, Promoting Art & Designs, etc.

An amount of ` 370.00 lakh was provided in the Annual Budget 2012-13 for the implementation of the above said schemes in the sector through the apex bodies SURABHI, HDCK, KADCO, KSBC and Bamboo Mission.

Plan Outlay and Expenditure in this sector for last two years

(` in Lakhs)

Annual Plan 2012-13 |

Annual Plan 2013-14 |

||

Outlay |

Expenditure |

Outlay |

Expenditure |

350.00 |

348.25 |

431.00 |

50.00* |

*Up to November. Expenditure is likely to pick up in the last quarter of 2013-14.

Achievements

SURABHI conducted 6 exhibitions participating hundreds of artisans and carried out sales through its 16 showrooms inside & outside Kerala. The turnover of the society during the year 2012-13 was ` 293.50 lakh. During 2013-14 the society conducted 5 exhibitions and the total turnover is `143 lakh.

KADCO conducted 4 Grihastha training programmes for about 400 female handicraft workers and provided loan to 98 artisans under NBCFDC loan scheme. Through Service & Supply scheme which is benefited to more than 100 units and above 3000 artisans, KADCO made a turnover of `13.29 Crore and a profit of ` 22.53 lakh in the year 2012-13.

Khadi and Village Industries

3.81 Khadi & Village Industries play a substantial role in generating employment in rural areas with minimum investment. These industries use eco-friendly, local resources and generate higher employment opportunities. “The Kerala Khadi and Village Industries Board is a statutory body constituted by the Act IX of 1957 Legislative Assembly. It is vested with the responsibility of organizing, developing and promoting Khadi and Village Industries in the State. Co-operative Societies, registered institutions and departmental units carry out activities of the Board by availing financial assistance from State Government, Khadi Commission and Nationalised Banks. The Board has achieved 100 per cent financial targets in 2012 and 2013.

Activities during the year 2012-13

3.82 The State Government had provided and released a sum of ` 1185 lakh under plan during the year 2012-13. In addition to this, an amount of ` 96 lakh has been received from State Government towards Modernisation of Khadi Sector under re-appropriation and ` 2000 lakh has been received from the State Government towards Income Support Scheme. The Board had also received ` 2094.84 lakh under Non-Plan Administrative Expenses. An amount of ` 550 lakh has been received towards Special Rebate on retail sale of Khadi throughout the year and a sum of ` 600 lakh has been received towards Special Rebate on retail sale of Khadi on Festival Seasons (for 108 days) under Non-Plan during the year 2012-13. The Khadi and Village Industries Commission had released an amount of ` 829.86 lakh (ie ` 824.76 lakh as Margin Money Grant and ` 5.10 lakh for Publicity) to the Board under Prime Minister’s Employment Generation Programme (PMEGP)

Box 3.10

Performance of Khadi Sector during 2012 and 2013

Under Prime Ministers Employment Generation Programme (PMEGP)

An amount of ` 829.86 lakh was disbursed as margin money grant for 374 projects. This generated 335 jobs under Special Employment Generation programmes, 2365 units were set up with total cost of `2665 lakh and an amount of ` 200 lakh was given as a subsidy (District wise achievement are shown in Appendix 3.31).

Goods worth ` 29052.18 lakh were produced and goods for 33830.96 lakh were sold by providing employment of 248528 persons. (Details of value of production, sales, employment, and wages paid are given in Appendix 3.32).

Under the Expansion and modernisation of sliver project of Ettukudukka in Kannur, a new carding machine and a simplex machine have been purchased and installed.

Board conducted Onam Mela to propagate Khadi.

Goods worth ` 3464-19 lakh has been sold through 216 sales outlets of Khadi & Village Industries. (District wise details are shown in Appendix 3.33) .

An amount of ` 20 crore has been received from Government under Income Support Scheme and disbursed to 11,193 Artisans in the Khadi Sector.

Goods worth ` 560.48 crore has been produced through the aided units of the Board and provided employment to 1,60,202 person.

Box 3.11

Major Schemes in the Khadi sector 2013-14

Scheme |

Outlay (`in lakh) |

1. Establishment and strengthening of Departmental Khadi production Centres |

335 |

2. Production / Festival Incentive to Khadi Spinners and Weavers. Establishment of new Khadi sales outlets, Modernisation & Computerization of existing sales outlets and Godowns to Khadi Board |

241.55 |

3. Special Employment Generation Programme |

450 |

3.83 The strategy for achieving growth during the 12th plan is to develop product –wise clusters of Khadi and Village Industries products and to develop their domestic as well as export market. Other strategies include introducing innovations in design and technology, creation of entrepreneurship and growth in manufacturing in rural non-farm sector to prevent migration by enhanced allocation for Prime Ministers Employment Generation programme.

