Macro Economic Profile

Banking

Bank Branches

The role of banks is not merely in aiding economic development, but also to include all segments of the population in the financial activities. The opening of bank branches in remote areas is essential for mobilising savings and channelizing them into efficient investment. In terms of number of branches, Kerala has the largest number of bank branches among the semi-urban areas in the country. Kerala has a total of 6166 bank branches as on March 2016, which accounts for 4.65 per cent of total bank branches in the country as against 5981 as on March 2015. During the period 2015-16, 185 new branches were opened in the State. The total number of bank branches increased to 6208 by the end of June 2016. Unlike the other States in the country, the bank branches are spread across the state indicating the penetration of banking activities in the rural areas (Appendix 1.41). The population group-wise breakup of the branch network in the State shows that 60 per cent of the branches are in semi-urban areas and 32 per cent of the branches are in urban areas. There are only 8 per cent of the total bank branches in the rural areas. There were 8966 ATMs in the State as on March 2016, which increased to 9063 in June 2016. The data of banking group wise branch network is given in Table 1.11.

Table 1.11

Banking Group wise Branch network in Kerala

| Banking Group | Number of Branches | ||||

| Rural | Semi-urban | Urban | Total | Percentage | |

| State Bank Group | 98 | 919 | 339 | 1356 | 19 |

| Nationalized Banks | 115 | 1462 | 629 | 2206 | 31 |

| RRB | 48 | 511 | 39 | 598 | 8 |

| Private Sector Banks | 179 | 1404 | 470 | 2053 | 29 |

| Co-Operative Banks | 136 | 43 | 794 | 973 | 14 |

| Total | 576 | 4339 | 2271 | 7186 | 100 |

Source: State Level Bankers Committee, Kerala 2016

Deposits

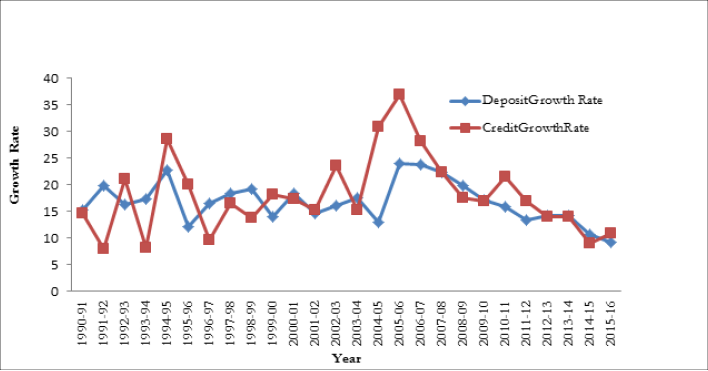

The credit and deposit growth of SCBs in the country shows a declining trend. Bank Deposits of SCBs witnessed a 9.30 per cent growth in 2016, lower than the growth rate of previous year (10.74 per cent). The annual deposit growth rate was above 15 per cent during the 1990s and it fell below 15 per cent after 2010-11. The cumulative deposits of all SCBs stood at 9,327,290 crore in 2015-16, which was 8,533,285 crore during 2014-15. The details of credit and deposit growth are given in Figure 1.14.

