Tourism

Recent Trends in Foreign Tourist Arrivals

The inflow of tourists to a country is affected by many factors. Political stability, economic crises and climatic conditions have a major influence on the travel plans of the people across countries. The policy shifts of governments also affect the arrivals of both foreign and domestic tourists to a region. Cost effective tour packages, branding, modernised marketing techniques and so on will also provide more impetus to the growth of the industry. The growth of Sri Lanka, Thailand, Singapore, and other East Asian and Pacific countries with increasing market share reveals this fact. Figure 9.1 portrays the trends in the arrival of foreign tourists in India and Kerala.

Figure 9.1

Annual growth rates in the arrival of foreign tourists in India and Kerala, in per cent

Source: Department of Tourism, Government of Kerala

In 2015, the number of foreign tourist arrivals in India was 8.03 million as compared to 7.68 million in 2014, thus registering a growth of 4.5 per cent over 2014. India’s share in international tourist arrivals is about 0.68 per cent and the country ranked 40th with respect to the same in 2015. The corresponding share and rank of India in the Asia and the Pacific region is 2.88 per cent and 11th.

The growth trends in foreign tourist arrivals into India have had a chequered history. The September 2001 terrorist attacks in the United States had affected the tourism industry across the world. This had repercussions in India too, with the sector witnessing negative growth rate in 2001 and 2002. But the industry gradually gathered momentum, and in 2003 the growth rate increased to 16 per cent, which further increased to 25 per cent by 2004 (one of the largest hikes during the last two decades). The trend continued up to 2007. During 2008-09, the growth rate began to decelerate again and dropped to a negative figure of -4.8 per cent by 2009. This recession in tourism was due to global slowdown, terrorist activities and the h4N1 influenza pandemic (Annual Report, 2010, Ministry of Tourism). The industry slowly recovered from the crisis by 2010 and since then the number of foreign tourist arrivals has shown a consistent growth.

In the case of foreign tourist traffic, the State has recorded a consistent growth in the number of tourist arrivals during the past two decades except during the crisis periods i.e., 2001 and 2009. The policies and marketing strategies adopted by the State government have succeeded to a great extent in attracting foreign tourists. The growth rate in Kerala with respect to foreign tourist arrivals is higher than that of India. But the national average surpassed the State annual growth rate of foreign tourist arrivals in 2014 for the first time in a decade. Further, the state has been witnessing a declining growth rate especially after 2010, which is matter of concern. In 2010, the growth rate was 18.31 per cent, which dropped to 8.12 per cent by 2013 and further to 5.86 per cent in 2015. Appendix 9.1

Compared to the previous year, Kerala has maintained 7th position in the share with respect to foreign tourist arrivals among top ten states in the country in 2015. The share of the State in the national pie of foreign tourist arrivals accounts for 12.2 per cent in 2015; for the past four years, the share has remained more or less the same. Tamil Nadu, the neighbouring state ranks first in foreign tourist arrivals and accounts for 21.9 per cent of the national pie.

Seasonality in Foreign Tourist Arrivals

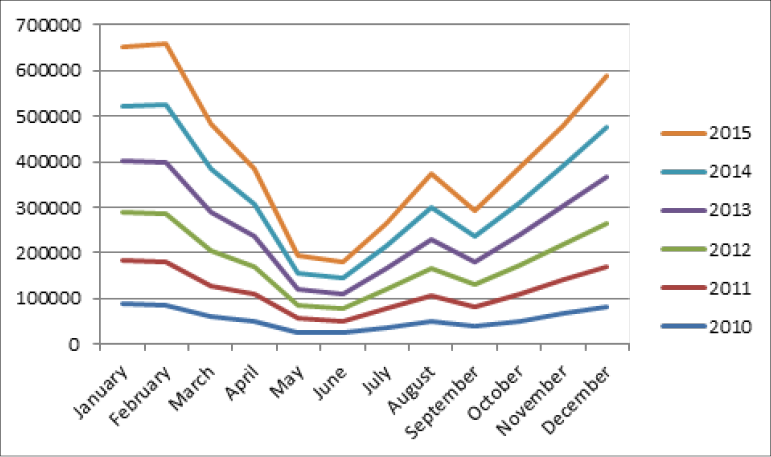

The month-wise analysis of foreign tourist arrivals in Kerala indicates that the tourist season starts from November and lasts up to March. The season is at its peak during the months December, January and February. A similar trend is visible in the national case also. During 2015, the maximum number of foreign tourists arrived in the month of February followed by January. Around 13.6 per cent of the total tourists visited the State during February. The lowest foreign traffic was registered for the month of June. Figure 9.2 depicts the month-wise comparison of foreign tourists from 2010 to 2015.