Coir Industry

3.84 Coir Industry is a major traditional industry in Kerala in terms of the employment generation and foreign exchange it earns. It provides livelihood to nearly 3.75 lakh people. Government has given more emphasis on Coir Industry by considering the social features and problems faced by it. Kerala accounts for about 85% of the total production of coir in the country. The availability of coconut husks, the basic raw material, the natural retting facilities present in the lakes, lagoons and backwaters of Kerala and the traditional expertise of the people of the state were the reasons for the concentration and growth of the industry in the state, especially in the coastal area. The Coir Industry is classified into four sectors viz: Retting and Fibre Extraction Sector, Spinning Sector, Manufacturing Sector and Export Sector.

Major Institutions in Coir Sector

1) Foam Mattings (India) Limited

3.85 In FOMIL the accent is on technology, infrastructure and machinery, which are visible from its quality products. Great care is taken to maintain the world class standards of FOMIL production facilities. The latex backing plant, which were imported from Denmark, is one of its kinds in India. It has a capacity to latex back up to 3.3 million sq.m. of matting 4 metre width, per annum on three shift basis.. Company is providing employment to 163 persons. Sales turnover to FOMIL during 2012 -13 is ` 622.38 lakh.

2) Coirfed

3.86 The Kerala State Co-operative Coir Marketing Federation Ltd. 679 (Coirfed) is the apex federation of primary coir co-operative societies spread all over Kerala. The main objective of the federation is the procurement of the entire product of the member societies and marketing the same through its sales outlet throughout the country and thereby providing fair wages and subsistence to the poor coir workers of Kerala. At present Coirfed has two factories engaged in the manufactures of value added products – One producing rubberized coir products and the other rubber backed coir mats.

Coirfed has 4 Defibering Units.

3) Kerala State Coir Corporation

3.87 The Kerala State Coir Corporation Limited was established in 1969 to cater the needs of the Small Scale Coir Manufacturer by providing them manufacturing and marketing opportunities. It has three production units in Kerala Establishment of one more unit in Adoor, is in progress. Kerala State Coir Corporation has vast infrastructure in terms of land and buildings. However the productivity of employees, material and money is not high enough to compete with private entrepreneurs. The cost of production is the main component which needs to be brought down. To make the product of Coir Corporation competitive in market, the assistance of technically and professionally competent personnel is needed in every department. The compensation /salary package offered is not found lucrative to attract the best hands to this industry.

3.88 Kerala State Coir Corporation is implementing in Purchase Price Stablization Scheme (PPSS) in Coir Sector. Under the scheme the Kerala State Coir Corporation will directly procure coir products from Small Scale Producers. Mats & Mattings Co-operatives and alike there by avoiding middle men. Details of export by Coir public sector undertaking /Coirfed is in Appendix 3.34.

4) National Coir Research & Management Institute

3.89 The National Coir Research & Management Institute, strengthen the Research & Development activities of Coir Sector to enable the industry to produce more value added and new design products at a reasonable, but competitive price. The National Coir Research & Management Institute has developed a Mini Defibering machine capable of defibering 3000-4000 husk per day. These machines supplied to coir co-operative societies on 100% subsidy and private sector, at 50% subsidy and 60 per cent on SHG. Around 198 Defibering machines were supplied on demand.

Major development activities

Major development activities in the sector during the period of report are as follows:-

(a) The Coir Development Department has organized “Coir Kerala 2013” an international event on coir and natural fibre products at Alappuzha. This fair witnessed participation of buyers from 52 countries apart from those within India

b) Debt Relief Schemes for Co-operative Sector / Entrepreneurs

Government of Kerala implemented a scheme to provide one time assistance as debt relief to coir co-operatives/Entrepreneur’s in the coir sector for the settlement of loan availed to set up coir industry. The Government support is to nullify loan arrears subject to certain limits. During the year 2012-13, an amount of र 1,30,000/- has been sanctioned to 2 societies and र 12,57,047/- to 60 small scale producers under the scheme.