Figure 1.14

Credit and Deposit Growth Rate of SCBs in India from 1990-91 to 2015-16

Source: Reserve Bank of India

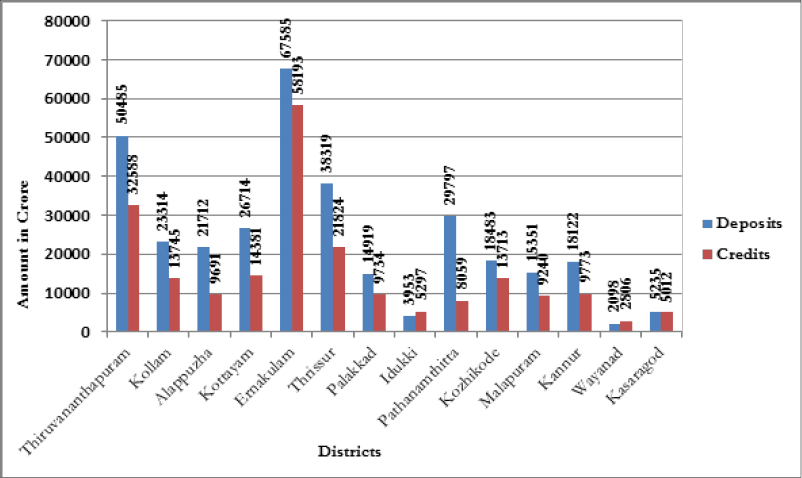

The total bank deposits in Kerala increased by 13.59 per cent and touched 363,511 crore during 2015-16 from 320,010 crore in 2014-15. The per centage increase in bank deposits during 2015 was at 15.14 per cent compared to 13.59 per cent in 2016. There is a slight drop in the growth of deposits as compared to the previous year in the State of Kerala. Maharashtra has the highest share of deposit (22.54 per cent) out of the total deposit in the country. The share of Kerala to the total deposits in the country is only 3.76 per cent (Appendix 1.42). The national average growth rate shows a 2 percentage point decrease in 2015-16 as compared to previous growth of 10.75 per cent. District-wise distribution of deposits and credits of Scheduled Commercial Banks as on March 2016 is shown in Figure 1.15. In Kerala, the share of deposit is more in Ernakulam district.

Figure 1.15

District-wise distribution of deposits and credits of Scheduled Commercial Banks in March 2016, in crore

Source: Reserve Bank of India

Agricultural Finance

Banks in Kerala including the private sector banks disbursed an amount of 282,556 crore as advances as compared to 252,104 crore in June 2015. In the disbursal of total advance, private banks stood at the first place disbursing 81,258 crore (28.76 per cent) in 2016, which was 70,542 crore in 2015 as at the month of June. Nationalised banks disbursed an amount of 78,815 crore followed by State Bank group and Co-operative Banks with 65,342 crore and 45,004 crore respectively during 2016. In terms of annual growth Co-operative Banks stood at first (34.88 per cent) followed by private sector banks (15.19) and RRB (14.39). The annual growth rate in advance among State Bank Group and Nationalized Bank is 5.05 per cent and 4.55 per cent respectively.

The Bank Group wise disbursement of agriculture advance shows that the total agricultural advance in the State reached 61837 crore, which was 60162 crore during June 2015. There is a two point decrease in the percentage of agriculture advance to total advance which fell to 22 per cent from 24 per cent. The bank group wise analyses show that Regional Rural Banks provide more agriculture advance (59 per cent) out of its total advances followed by Nationalized Banks (28 per cent) and private sector banks (13 per cent). But the growth rate in disbursement of Agriculture advance compared to previous year shows a different picture. The disbursement of agriculture advances of Nationalized Banks and State Bank Group shows a negative growth as compared to previous year. The major state wise advance disbursed by Scheduled Commercial Banks is given in the (Appendix 1.43).

Advances to SC/ST

An amount of 4312 crore and 1128 crore was disbursed to SC and ST persons respectively in June 2016 in the State by various banks including private sector banks, commercial banks and co-operative banks. Compared to previous year, the advance given to the Scheduled Caste persons is less and there is slight increase in the advances given to Scheduled Tribe persons. The bank-wise analysis of advances to SC/ST persons shows that the commercial banks are giving more advances given to these social groups in the State. However, the credit facilities extended to marginalized sections are very less when we compare this with the total advances disbursed in the State through various banking institutions. The private banks should given more attention for rendering assistance to scheduled caste and scheduled tribes in the State. The bank group wise advances given to Scheduled Caste and Scheduled Tribes are given Table 1.12.