Figure 9.2

Month-wise comparison of foreign tourists in Kerala from 2010 to 2015, in number

Source: Department of Tourism, Government of Kerala

The seasonality in foreign tourist arrivals in Kerala has remained almost the same over these years. The period from April to September is considered off-season. The number of tourist arrivals during the off-season has shown a marginal increase for the last five years. In between the off seasons, a hike in the flow of tourists is noticed during August for the past two decades.

Even though Kerala’s tourism sector is aiming to change the State into a 365 days destination, the month-wise figures of foreign tourist arrivals shows the need to identify, diversify and develop new destinations and products, where the state has a comparative advantage, to overcome the aspect of seasonality. The Department of Tourism has taken many measures to make Kerala an all-time destination and promoted products like monsoon tourism, Meetings, Incentives, Conferences and Exhibition (MICE) tourism and customised packages for off-season months. The marginal increase in the number of foreign tourist arrivals during the off-season for the past five years is a clear indicator of the efforts taken by the tourism industry of the State. These initiatives need to be continued and products that fit all seasons should be introduced to convert tourism to a regular activity generating sustainable income and full-time employment. Besides, market-specific, multi-pronged marketing strategies based on market analysis should be put in place to attract quality foreign tourists throughout the year.

Source Market of Tourist Arrivals

The country-wise details of foreign tourist arrivals (FTA) into India in 2015 reveals that about 15.1 per cent of the FTAs were coming from United States followed by Bangladesh (14.13 per cent), United Kingdom (10.81 per cent) and Sri Lanka (3.73 per cent). The trend was same for the years 2012, 2013 and 2014.

In Kerala, United Kingdom, with an arrival percentage share of 17.1 per cent, remains on the top of the countries that generate foreign tourists. France occupied the second position with a 9.4 per cent share. Germany (7.9 per cent) and USA (7.8 per cent) contribute the next major shares of foreign tourist arrivals. Appendix 9.2

Even though UK occupied the top share in the source market of foreign tourist arrivals in the State, its share had declined from 23.36 per cent in 2007 to 17.1 per cent by 2015. The share of France and USA remained stable while that of Germany showed a marginal decline from 7.9 per cent in 2007 to 6.9 per cent by 2015. But the share of Saudi Arabia substantially increased from 1.66 per cent to 5.2 per cent between 2007 and 2015. The shares of Russia and Malaysia have also increased over these years. During 2007, Maldives contributed a share of 4.9 per cent in the total foreign tourist arrivals in the State but the percentage share came down to 1.29 per cent by 2015. Figure 9.3 portrays the trend in the share of foreign tourist arrival from top ten countries of the world during 2007 and 2015.

Figure 9.3

Trend in the share of foreign tourist arrival from top ten countries of the world to Kerala between 2007 and 2015, in per cent

Source: Department of Tourism, Government of Kerala

District-wise data on Foreign Tourist Arrivals

While analysing the data on the district-wise foreign tourist arrivals, it is noticed that the preference of various districts for the foreign tourists were almost same during the last two years. Foreign travellers are highly concentrated on the central and southern districts of the State. Ernakulam ranks at the top in attracting foreign tourists, accounting for a share of 39.2 per cent during 2015. Thiruvananthapuram (31.7 per cent), Idukki (8.6 per cent), Alappuzha (6.5 per cent) and Kottayam (5.1 per cent) were the other districts in the ranking of top five districts in the State. The northern part of the State is still lagging in attracting foreign tourists. The share of all the districts in the northern region of the State with respect to foreign tourist arrivals is negligible and less than 3 per cent. Appendix 9.3 Figure 9.4 depicts the region-wise share of foreign tourist arrivals in Kerala.

Figure 9.4

Region-wise shares of Foreign Tourist Arrivals in Kerala, in per cent

Source: Department of Tourism, Government of Kerala

The northern region of Kerala has the advantages of long coast line, backwaters, high range tourism and vast scope for the development of cultural and heritage tourism. The government should find measures to develop tourism in this region to avoid regional disparities existing in the industry.