c) Working Capital Assistance to Coir Co-operative

The major issue of the Coir Co-operatives is shortage of working capital. In order to overcome the hurdle the Government of Kerala has released an amount of र 8,96,92,648/- to 440 Coir Co-operative Societies as working capital assistance during 2012-13. (Details of Coir Co-operative societies in Kerala in Appendix 3.35 and Activities of coir Co-operative societies in Appendix 3.36)

d) Husk Collection Scheme

The major hurdle in the coir sector is the shortage of sufficient quantity of husk and also poor mechanism to collect the husk. Government of Kerala has launched a scheme of husk collection. Under the scheme, the activity of collecting husk is done through Coir Co-operative Societies and Consortia. The husk collection scheme was modified and under the modified scheme revolving fund to the tune of र 1,00,000/- can be sanctioned to societies engaging in the collection of husk for their use. And the worker, who collects the husk will be given a financial assistance as incentive. Under the scheme 3,73,28,380 Nos. of husk has been collected during 2012-13.

e) Cluster Development Programme

An amount of र 46,89,950/- is released to 4 societies, Coirfed and Kerala State Coir Corporation during 2012-13, under the scheme.

f) Production and Marketing Incentive

An amount of र 300 lakh has been sanctioned and released to 278 societies under the scheme during the period 2012-13.

g) Marketing Development Assistance:-

An amount of र 8 crore has been released as follows during the period of report in Table

Table 3.2

Market Development Assistance

| Coir Societies | र 4453690/- |

Kerala State Coir Corporation |

र 49789030/- |

Foam Mattings (India) Ltd |

र 2360938/- |

Coirfed |

र 23396342 |

h) Income Support Scheme

Government of Kerala introduced a scheme ensuring at least र 210/- as wages per day for the works in the yarn sector providing a portion of the wage directly for the year 2012-13. Under the scheme the enhanced portion of wage will be released direct to the bank account of the coir workers, by utilizing Government fund. The wage increased to ` 260/- from 01.05.2013 onwards.

i) Pension to Coir Workers

A total amount of ` 3,200 lakh has been released as pensions to 60,000 coir workers during the period under report.

Box 3.12

Major Schemes in the Coir Sector 2013-14

Schemes |

Objective |

Allocation ( र in lakhs) |

| Regulated Mechanization of Coir Industry | Modernisation of Coir Industry and enhancement of production |

6858.85 |

| Marketing and publicity | Organising trade fairs at State National and International |

950.00 |

| Price Fluctuation Fund | Stablilzation of price of coir fibre yarn and coir products |

1500.00 |

| Coir Geo Textiles Development Programme | Implementing pilot projects inclusion of Geo textiles as a standard Engineering material |

30.00 |

| Cluster Development Programme | Formation of clusters as per direction from Government |

250.00 |

Box 3.13

Challenges and Remedial Measures in Coir Sector

CHALLENGES IN COIR INDUSTRY |

REMEDIAL MEASURES REQUIRED |

Husk Procurement not achieved as desired, Frequent hike in price of Fibre in neighbouring States

|

Strengthening of Husk collection and Fibre Production

|

Health and environment issues in traditional method in retting and husk beating Low Productivity |

Mechanisation in Fibre Extraction, spinning and weaving sector |

Competition from synthetic and other cheaper substitutes |

Diversification in Coir production Focus on Coir Geo-textiles |

Lack of professional management system |

Skill and Technology Development for coir workers Modernisation and Technology up gradation in spinning and product development |

Migration of workers to construction and other areas |

Introducing home concept in spinning sector Strengthening Cluster based activities in Coir Sector from clusters Strengthening support institutions and R & D Providing financial assistance to purchase land for selected societies, Revival of dormant Coir Co-operative |

Cashew Industry

3.90 India is the largest producer, processor, exporter, and the second largest consumer of cashew in the world which is an important commercial horticulture crop. India’s processing capacity of cashew far exceeds its production of raw nuts, with only half of the cashews processed in the country being produced domestically. The industry is highly dependent on imported raw-materials for value addition and the export marketing is highly competitive which is the most unfortunate situation. One of the key factors in favour of expanding the cashew industry in India is the stable price in the International market when compared to other nuts.

Importance of Cashew industry

3.91 The Cashew Industry in Kerala is a Traditional Industry mainly concentrated in Kollam District and is mainly controlled by private sector. The industry has a long history of employing large numbers of workers in decentralised units. The industry is highly labour intensive which employs more than 3, 00,000 workers, barely literate and majority of them are women. The skills of these workers do not include any entrepreneurial capacities and Cashew processing is a highly labour-intensive activity which includes grading and packaging of finished products. Export of Cashew & Foreign exchange earnings are given under Trade in Chapter 6.