Table 1.12

Banking Group wise Details under SC/ST Advance, in crore

| Bank | SC Advances | ST Advances | ||

| Number | Amount | Number | Amount | |

| State Bank Group | 219375 | 3468 | 76596 | 806 |

| Nationalized Bank | 67922 | 644 | 23945 | 248 |

| RRB | 23658 | 118 | 12738 | 64 |

| Private Sector Bank | 8530 | 82 | 1049 | 12 |

| Total Commercial Banks | 319485 | 4312 | 114328 | 1130 |

Source: State Level Bankers Committee, Kerala 2016

Micro finance

Microcredit plays a crucial role in the State in reduction of poverty level through gainful employment provided by microcredit enterprises. The various commercial as well as the co-operative banks are extending loans to SHGs for starting new venture to generate income and employment. Kudumbasree has undertaken various activities for the members of Self Help Groups and work as a nodal agency in the State. The activities of the groups range from catering services, dairy services, dairy units, cafeterias, garment units and also agriculture activities.

As per the SLBC data, there are 2.40 lakh Self Help Groups (SHG) maintaining their savings bank accounts with 1,423 crores in various banks as on June 2016. The bank group wise data shows that Nationalized Banks attracts more accounts (50.50 per cent) followed by RRBs (23.32 per cent), private banks (16.07) and the State Bank group (10.11 per cent). In terms of deposits, nationalized banks attract 82.57 per cent of total SHG deposits. The deposit shares of SHG in the State Bank Group were 3.94 per cent, RRBs was 5.34 per cent and private banks was 8.22 per cent for the year 2015-16.

Housing Loans

During 2015-16, banks in Kerala, including private sector banks, sanctioned an amount of 34,555 crore to 728,393 beneficiaries as housing loan against 31,414 crore to 760,968 beneficiaries during 2014-15. State Bank Group disbursed an amount of 13,721 crore to 207,919 beneficiaries, while nationalised banks released largest amount of 8,946 crore to 164,334 beneficiaries. Among the other bank groups, Regional Rural Banks disbursed 1606 crore to 40,122 beneficiaries, Private Sector Banks disbursed 3693 crores to 254,508 beneficiaries, and Co operative Banks disbursed 6589 crore to 254,508 beneficiaries. The share of beneficiaries to total is more in Co-operative Banks (34.94 per cent) followed by State Bank Group (28.54 per cent) and other Nationalised Banks (22.56 per cent). However, State Bank Group has disbursed the major share of housing loans (39.71 per cent) followed by other Nationalised Banks (25.89 per cent) and Co-operative Banks (19.07 per cent).

Educational Loans

There was substantial increase in the disbursement of educational loans in Kerala during 2015-16. At the end of June 2016, 9558 crore was sanctioned to 359,164 students. The Nationalised Banks disbursed an amount of 4475 crore to 170,062 students, which accounted for 46.82 per cent of the total educational loan disbursed by all banking groups in the State. State Bank Group disbursed 3054 crore to 103,408 students. Regional Rural Banks disbursed 848 crore to 33,618 students, Private Sector Banks disbursed 1081 crore to 46,487 students and the Co-operative Banks disbursed an amount of 100 crore to 5589 students as educational loan during 2016. The share of educational loan NPA in total outstanding educational loan during 2016 was 12 per cent.

Co-operative banking sector in Kerala

Co-operative banking in Kerala is well developed and established and plays a pivotal role in the economy. The setting up of a single bank by merging all the co-operative banks in the State is a progressive proposal by the new government for mobilising financial resources. The Finance Minister, in his budget speech, stated that the government is looking at merging district and state level co-operative banks to form a single bank. The government has also allocated 10 lakh to set up the committee to prepare the detailed recommendations regarding the concept of Kerala Bank. As it is spread across the State, with large number of branches, they can play an important role in the development of Kerala economy. As per the available data, Kerala State Co-operative Bank is the apex bank of the short term credit co-operatives in the State with 14 District Co-operatives and about 1500 Primary Agriculture Co-operative Societies (PACS). According to the SLBC data for 2016, there were a total of 973 branches working in the co-operative banking sector in Kerala, of which 136 are in rural, 43 in semi urban area and 794 in urban area. The financial activities of the District Central Co-operative Banks (DCCBs) and affiliated PACSs reveal the significance of co-operative Banks in banking activities at the grass root level.

The deposits of co-operative banks as on June, 2016 were 67,534 crores, which is 15.42 per cent of the combined deposits of commercial banks and co-operatives. There are total of 7186 bank branches in the State, including those of the public sector, commercial and co-operative banks. The total deposits in the banking sector, as on June, 2016 was 437,946 crore. The total advances from the banks put together in the state was 282,556 crore of which the share of co-operatives is 45,004 crore, which account for 15.93 per cent of the total advances in the state. The total banking business in the state, as on June, 2016 was 720,502 crores and the share of co-operatives was 112,539 crore (15.62 per cent) (Table 1.13).

Table 1.13

Performance of Co-operative Sector, n crore

| Parameter | June 2016 | Share of Co-operative to Total | ||

| Co-operative Sector | Commercial Banks + Cooperatives | Commercial Banks | ||

| Branches | 973 | 7186 | 6213 | 13.54 |

| Total Deposits | 67534 | 437946 | 370412 | 15.42 |

| Total Advances | 45004 | 282556 | 237552 | 15.93 |

| Total Business | 112539 | 720502 | 607963 | 15.62 |

| Priority Sector Advances | 23115 | 159004 | 135889 | 14.54 |

| Agriculture Advances | 5893 | 61837 | 55944 | 9.53 |

| SME Advances | 1000 | 41603 | 40603 | 2.40 |

Source:- State Level Bankers Committee, Kerala 2016

Box 1.2

Demonetisation

on November 8, 2016, the Government of India cancelled the legal-tender character of bank notes of Rs 500 and Rs 1000 denominations and placed several restrictions on the exchange, withdrawal, and deposit of these notes. These measures, commonly referred to as “demonetisation”, had wide-ranging effects on the economy. The Kerala State Planning Board appointed a Committee to study the impact of demonetisation on the economy of the State of Kerala on November 23, 2016. The Committee was headed by Professor C. P. Chandrasekhar (Centre for Economic Studies and Planning, Jawaharlal Nehru University). Professor D. Narayana (Director, Gulati Institute of Finance and Taxation), Professor Pinaki Chakraborty (National Institute of Public Finance and Policy), Dr. K. M. Abraham (Additional Chief Secretary, Finance), and Shri V. S. Senthil (Member Secretary, Planning Board) were the other members. A summary, with excerpts from the report presented by the committee, is as follows.

Demonetisation had a severe impact on Kerala as cash transactions are predominant in the State's economy, particularly in the unorganised sectors and in the traditional sectors of fisheries, coir, handlooms, cashew processing, crop and plantation agriculture. Cash-intensive sectors such as retail trade, hotels, and restaurants and transportation account for over 40 per cent of the Kerala economy, and the primary sector accounts for another 16 per cent of the economy. Thus, 56 per cent of the economic activity of Kerala was immediately affected by the withdrawal of the specified bank notes. It also affected earnings from tourism and in the flow of remittances, which are important drivers of growth in Kerala's economy.

The impact of demonetisation in terms of the cash deficit and its consequences was particularly severe in Kerala also because of the distinct character of its banking sector. Around 60 per cent of all deposits are in the co-operatives in Kerala; the corresponding figure for India is less than 20 per cent. Thus the notifications by the Reserve Bank of India (RBI), which kept the cooperative banks and societies out of the note exchange process, were particularly damaging for Kerala. It resulted in the closure of banking activities at the level of the PACS and targeted the credibility of the PACS, which had served as democratically run, participatory financial institutions.