3.92 The Kerala State Cashew Development Corporation (KSCDC) and Kerala State Cashew Workers Apex Co-operative Society (CAPEX) are the two agencies of the State engaged in cashew processing sector in Kerala. CAPEX with headquarters in Kollam, is the apex body of cashew workers primary societies engaged in the procurement of raw cashew nuts and marketing the processed kernels. The Society owns 10 factories. There are about 6300 workers. The performance of CAPEX by the last 5 years is given in Appendix 3.37. The Kerala State Cashew Development Corporation (KSCDC) has 30 factories with about 18000 workers. The Corporation processes raw cashew nuts and produces value added products. The Corporation could provide employment for 202 days in 2012-13. The performance of KSCDC by the last 5 years is given in Appendix 3.38.

Kerala State Agency for the Expansion of Cashew Cultivation (KSACC)

3.93 Kerala State Agency for the Expansion of Cashew Cultivation (KSACC) was constituted by Government of Kerala to overcome the crisis of diminishing trend in shortfall of area under cashew cultivation in the State. Since 2008, KSACC has been organizing promotional activities in cashew cultivation and distributing cashew grafts of high yielding varieties and financial assistance to farmers and institutions in the State. KSACC is the nodal agency for the Cashew cultivation activities in Kerala, approved by NHM (National Horticulture Mission). The area, production and productivity of cashew in Kerala shows a sharp increase during 2011-12 when compared to previous years.

3.94 An additional 19000 ha has been brought under the canopy of the project and implemented by the KSACC during the period 2008-09 to 2012-13. In spite of all these promotional boost, the area under cashew diminished further to 43848 ha and production to 35000 MT. involving more than 100000 farmers and a good number of institutions. Assistance was also given for establishing apple processing units.

Cashew Export Promotion Council of India (CEPCI)

3.95 The Cashew Export Promotion Council of India (CEPCI), a non-profit making company, was established at Kollam, Kerala with the object of promoting exports of cashew kernels and cashew nut shell liquid from India. The council operates plan schemes for GOI, and offers various services to its member exporters. The council has set up a Laboratory and Technical Division of international standards which is recognised as an approved Research Centre for Doctoral research by Kannur University and University of Kerala. The service of CEPC Lab is available to cashew industry as well as entire food processing industry in India and abroad. The lab analysed 4373 samples during 2012-13 and 69 trainees underwent the training Programmes conducted by the lab.

Box 3.14

Cashew Sector in Annual Plan -2012-13 & 2013-14

Major Initiatives and Objectives

1. Cultivation of Organic Cashew and Establishment of a Raw-nut Bank

For the establishment of cashew gardens and organic cashew cultivation in the available land and also to establish a Raw nut Bank to ensure steady supply of nuts for processing and promotion of the cultivation of organic cashew nuts.

An amount of ` 410.00 lakh was provided in the Annual Budget 2012-13.

2. Modernisation of Cashew Sector Including Brand Building

New scheme proposed in the Annual Plan 2012-13 incorporating the existing schemes Rejuvenation of cashew Industry, Upgradation of Facilities and Modernisation of Cashew factories, Modernisation of Cashew Factory Sheds, Expansion of Domestic market for cashew/Market Development & International Brand Building for cashews. The objectives were upgradation and modernization of cashew factories, construction and renovation of Godown sheds and factory sheds, upgradation of procurement centres and international brand building of cashews.

An amount of ` 6090.00 lakh was provided in the Annual Budget 2012-13, of which `3790.00 lakh is for KSCDC and ` 2300.00 lakh is for CAPEX.

Major Initiatives of Annual Plan 2013-14

Modernisation and Partial Mechanisation of Cashew Factories and Brand building

The main objectives of the scheme were to enhance the production output and productivity of the factories of Kerala State Cashew Development Corporation Ltd. And CAPEX by introducing partial mechanisation in the production process by installing Shelling, Peeling and Grading machinery which runs in parallel with workers and to achieve maximum capacity utilization in addition to the modernization and upgradation of infrastructure facilities of factories and brand building in Kerala, India and in international markets. ` 4170.00 lakh to KSCDC and ` 2530.00 lakh to CAPEX were provided.

Plan Outlay and Expenditure in this sector for last two years

(` In Lakhs)

Annual Plan 2012-13 |

Annual Plan 2013-14 |

||

Outlay |

Expenditure |

Outlay |

Expenditure |

6500.00 |

6121.95 |

7150.00 |

326.63* |

*Up to November. Expenditure is likely to pick up in the last quarter of 2013-14.

Achievements

• During the period, Modernization of Cashew factories were done in all levels.

• Value added products were produced through Value addition units.

• Continuous Employment was given to workers of KSCDC & CAPEX with good ESI facilities and other benefits.

• Established branded products in domestic and international markets.