The ceiling on withdrawals of Rs 24,000 per individual per week after demonetisation was also made applicable to the cooperative societies. The ceiling affected the day-to-day functioning of various sectors. The cooperatives and the employers found it extremely difficult to make payments to the farmers or workers, whose earnings after meeting costs are so low that they could not make ends meet without receiving payments regularly. In fisheries sector, the wholesale buyers were not able to carry out business in high volumes. A large number of the two and a half million migrant workers in the State were reportedly going home as employment declined and as they did not possess bank accounts to deposit demonetised notes.

The news of the serpentine queues at money exchange counters in airports and outside and the limits on the amount of Indian currency that can be obtained in exchange for foreign currency resulted in rise of cancellations and a fall in tourist arrivals. As per quick estimates from the Department of Tourism, Kerala, relative to the corresponding month of the previous year, domestic tourist arrivals fell by 17.7 per cent in November 2016 and foreign tourist arrivals by 8.7per cent. Similarly, because of the difficulties in withdrawing rupees from banks and the inability of instant transfer agents to provide rupees at local counters, remittances too have reportedly fallen.

In the case of Kerala, its own tax-to-GSDP ratio has declined from 7.06 per cent in 2011-12 to around 6.5 per cent by the end of 2015-16 (Revised Estimates). In its Revised Budget, the present Government, which came to power in May 2016, proposed that the tax-to-GSDP ratio be increased to 6.85 per cent. That is, own tax revenue was expected to grow at the rate of 19.39 per cent in 2016-17. However, there is a post-demonetisation slump in economic activity and the revenue loss is already seen in the real estate sector on account of stamp-duty collection and in motor vehicle tax collection. A fall in revenue coupled with a decline in central transfers would either mean a bigger deficit or a contraction in expenditure at the state level. This contraction in public expenditure can also further contribute to a process of slowdown that has already begun in the state as a result of demonetisation.

NRI Deposits

Remittances from the other countries, especially Gulf countries, are the key growth engine for the State of Kerala. According to Kerala Migration Study (KMS 2014), 2.4 million Keralites are working abroad. The inflow of NRI deposits increased by 24 per cent from 109,603 crore in March 2015 to 135,609 crore in March 2016 according to SLBC data (Appendix 1.44). Domestic deposits grew by 13.20 per cent to 225,984 crore during March 2016, as against 210,287 crore in March 2015. Domestic deposits constitute 67.81 per cent of the total deposits of the state. The bank-wise analysis of deposits shows that major share of deposit comes from domestic deposit except for Federal Bank. The Federal Bank attracts more NRI deposits than the other public and private sector banks. During March 2016, the share of NRI deposits to total deposit of the Federal Bank was 55.29 per cent whereas it is less than 50 per cent for all other public and private sector banks (Appendix 1.45). The Bank Group wise analysis shows that the Kerala's NRIs seem to prefer public sector banks over private banks when depositing their money. The total NRI deposits in public sector banks is 77,177 crore, compared to 58,431 crore in the private sector banks. The percentage share of the NRI deposit is 56.91 per cent in public sector banks and 43.09 per cent in private sector banks. The State Bank Group attracts 36.16 per cent and Nationalised Banks get 20.39 per cent of the total remittance flowing through the banking sector.

Credit-Deposit Ratio

The credit deposit ratio of banking sector in India at the end of March 2016 was 77.86, which was 76.05 in 2015. Tamil Nadu stood at first position in CD ratio among the major States at 112.86; however, the ratio is quite lower than the previous year. Andhra Pradesh (104.52), Telangana (103.61) and Maharashtra (102.65) are the other Sates with CD ratio higher than 100. The CD ratio in Kerala is only 61.84, which is lower (69.48) than that of previous year (Appendix 1.46). In Kerala, the credit-deposit ratio is high in district of Idukki (134) and Wayanad (133.73). Among the districts, Pathanamthitta stands at the bottom with CD ratio of 27.04 per cent (Appendix 1.47).