• The Area of production of cashew enhanced to 43848 ha and rate of growth of production of raw nuts and the productivity per hectare were improved

Central Govt. Schemes & Programmes with their achievement

Market Development Assistance for MSME exporters (MSME – MDA)

3.96 The scheme encourage Small & Micro exporters in tapping and developing overseas markets, increase participation of representatives of small/ micro manufacturing enterprises under MSME at International Trade Fairs/ Exhibitions and enhance export from the small/ micro manufacturing enterprises. During 2012-13, MDA Grant reimbursed from exporters under this scheme was ` 18.80 lakh and Grant-In-Aid disbursed is ` 500 lakh, through CEPC. In 2013-14 disbursed Grant-In-Aid is `1000 lakh.

Promotional Events

3.97 ‘Cashewotsavam’ a meeting of all stakeholders of cashew in the country along with Cashew Machinery Expo was organised by CEPC in September 2012. Other than this, the Council participates in 3 International Exhibitions, 2 trade delegations, 3 international conferences and organised 2 BSMs abroad.

Outlook for Cashew Industry

3.98 Sustained availability of quality raw cashew nuts should be ensured to meet the requirement of the industry through increased domestic production by enhancing the area, production and productivity of cashew, by adopting high-end technology, promoting organic farming and by empowering women through formation of Self Help Groups (SHG) for processing and value- addition.

Industrial Financing

(A) Kerala Financial Corporation

3.99 Kerala Financial Corporation (KFC), provides long term finance, primarily to Micro, Small and Medium Enterprises (MSME), both in manufacturing and service sectors. Government of Kerala is the major shareholder with more than 97 per cent and the balance is held by SIDBI, LIC, SBT and others.

3.100 Kerala Financial Corporation has achieved substantial growth in terms of sanction, disbursement and recovery of financial assistance with the operational profit making a significant leap crossing the ` 100 crore mark for the first time in the history of the Corporation. KFC has emerged as the best performing public sector undertaking in Kerala. It also ranks No. 1 amongst all State Financial Corporations in the country in terms of profitability and low level of non productive assets (NPAs). The Corporation earned the highest ever profit of ` 66.83 crore during the FY 2012-13. The Non-Performing Assets are at the lowest level.

3.101 The Corporation sanctioned financial assistance of ` 625.82 crore during 2012-13 (16.3% growth over previous year). An amount of ` 475.91 crore was disbursed to various industrial units during 2012-13 (2% increase over previous year). Performance of working of KFC during the last five years is given in Appendix 3.39. The details of loan operations and industry-wise classification of loan during 2012-13 of KFC are shown in Appendix 3.40 and Appendix 3.41.

B) Kerala State Industrial Development Corporation (KSIDC)

3.102 Kerala State Industrial Development Corporation Ltd. (KSIDC) has the main objective of promoting, stimulating, financing and facilitating the development of large and medium scale industries in Kerala.

3.103 KSIDC has sanctioned projects involving a capital investment of ` 2172 crores with direct term loan assistance of ` 54 crores in the financial year 2012-13. The new projects are expected to generate employment for 10,000 persons directly and indirectly. The Corporation has also registered an all-time record of ` 54.20 crores profit before taxes (provisional) and an income of ` 63.72 crores. The disbursements also touched an all-time high record of ` 118.49 crores. Details of investment and employment made in KSIDC units during 2012-13 are given in Appendix 3.42.

3.104 During the year 2012-13, KSIDC initiated various industrial and infrastructure projects which are strategically important to Kerala’s industrial and economic development. The cumulative investments in these projects are expected to be around ` 1, 00,000 crore. Major projects developed by KSIDC are listed in Box 3.15 and the physical and financial performance during 2012-13 is given in Appendix 3.43.

Box 3.15

Major Projects Promoted by KSIDC for Industrial Development

• Electronic Hardware Park at Kochi – a world class manufacturing and R&D facility for Electronic Sector.

• Life sciences park for setting up state-of-the-art manufacturing and R&D facility for Biotechnology, Nano Technology, Contract Research etc.

• Titanium Sponge Project at Kollam

• Supplementary Gas Infrastructure Project

• Coconut Industrial Park, Kuttiyadi

• Organic Industrial Park, Kodungallor.

C) Kerala Industrial Infrastructure Development Corporation (KINFRA)

3.105 Kerala Industrial Infrastructure Development Corporation (KINFRA) aims at accelerating the industrial development of the State by providing infrastructure facilities to industries. The Industrial Parks developed by KINFRA have facilities like developed land or built up space, dedicated power, continuous water supply, communication facilities etc.